2020-7-18 00:00 |

Ethereum has been closely tracking Bitcoin’s price action throughout the past several days and weeks.

This has made it exposed to some near-term downside, as BTC is currently sitting just a hair above the lower boundary of its long-held trading range between $9,000 and $10,000.

It appears that ETH has been forming a bullish technical formation throughout the past several weeks, which could bolster its mid-term outlook.

The same pattern was formed in early-May when it was trading within the lower-$200 region. If this pattern results in a similar rally, it could send the crypto past its previously established 2020 highs at $290.

The next uptrend could also be perpetuated by the growing amount of Ethereum that is locked within DeFi protocols. This could alleviate the selling pressure placed on the asset.

Ethereum’s Technical Outlook is Growing BrighterAt the time of writing, Ethereum is trading down marginally at its current price of $233. This is around the level at which the crypto has been trading throughout the past several days.

ETH has been closely tracking Bitcoin’s price action, which is the primary reason why it is currently trading at the lower end of its trading range between $230 and $250.

Sellers have tried to force the token below its near-term support, but the buying pressure established here has proven to be quite significant.

Where it trends next may largely depend on whether or not buyers can start pushing it back up towards the upper end of its range.

Because it has formed a striking correlation to Bitcoin throughout the past few weeks, the benchmark crypto’s price action will also hold sway over it.

One analyst recently explained that Ethereum is on the cusp of confirming a bullish technical pattern that may allow it to see some serious upside in the coming weeks.

In a tweet, the trader noted that an inverse head and shoulders pattern seen while looking towards its weekly chart is forming.

He added that an explicit confirmation of this pattern could be enough to send Ethereum surging to fresh yearly highs.

“A pattern we have already seen recently is developing for ETH which can push it to new highs.”

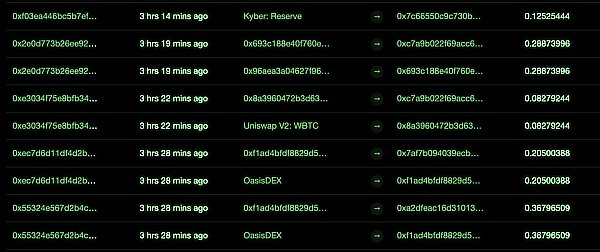

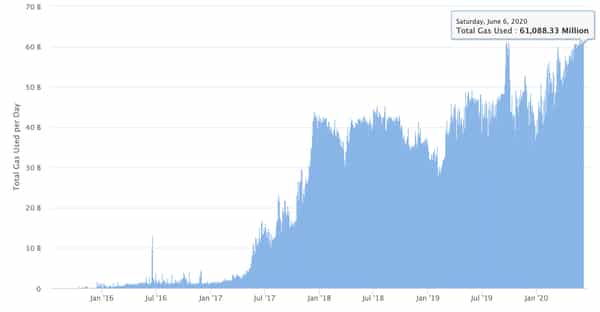

Image Courtesy of Wolf. Chart via TradingView. DeFi’s Continued Growth to Boost EthereumThe growth seen by the DeFi sector could also start having tangible impacts on Ethereum’s price action.

Another analyst spoke about this in a recent tweet, explaining that the amount of ETH locked within protocols is climbing.

“Visualization: ETH Locked in DeFi Platforms. Currently, some outside speculation are saying DeFi is a bubble, but honestly users and tokens locked has been climbing the past two years steadily on ETH… Likely DeFi is the first mainstream adoption channel.”

Image Courtesy of Cactus.This will lessen the selling pressure placed on the crypto and reduce its circulating supply – both of which bode well for bulls.

Featured image from Shutterstock. Charts and pricing data via TradingView. origin »Ethereum (ETH) на Currencies.ru

|

|