2023-11-7 13:15 |

Quick Take

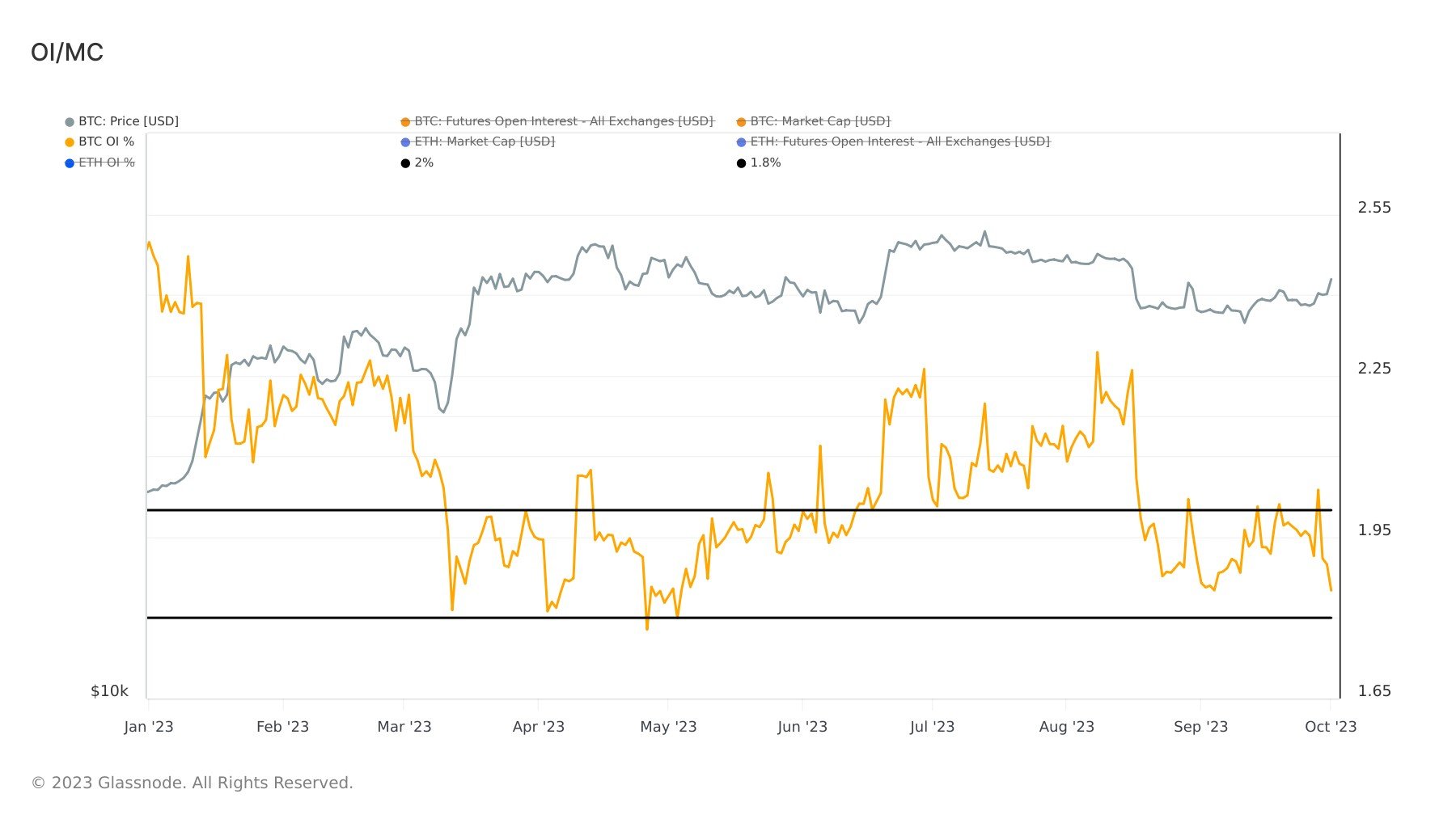

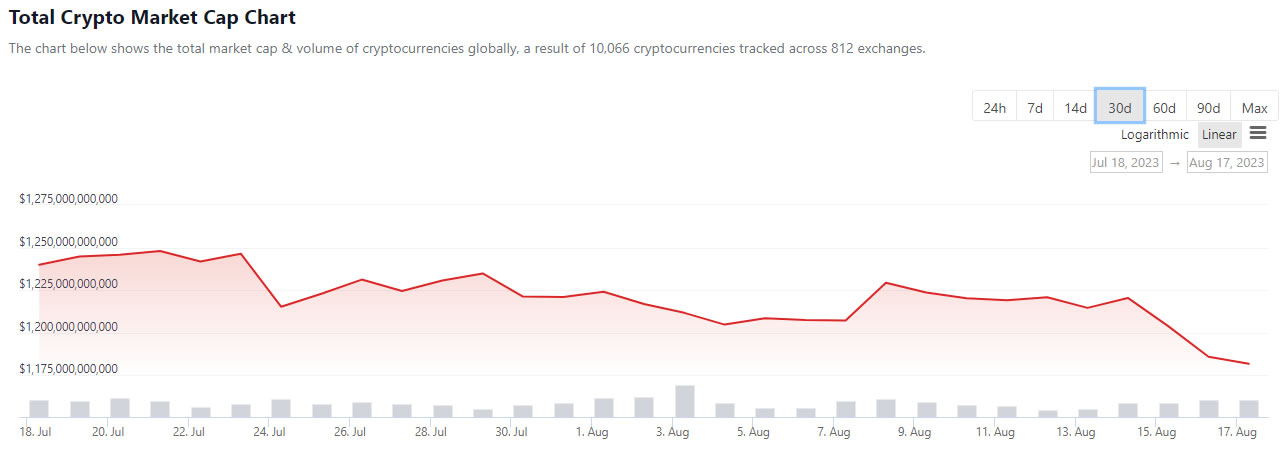

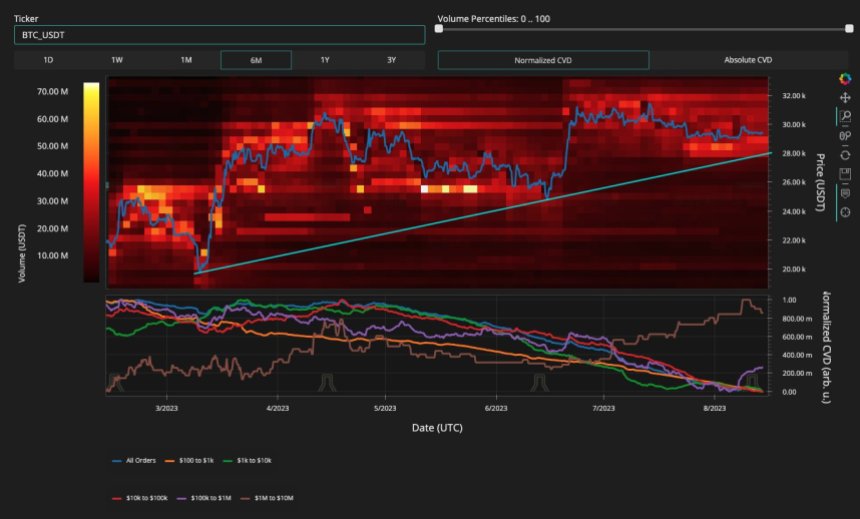

The open interest in Bitcoin – the total value in U.S. dollars of all open futures contracts – is experiencing a noticeable uptick, indicating a rise in market activity. Currently, the open interest in Bitcoin is quite substantial, amounting to 435,000 BTC, corresponding to a market value of over $15 billion.

Total open interest on Bitcoin futures from March to November 2023 (Source: Coinglass)The CME exchange, preferred by institutional investors, has achieved a new record in open interest, with 105,380 BTC contracts open, valued at $3.68 billion. Binance has edged past this figure with open interest of approximately 113,500 BTC.

This trend points to increasing involvement in Bitcoin futures, hinting at either a positive shift in market mood or a move towards protective strategies by investors.

CME Bitcoin futures open interest from February to November 2023 (Source: Coinglass)The post Record-breaking open interest on CME shows growing market activity appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|