2020-9-20 01:54 |

Bitcoin has surged to $11,050 as of this article’s writing. The coin has gained over 10% from the lows earlier this month of $9,800. Despite the rally, Bitcoin is not yet in a fully bullish state according to some analysts. Traders say that BTC must retake the $11,200 horizontal to confirm the ongoing rally has legs. This technical feat may not be easy, though. BTC Must Move Above $11,200 to Confirm More Upside

While many analysts have embraced Bitcoin’s rally from $9,800 to $11,000, the cryptocurrency is not yet in a bullish state.

One trader says that for BTC to truly convince market participants that it is in a bullish state, it will need to flip $11,200 into support on a weekly time frame. It attempted to do so in August but failed when the coin slipped in early September.

“Target / Major resistance finally hit, if you worried about price dropping from here and using leverage then close out your position and wait for this level to be flipped support… $11,200 is a key HTF level for flipping it will not be easy.”

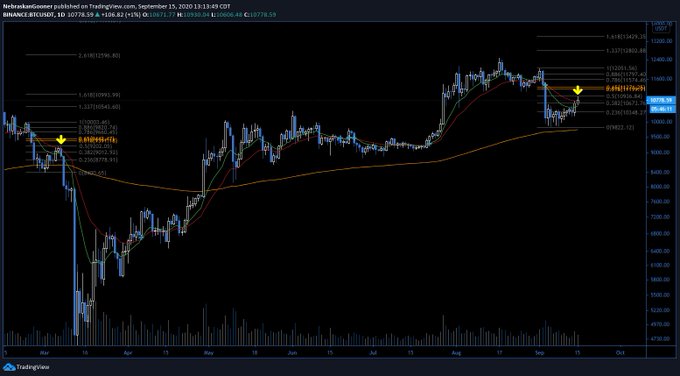

Chart of BTC's price action over the past two years with analysis by crypto trader Cactus (@TheCryptoCactus on Twitter). Chart from TradingView.comBitcoin will have trouble breaking past $11,200, though.

One cryptocurrency trader recently noted that there is a clear confluence of reasons why Bitcoin’s ongoing rally above $11,000 will soon reverse. A few of these reasons are as follows:

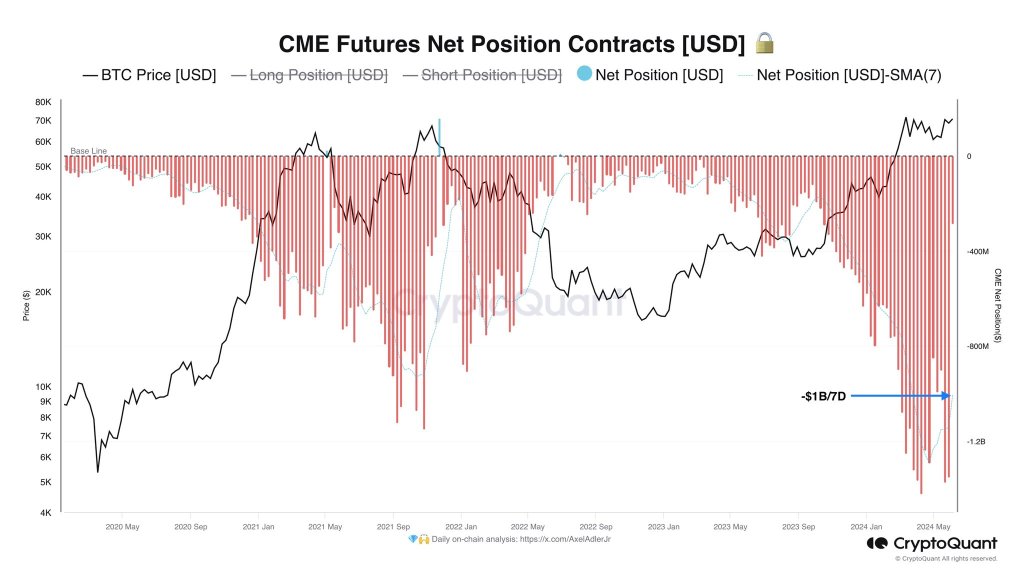

$11,100 is the 61.8% Fibonnaci Retracement of the drop from $12,000 to $9,800. There are two key short-term moving averages at around $11,000. A bearish CME gap is forming between Friday’s price action and that of Monday. There is decreasing volume as Bitcoin moves higher, suggesting the bullish recovery is losing momentum. The lack of bullish volume could result in a reversal lower. Bitcoin Remains Long-Term BullishAnalysts remain convinced that Bitcoin’s long-term trend remains bullish despite any mishaps that may transpire in the near term.

Dan Tapiero, the co-founder of DTAP Capital along with a number of other firms, recently commented that Bitcoin is likely to undergo exponential growth this cycle:

“Tremendous long term Log Chart of #Bitcoin projects up 5-10x on this run. Just breaking up NOW. Should last a few years as 2.5yr consolidation is fantastic base for catapult up. Break of old highs will have explosive follow through. Time to sit and be patient.”

Chart of BTC's macro price action (Logarithimic chart) by Bitcoin bull and gold investor Dan Tapiero. Chart from BloombergCorroborating this sentiment, long-term on-chain signals indicate that Bitcoin is currently unvervalued, making current prices a buying opportunity.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com This Level Holds the Key to Bitcoin Moving Higher in the Near Term origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|