2022-12-19 20:00 |

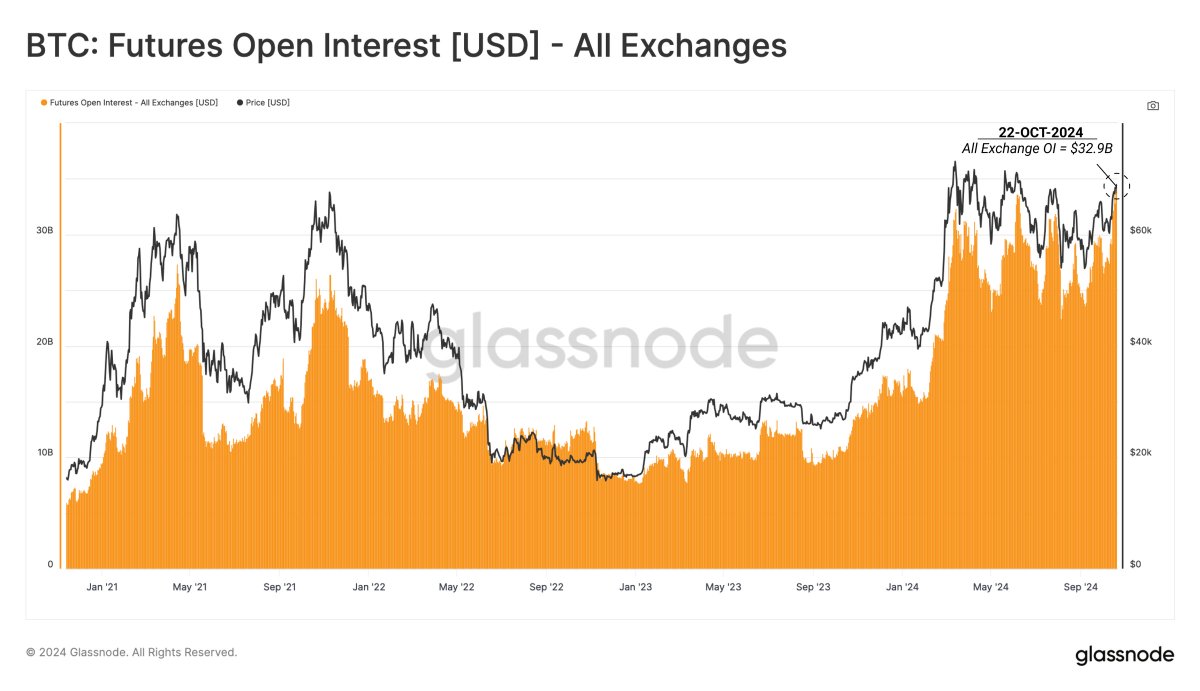

Bitcoin open interest has been on a steady decline since last week. After hitting a peak of $10.2 billion in early December, a swift reversal has seen open interest fall to monthly lows. Now, the decline in less than a week has put some pressure on the price of the pioneer cryptocurrency.

Bitcoin Open Interest Nosedives By 8.8%Over the month of December, market sentiment has not been overall positive for bitcoin which has led to the stagnant growth in bitcoin open interest. Nevertheless, there was some positive movement last week given the encouraging CPI data release and reduced interest rate hikes by the Fed in response to this. However, most of this growth would quickly be wiped out in a few days.

Between the start of last week and the end, there was about an 8% increase in the exchange of bitcoin futures open interest. This brought it close to the month’s peak once more as prices began to recover. But by Monday, only four days after hitting this local peak, it would decline another 8.8%.

