2021-5-22 20:25 |

China appears to be ready to go to war with Bitcoin and other cryptocurrencies just about a month removed from changing its stance on digital assets. Earlier this week, it was reported that the country had banned financial institutions from conducting any crypto transactions but subsequent claims pointed out that the powers that be are simply seeking to reinforce laws passed a few years ago.

China Is Ready To “Crack Down”This week has been a very bad one for Bitcoin, in particular. The currency dropped as low as $36,309.60 on Friday after Chinese Vice Premier Liu He and the State Council announced plans to “crack down” on Bitcoin mining and trading in the country.

This comes after Elon Musk suspended Bitcoin payments for Tesla’s vehicles and implying that the company had sold its holdings. Musk has since confirmed that Tesla is still in possession of its Bitcoin yet that has done little to remedy the fall. The United States government has also taken a stance against crypto, ordering that any transaction north of $10,000 should be reported to the IRS.

Meanwhile, China has doubled down on its previous edict, with the Premier releasing a statement in which he revealed plans to take action.

“It is necessary to maintain the smooth operation of the stock, debt, and foreign exchange markets, severely crack down on illegal securities activities, and severely punish illegal financial activities,” the statement reads. “It is necessary to strictly guard against external risk shocks, effectively respond to imported inflation, strengthen anticipation management, strengthen market supervision, and prepare response plans and policy reserves.”

There Could Be More To ThisThe statement is rumored to be in part retaliation for the digital yuan’s poor reception. China’s central bank was one of the first in the world to develop its own digital currency but the likes of Bitcoin and Ethereum have continued to dominate the digital space, as have a number of other altcoins.

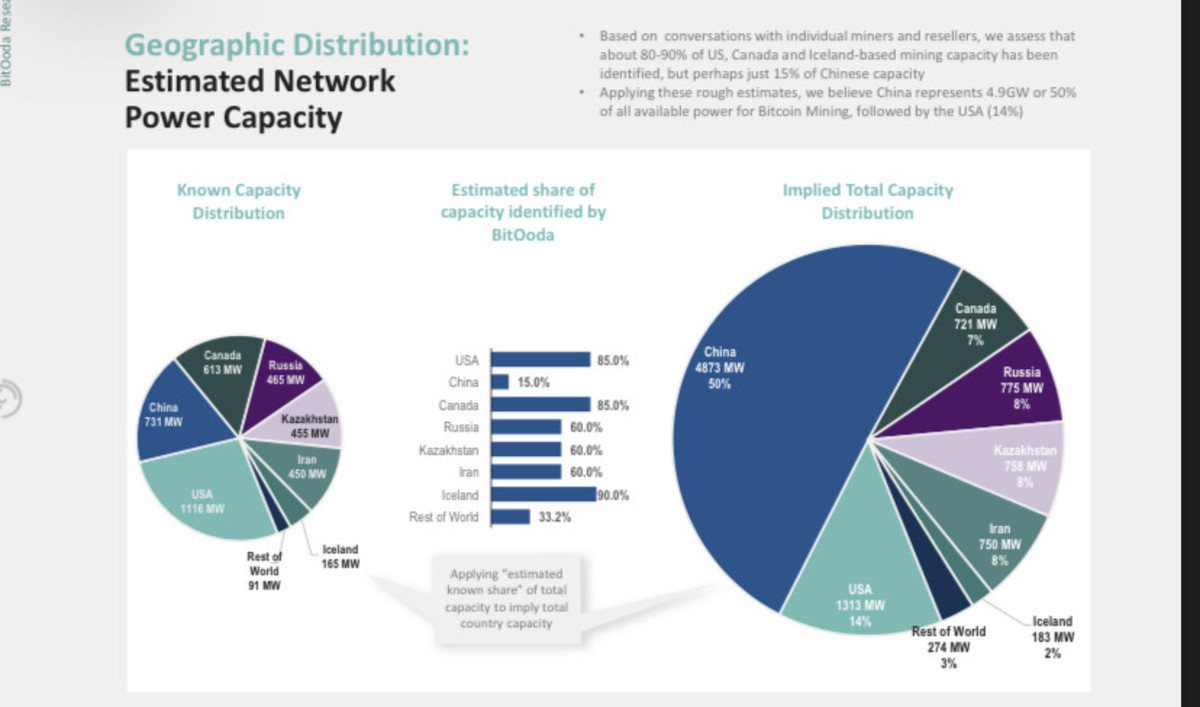

The Chinese market is the biggest in the world when it comes to non-bank mobile transactions. The market experienced a 55% rise in electronic transactions between 2018 and 2019, which is pretty significant given that such payments only grew by 10% in the U.S. The figure has since gone up to 86%. China is also the world’s biggest Bitcoin mining hub.

Mainstream cryptocurrencies have come under fire for their impact on the environment, as well as the fact that transactions are independent of banks or governments. China is apparently looking to become the most powerful voice in opposition to the crypto boom.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|