2020-1-6 13:00 |

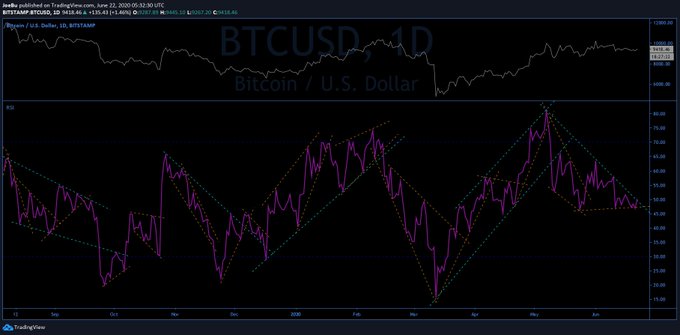

Over the holiday season, Bitcoin (BTC) has stalled in the low-$7,000s, finding itself stuck between heavy macro support in the mid-$6,000s and rather pertinent resistance in the high-$7,000s, which the cryptocurrency has been rejected by multiple times. Despite this, a number of analysts are still bullish on the asset. One analyst recently drew attention to a fractal, suggesting that should BTC follow it, the price of the cryptocurrency could top $10,000 by February. Related Reading: Early Bitcoin Adopter Throws Cold Water On Halving Narrative; Here’s Why Bitcoin Ready to Surge Higher, Fractal Suggests Asset analyst Bill Charison recently noted that the charts of gold and Bitcoin are eerily similar. Just look below, in which he notes that the two-day BTC chart and the one-day XAU (gold) chart are effectively identical to each other, sharing three distinct bouts of price action: a first correction, a second correction, then a falling wedge marking the local top. Right now, the Bitcoin chart is lagging behind the gold chart, with gold surging decidedly out of the falling wedge depicted in yellow while BTC is undecided, stuck in the middle of the often-bullish chart pattern. Charison notes that if BTC follows gold’s trajectory to a T, the cryptocurrency could trade above $10,000 — at least 33% higher than the current price of 25% — in February, and potentially surge even higher as we near the block reward reduction in May 2020. Related Reading: Institutions Likely to Invest Big in Bitcoin in 2020; Here’s Why Not Only Bullish Signal It isn’t only this fractal that has analysts bullish on Bitcoin in the relatively short-term. Cryptocurrency trader CryptoHamster recently noted that Bitcoin’s on-balance volume reading — an indicator which “uses volume flow to predict changes in stock price” — is printing a clear falling wedge pattern, a chart pattern marked by falling prices (or in this case, a reading) and a tightening range. On-balance volume descending wedge is getting tighter.#bitcoin $BTC $BTCUSD pic.twitter.com/XT5EJDoQIW — CryptoHamster (@CryptoHamsterIO) January 4, 2020 In this case, the falling wedge seems bullish, with the Bitcoin-related on-balance volume reading rallying, implying imminent continuation to the upside. Not to mention, another analyst, this one going by Velvet, posted an analysis, showing that he believes Bitcoin is currently in the midst of reflecting a textbook Wyckoff Accumulation pattern: a strong decline, a recovery and false breakout constricted by resistance, a drop to set a fresh bottom lower than the original, failed attempts to break past resistance, then a final shakeout prior to a surge back to pre-decline levels. Related Reading: Why Bitcoin Investors’ HODL Mentality Means a Price Surge Is Coming Right now, as Velvet suggested, Bitcoin is in its final shakeout phase of the pattern, with the price recently dropping to the $6,800s. Should this textbook technical analysis pattern play out exactly as the studies of Richard Wyckoff, a noted technician, says, BTC is likely to break $9,000 and maybe $10,000 by the end of January. Featured Image from Shutterstock The post appeared first on NewsBTC. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|