2020-6-24 03:00 |

After holding in the low-$9,000s, Bitcoin finally saw a breakout recently.

The cryptocurrency liquidated $15 million worth of BitMEX short contracts as it shot as high as $9,800 during Monday’s trading session. This was the highest BTC had traded in 10 days.

Bitcoin’s strength came on a swath of positive news.

Firstly, while the S&P 500 saw a mild gain, the Nasdaq rocketed to new all-time highs on the back of Microsoft and Netflix rallying. The strength in the stock market comes after the Federal Reserve announced it will be buying individual corporate bonds.

Secondly, it was revealed that PayPal is looking to allow users of Paypal and Venmo to directly buy and sell crypto.

Sources told CoinDesk: “My understanding is that they are going to allow buys and sells of crypto directly from PayPal and Venmo. They are going to have some sort of a built-in wallet functionality so you can store it there.”

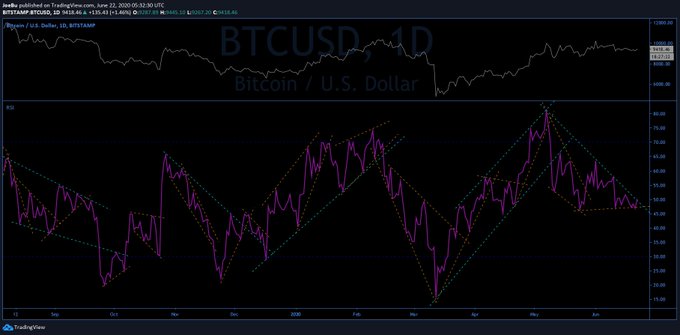

Despite these events, an analyst isn’t convinced that Bitcoin’s strength will continue. He is arguing for a retracement of nearly 15% in the coming days and weeks.

Related Reading: U.S. Congressman Davidson Says Bitcoin Is “Required to Defend Freedom” Analyst Expects Bitcoin to Retrace to $8,500Bitcoin’s recent price action has been bullish. It shows that even though bears had a chance to send the cryptocurrency plummeting, it didn’t.

Yet according to an analyst, a retracement to $8,500 is likely. A drop to that level would mark a drop of nearly 13% from the current price of $9.700 and nearly 15% from yesterday’s highs around $9,800.

As to why he is expecting a drop towards $8,500, he explained:

“Bulls are very greedy here and all the upside liquidity has already been taken. Funding with positive peaks on several exchanges. Starting to see some people calling 33k by July and some bullish fractals with no sense. It’s time.”

Bitcoin liquidation levels chart (BitMEX), suggesting that there may be a cascade of liquidations if prices drop as the market is long-centric. Chart from il Capo of Crypto.The analyst who shared the chart and sentiment above is the one that predicted Bitcoin would revisit the $3,000s. This prediction was made months before the March drop took place.

The Importance of $10,500The reason why the analyst in question is supporting a bearish narrative is largely tied to the $10,500 level.

He noted in a previous analysis that the fact that Bitcoin has yet to close above $10,500 on a high time frame suggests a bear trend is still intact.

The analyst previously suggested that a drop under $3,000 is in the works. He specifically cites fractals from other time periods suggesting a long-term correction.

Related Reading: Crypto Tidbits: Bitcoin Holds $9k, Ethereum DeFi Gains Traction, Trump Talked BTC in 2018 Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Analyst Who Predicted Bitcoin Would Hit $3,000s in 2020 Expects a 15% Drop origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|