2020-11-21 20:14 |

Another interview, another strike from Ripple CEO on Bitcoin.

Brad Garlinghouse clarified that he is a bull on Bitcoin and that he owns it, but at the same time, he said,

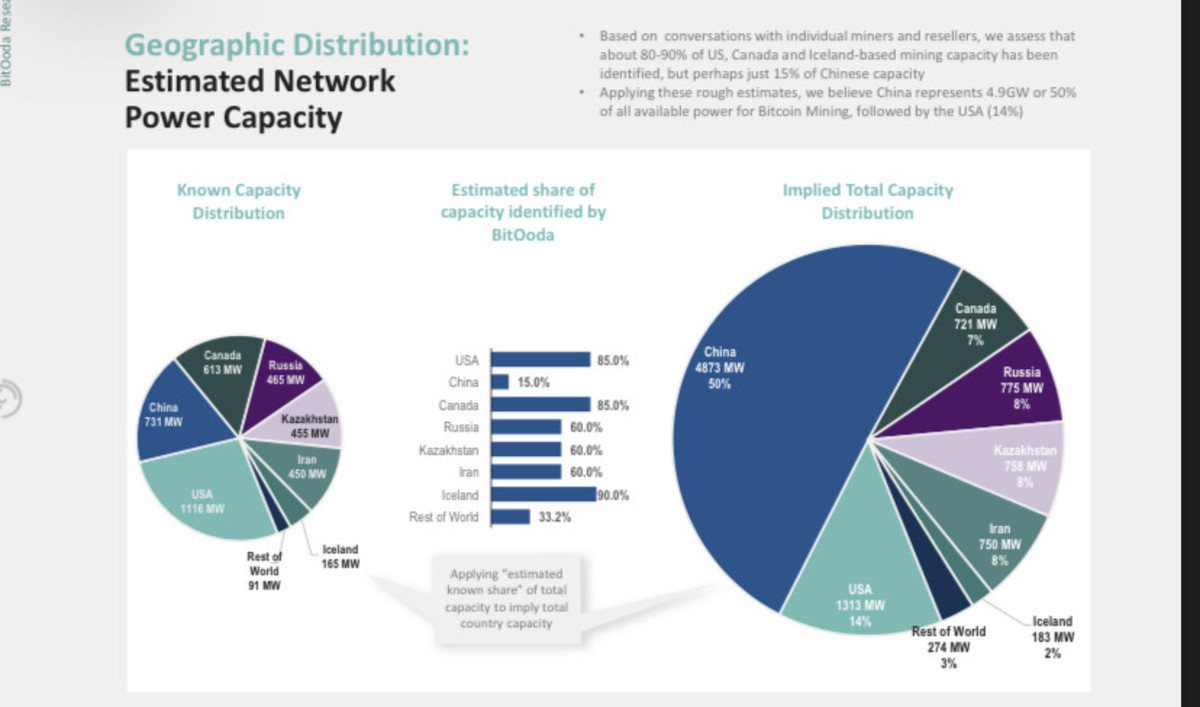

“We need to acknowledge that when Bitcoin is more than 50 percent of the mining in China that China can control those technologies.”

He believes that the US needs to get in sync with other major economies regarding how to treat assets like XRP similarly. He said,

“The Chinese Communist Party is being very strategic and is very focused on dominating this technology. I worry that this will be the next 5G race… We lost that race and I think we are in danger of repeating that mistake again in the battle of what I think will be the future of our global financial and infrastructure of payments.”

Never a dull moment in crypto! Institutional investor interest is skyrocketing… industry growth comes down to real world utility. As a store of value, BTC is an extremely useful inflation hedge. XRP’s speed, cost and scalability make it extremely useful for payments. (1/2)

— Brad Garlinghouse (@bgarlinghouse) November 19, 2020

Commenting on the ongoing rally in the cryptocurrency market, which has the leading digital asset up 154% YTD compared to XRP’s 55%, Garlinghouse said this rally would “last for a while.”

“What we’re seeing happen are some macro factors not the least of which is… you print billions and trillions in dollars in stimulus of fiat currencies.”

This is where many people take a look at the inflation hedges, and while gold has historically been the darling in that category, bitcoin and digital assets are being broadly viewed as the real inflation hedge, said Garlinghouse.

This has driven a lot of the activity we’ve seen lately to almost record highs, he added.

According to him, PayPal allowing its customers to buy, sell, and hold digital assets is what “kicked off this big run.”

As for PayPal not including XRP in its offering, Garlinghouse explained the digital asset “has been a topic of lots of speculation in terms of how the US regulatory environment would look at currency XRP which is separate from the company.”

He further shared that many of the regulators worldwide looked at and have been decisive about looking at XRP as a virtual currency, unlike in the US, where there isn’t the same clarity. Because of this clarity, companies like PayPal and Square are supporting bitcoin, said the Ripple CEO.

The irony is unintentional as a regulatory body in the United States, “we have given an advantage to Bitcoin what I’ll call the good housekeeping seal of approval from the SEC,” and this clarity and certainty has allowed the likes of PayPal to support it, said Garlinghouse.

This has been due to this lack of regulatory clarity that the company has been planning to move out of the US. Although Joe Biden has won the election, this doesn’t change things much, and Ripple needs a level playing field, he said.

“If we can’t compete effectively with these technologies, in this case, controlled by Chinese miners,” then Ripple has to look elsewhere, he concluded.

Ripple (XRP) Live Price 1 XRP/USD =$0.2464 change ~ 2.46%Coin Market Cap

$10.67 Billion24 Hour Volume

$186.84 Million24 Hour VWAP

$024 Hour Change

$0.0061 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~XRP~USD"); The post Ripple CEO’s Broken Record: Level Playing Field for XRP to Compete with China Controlled Bitcoin first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|