2023-8-10 13:00 |

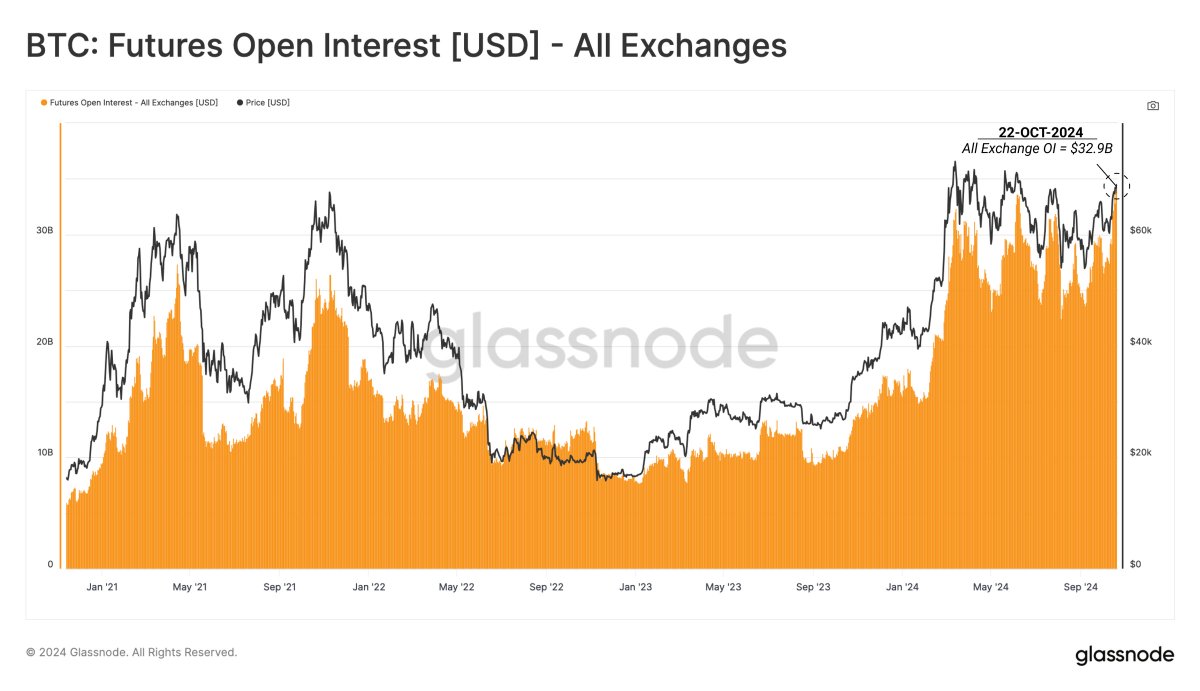

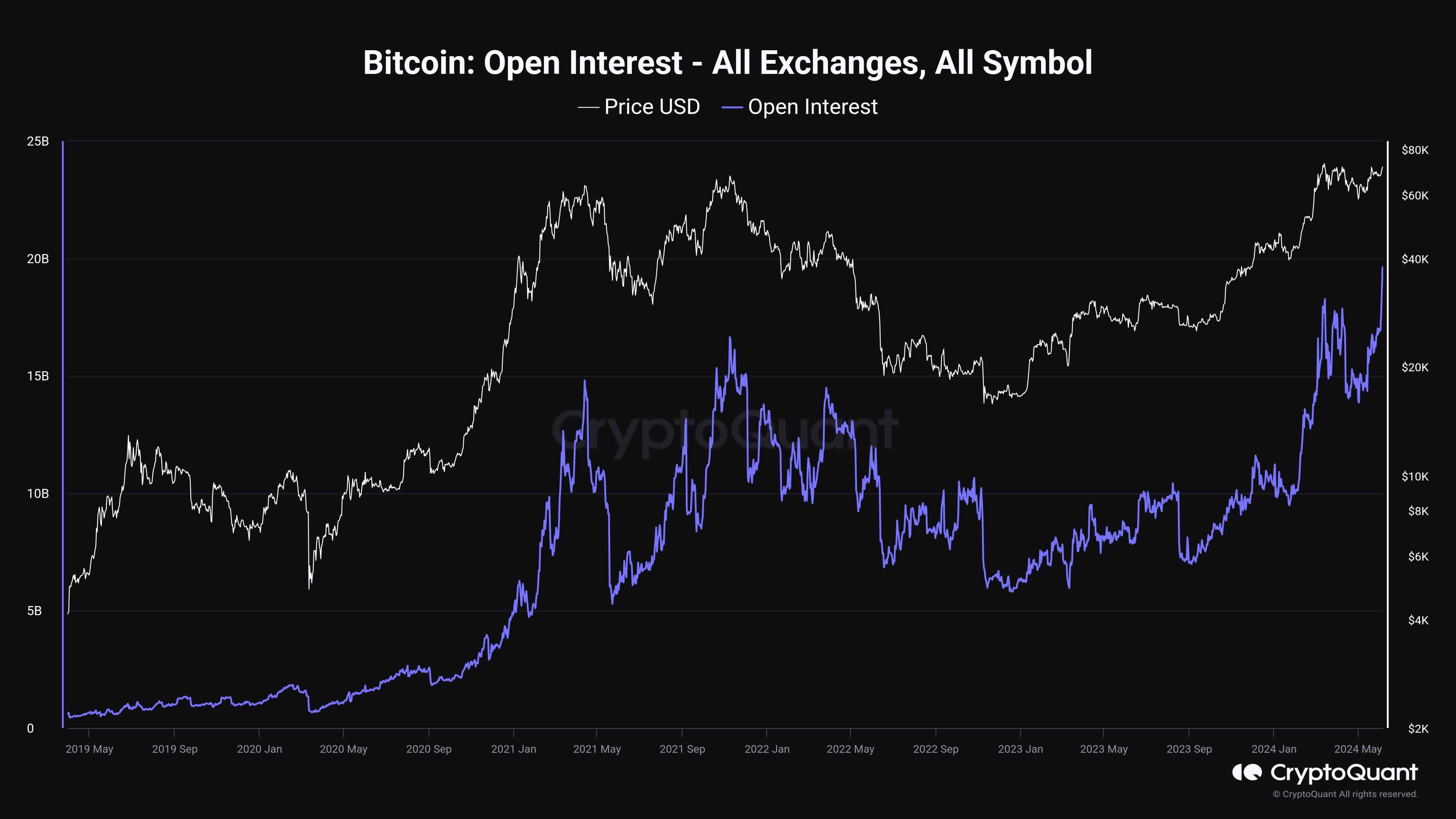

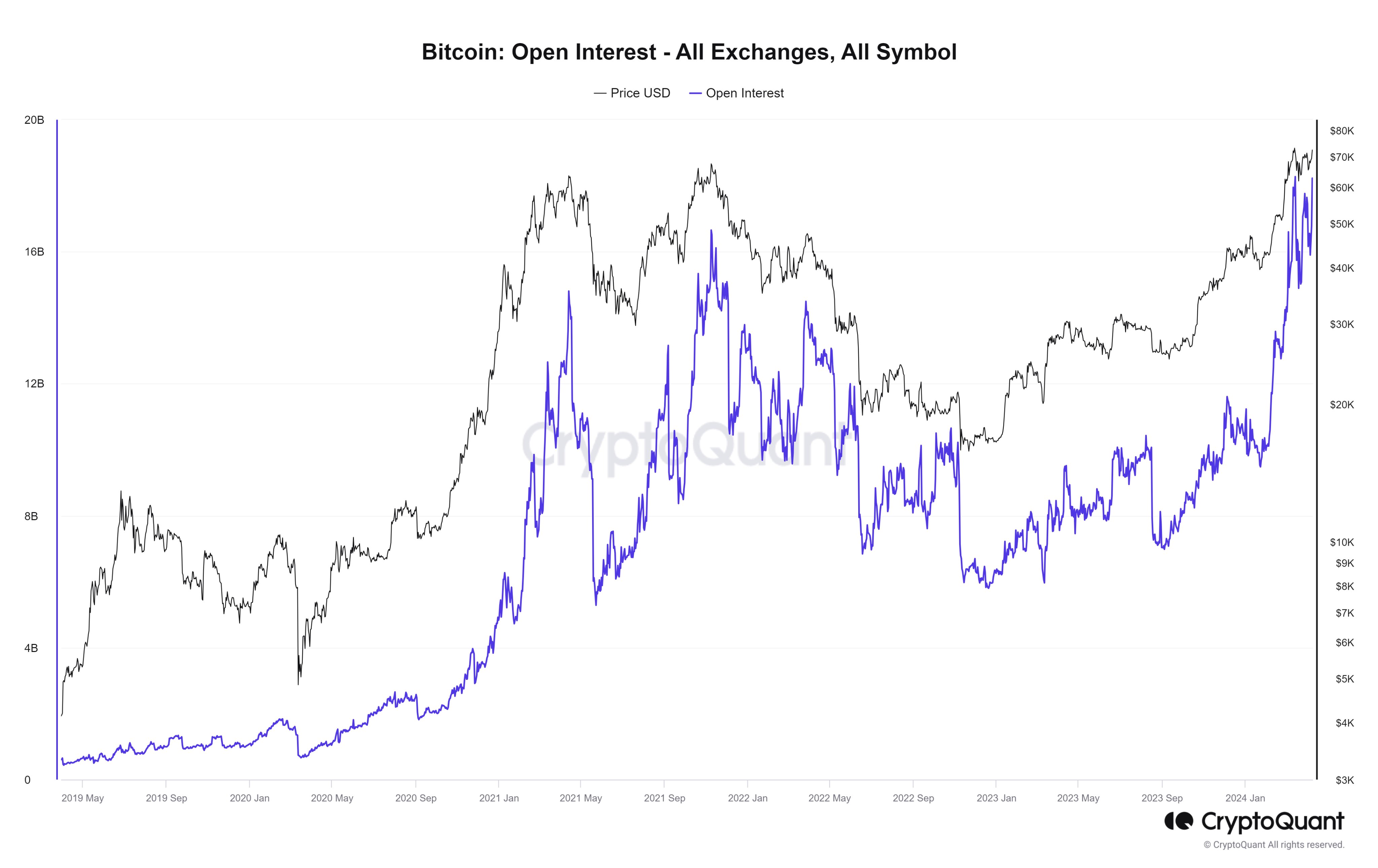

Quick Take A sharp increase in futures open interest occurred on Aug. 9 to a level seen just seven times this halving cycle, thus registering one of the largest single-day surges ever. An impressive addition of over 32,000 Bitcoin was channeled into futures open interest contracts, pushing the open interest close to the year-to-date highs. A sharp variation in Futures Open Interest often indicates deleveraging events and liquidation cascades and can swing both ways – long and short. Significant positive spikes typically signify substantial inflows of Open Interest, hinting at fresh capital venturing into the market and an upswing in leverage. On the other hand, large negative spikes usually emerge from short/long squeezes or liquidation cascades, which results in a massive volume of open contracts being margin called and closed. FOI: (Source: Glassnode)

The post Bitcoin futures surge suggesting fresh capital entering market appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Interest (BCI) на Currencies.ru

|

|