2021-6-22 07:00 |

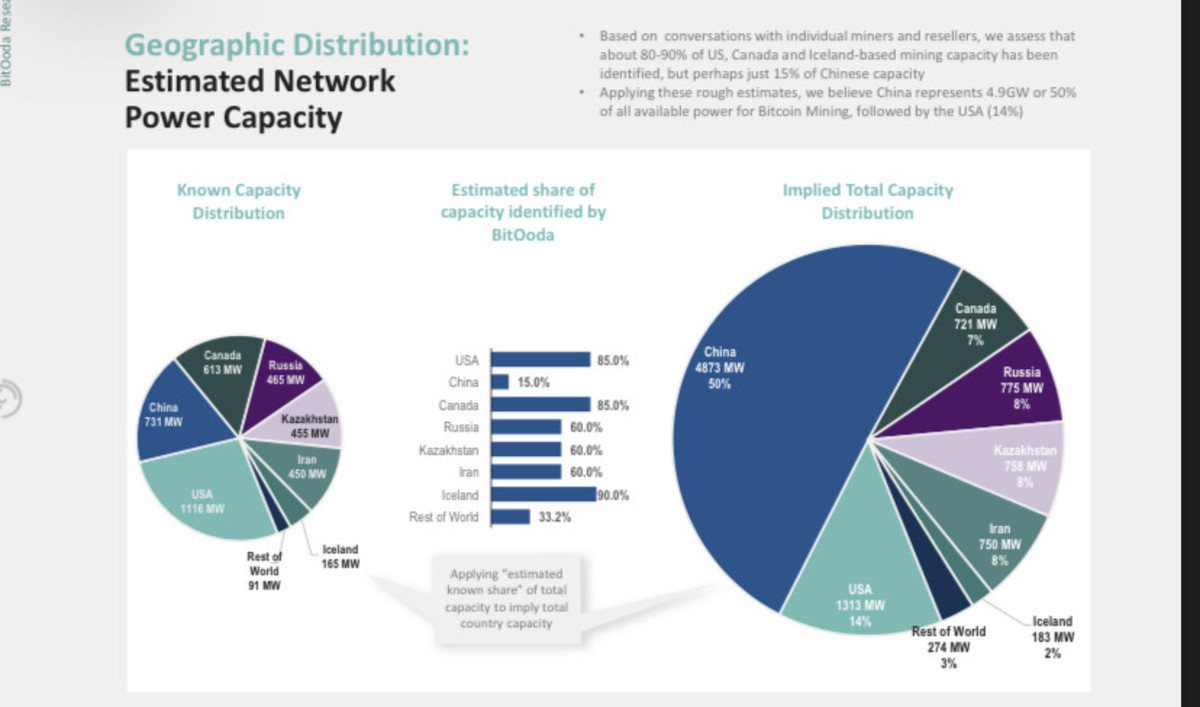

Bitcoin miners were dealt a blow in May as the Financial Stability and Development Committee of the State Council of China announced further controls on financial risk.

The announcement was the latest in China’s long-running friction with the cryptocurrency industry. But this time, given the Chinese Communist Party’s promotion of its digital yuan, it looks as though commercial operations, more specifically miners, are feeling the pinch and looking to move elsewhere.

The release specifically mentioned cracking down on Bitcoin mining and trading within the bounds of controlling financial risk.

“Promote the reform of small and medium financial institutions, focus on reducing credit risks, strengthen the supervision of platform enterprises’ financial activities, crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to the social field.”

With Latin American countries coming on board with Bitcoin, could we see a shift in the geolocation of Bitcoin mining infrastructure?

Bitcoin mining hash rate takes a tumbleAccording to Reuters, China’s crypto crackdown has already found its way to the western province of Sichuan, where authorities have ordered the closure of Bitcoin mining operations in the region.

“The Sichuan Provincial Development and Reform Commission, and the Sichuan Energy Bureau issued a joint notice, dated Friday and seen by Reuters, demanding the closure of 26 suspected cryptocurrency mining projects by Sunday.”

Reports indicate that electricity companies in the region were ordered to stop supplying power to mining firms.

The effect on Bitcoin’s hash rate took a sharp decline around the time of the announcement. In mid-April, it hit an all-time high of about 180 million TH/s. But since then, the latest data shows hash rate dropping to November 2020 levels of around 125 million TH/s.

Image: Blockchain.comThe hash rate is a measure of the processing power of the Bitcoin network. The higher the hash rate, the more secure the network. Some have also taken hash rate as a measure of the network’s health.

Will Paraguay fill the void?In a bid to attract miners, the U.S via Texas and Florida (Miami) have put themselves forward as feasible places to set up shop.

But with a flood of Latin American countries joining the Bitcoin revolution, might we see Chinese mining firms favor the lower costs and abundant renewable energy sources in countries such as Paraguay?

In recent weeks, several Latin American countries, including Paraguay, have signaled their intent to follow El Salvador in formally recognizing Bitcoin.

Paraguay is home to the Itaipu Hydroelectric Dam (IHD), which is located on the border with Brazil. The IHD is the world’s second-biggest hydroelectric dam, with an output of 14 gigawatts. It supplies Paraguay with 90% of its electricity and 15% of Brazil’s needs.

Although Paraguay’s National Deputy Carlitos Rejala has kept his specific Bitcoin (and PayPal) plans under wraps for now, given the IHD’s importance to the country, it’s almost a given that it will play some role in Paraguay’s Bitcoin revolution.

Rejala will table Bitcoin legislation to the national Congress in July for discussion.

The post Could Paraguay emerge as a Bitcoin mining hub after China crackdown? appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|