2020-6-15 19:05 |

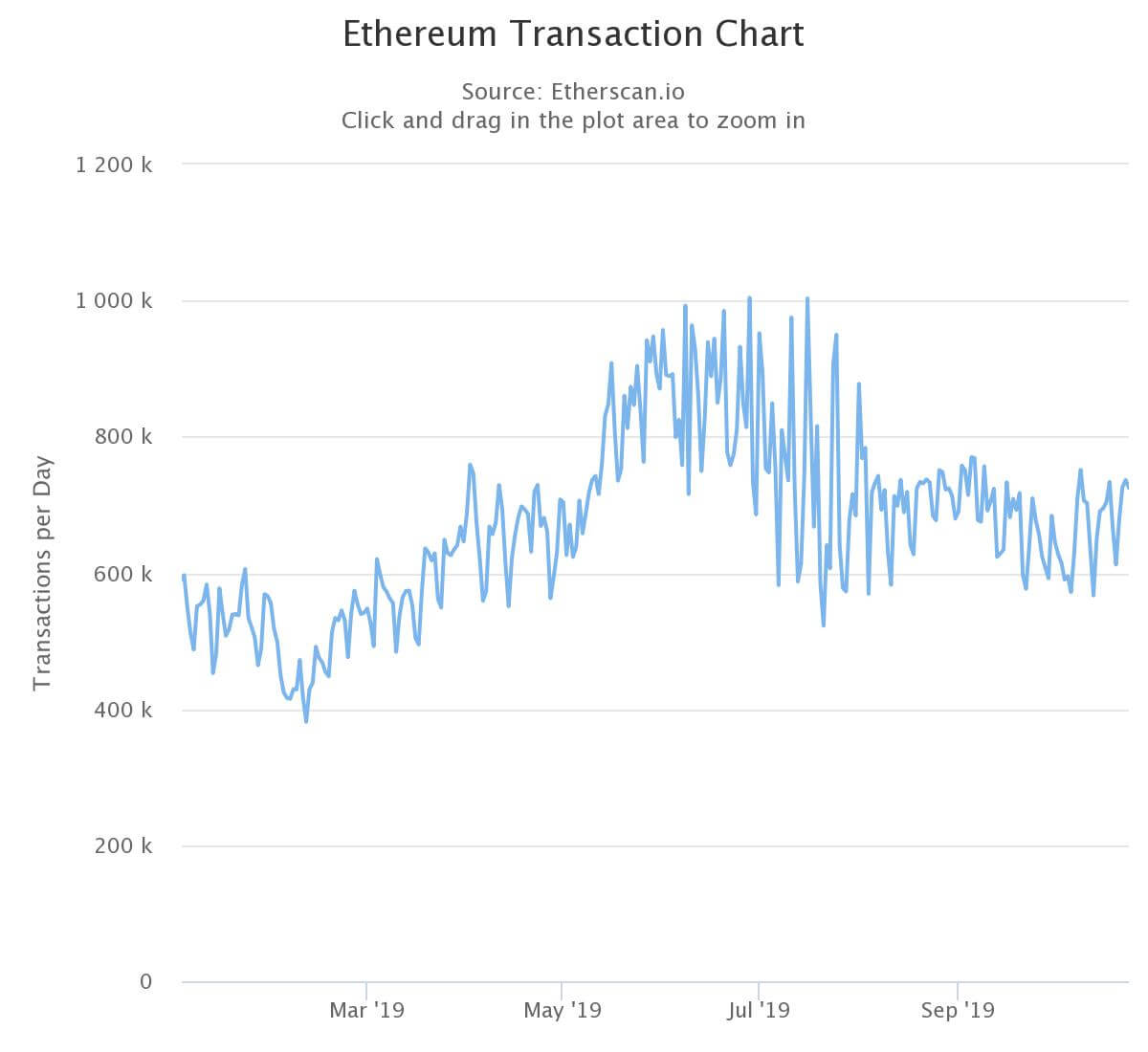

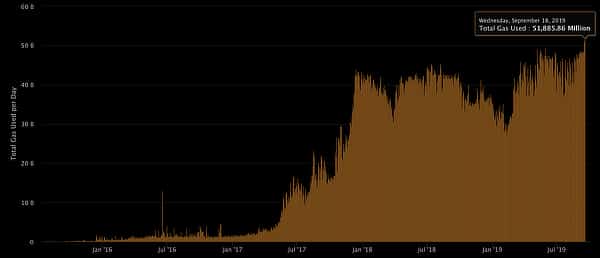

Daily Ethereum gas usage continues to be at its all-time high after seeing an increase of 58% since the beginning of the year. Currently, it is hovering above the 60 billion mark.

During the 2017 bull run, the Ethereum gas usage spiked significantly, surging 3413%. Since December 2019, it is yet again on an incline which took charge on March 29 and now continues to make new all-time highs.

Just last week, one user paid $5.2 million in fees to make two transactions, one of them to transfer just $130 worth of Ether. Another transaction was made by another user, with relatively smaller fees of $500,000.

These transactions were probably “gas price ransomware attack,” as per the China-based blockchain analytics company PeckSheild.

Analysis done by PeckShield on the recent two major ETH transfers. This may be a GasPrice ransomware attack launched by hackers targeting the exchange. @thomasheller_ @celiawan2 @bitentrepreneur @sallywang666 @tzhen https://t.co/ve16ImVQsl

— Minion@TokenInsight (@minionabct) June 12, 2020

The third transaction was reportedly used to cause a direct hack on another exchange for $1.3 million. NEO co-founder Da Hongfei tweeted,

“The 3rd abnormal tx on ethereum with over 2000 ETH fee went [through]. Someone believes it could be a hacker's blackmail to some exchange.”

“What happened to decentralization?”Most of the growth on the Ethereum network, which is almost at full capacity with ETH 2.0 still not here, is driven by stablecoins.

However, ETH 2.0 upgrade that will allow staking will soon be here, and interest in it is growing as evident from the growing number of 32 ETH, the requisite deposit for staking. The number of Ether wallets with 32 ETH or more has jumped 13% this year.

Interest in ETH 2.0 on Google trends is also looking for another spike.

Users can either opt to run their own validator node, join a staking pool, or use a third-party staking provider service such as crypto exchanges.

But this choice to either run your own node or choose a staking service, is it really a choice, argued trader Josh Olszewicz. “What happened to decentralization and moving away from big bad ASICs?”

Currently, Ethereum is based on the PoW system just like Bitcoin but instead of relying on specialized ASIC machines, it is favored by GPU units. But the Ethereum network is not completely immune to ASIC miners, back in April 2018 Bitmain released Antminer E3, an ASIC specifically produced for mining Ether.

It was also revealed in a paper that 40% of Ethereum’s hashrate is actually generated by Bitmain”s ASICs.

Ethereum’s shift from proof-of-work to proof-of-stake algorithm later this year won’t be leaving the miners with many options either. They either have to take up staking their Ether or take up mining altcoins.

Ethereum (ETH) Live Price 1 ETH/USD =$231.1837 change ~ -1.52%Coin Market Cap

$25.75 Billion24 Hour Volume

$2.12 Billion24 Hour VWAP

$22724 Hour Change

$-3.5076 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|