2021-3-30 15:28 |

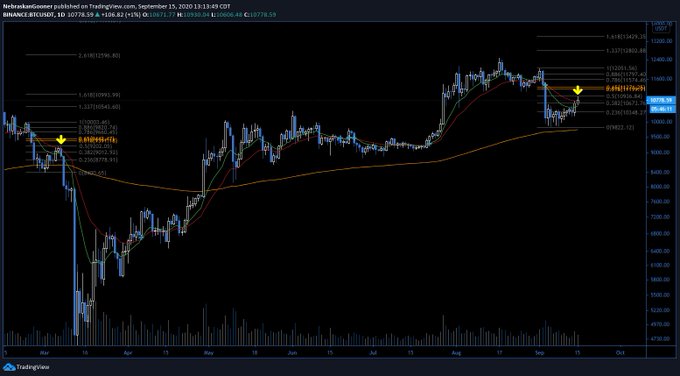

The price of Bitcoin went as high as $59,445 today, for now, adding to the gains the cryptocurrency started making on Monday.

Last week, BTC price experienced nearly a 20% pullback from its ATH while following the traditional markets.

The subdued volatility, which resulted from lack of new developments or catalysts in the space, was what forced Bitcoin “to move in tune with larger macro markets as a whole most of which has been treading water since the FOMC meeting 2 weeks back,” noted QCP Capital.

But with March's options expiry, “the largest on record with a $6bn notional OI” out of the way, the market is “positioned bullishly.”

Not to mention “strong” Q2 seasonality which always resulted in gains, as much as 157.5% in 2019, except for 2018’s -6.7% loss, as per Skew.

“Last week's bounce off the parabolic trendline again is setting itself up for another strong Q2 – with the coast much cleaner now from the perspective of the derivative leverage market. ” – QCP Capital

The catalyst this time is expected to be the participation of Sovereign wealth funds, a buzz that already started last week with Temasek and New Zealand pension fund KiwiSaver. Earlier this year, Grayscale CEO Michael Sonnenshein also said they have now begun seeing participation from real heavy-hitters, including pensions and endowments.

For now, $60k on BTC remains a “key” hurdle, but QCP Capital expects “$80k to hold out through the quarter regardless.”

As for Ethereum (ETH), $2k is its key hurdle with end-June calls as an interesting trade in preparation for July's EIP-1559, which will burn gas fees paid in Ether, creating a positive feedback loop for its price.

Full Send ModeAfter falling to about $50k last week, towards the end of it, Bitcoin started trending up and now making its way to its all-time high of just shy of $62,000. The upcoming April, historically green and the best month for BTC, only adds to the overall bullishness.

“I remain in full send mode. Last week was nothing more than unpleasant noise. And a great BTD opportunity,” said trader and economist Alex Kruger.

Interestingly, Bitcoin’s gains are coming despite the dollar climbing above 93 level, last seen in early November. The dollar gains strength from the rising US Treasury yields. Before ending the day lower, the U.S. 30 Year Treasury rose to 2.454%, and yields on the U.S. 10 Year Treasury have jumped to 1.765%, making the currency more attractive as an investment.

While the market is feeling optimistic about the forthcoming payrolls release, Rabobank currency strategist Jane Foley wrote in a report that at the same time, “the market is in danger of pricing in too much inflation risk,” meaning “we see scope for the USD to soften in the months ahead.”

Meanwhile, accelerating vaccinations and massive stimulus in the US continue to stoke inflation concerns.

The S&P 500 is keeping near its ATH while tech-heavy Nasdaq sees a downtrend, keeping around 13,000. Gold, in the meantime, is doing nothing but going down, now under $1,700 per ounce.

“Bond yield up again. Dollar up. Stocks and gold down. Bitcoin resilience keeps on giving within an inflationary risk-on environment,” said Charlie Morris, founder, and CIO of ByteTree.

Bitcoin BTC $ 59 316.50 +2.40% Ethereum ETH $ 1 843.90 +4.41% Binance Coin BNB $ 297.04 +7.90% The post Bitcoin Shows Resilience as it Aims For An ATH, Despite the Soaring USD & Bond Yields first appeared on BitcoinExchangeGuide. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|