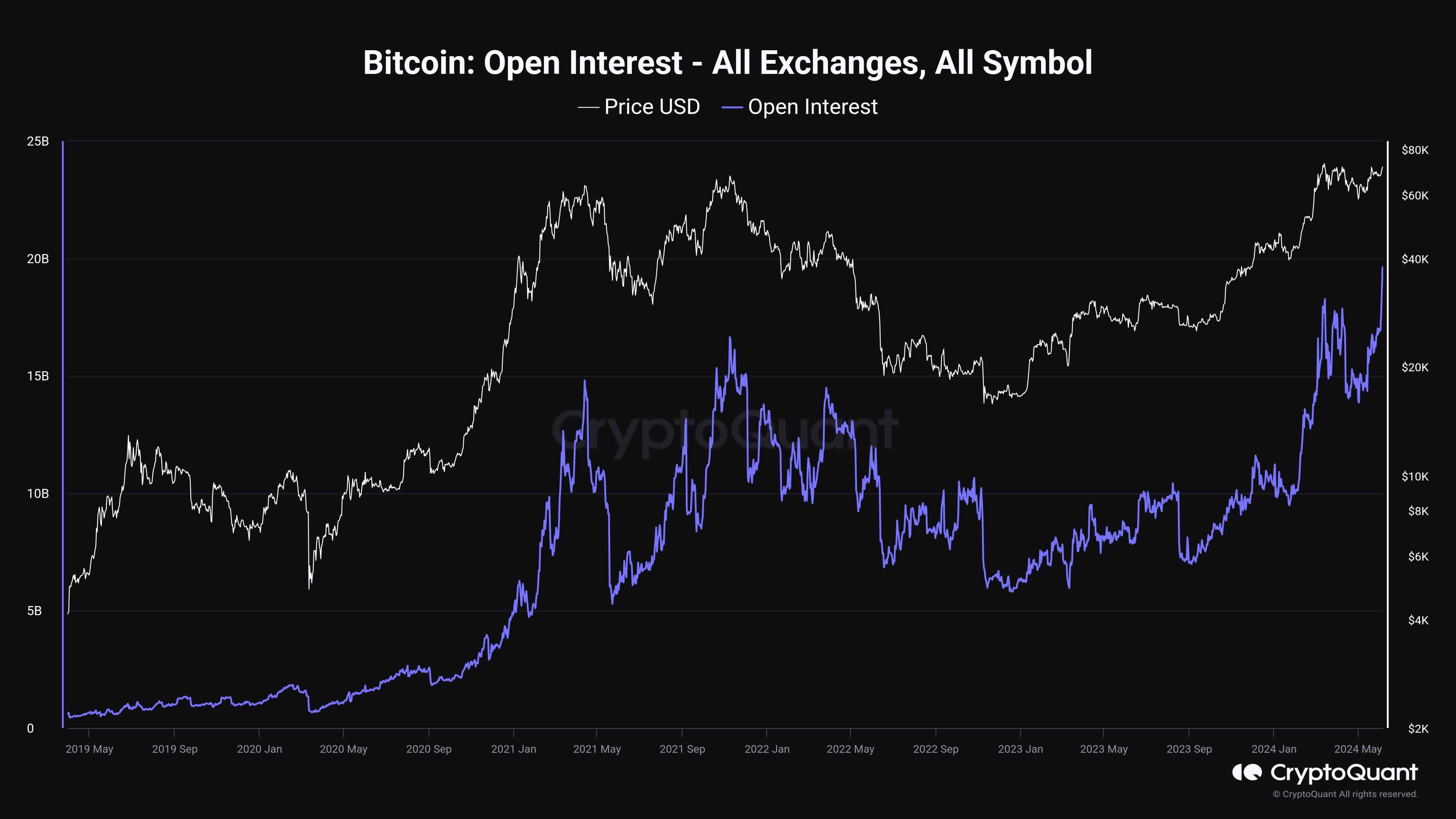

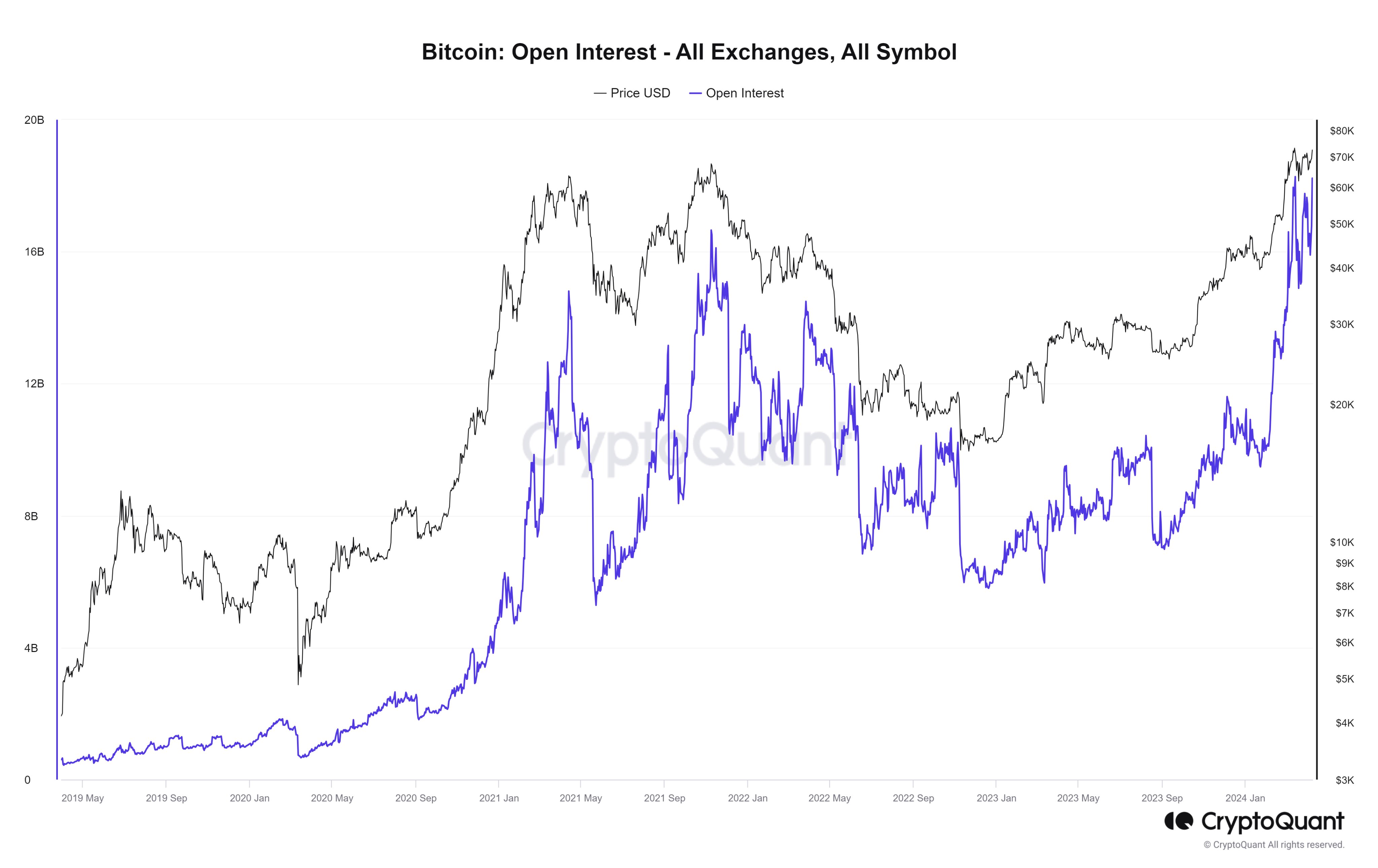

The total open interest across all exchanges is currently sitting at $9.353 billion in the early hours of Monday. It is now a long way from the $23.805 billion high that was recorded in April 2021, and the last time open interest was this low was in January of 2021, almost two years ago.

BTC Not Looking GoodFor bitcoin, finishing a year such as 2022 on a strong note would be a good boost for the digital asset. However, indicators continue to point towards a weak finish for it and the decline in the exchange bitcoin futures open interest contributes greatly to this.

Firstly, bitcoin has been unable to successfully break out of its $16,000 rut. This continuous drag on the cryptocurrency was expected after it fell below the $17,000 support level but there is no recovery on the horizon. Even the $16,500 support remains shaky at best at this point.

Unless there is some uptick in momentum in the coming days, bitcoin might be closing out the year below $16,000. This will naturally be propelled forward by the lull triggered by the holiday season as most take a break from the market. Also, the pullout of liquidity for holiday expenses is something that affects financial markets and bitcoin is not left out of this.

A break above the resistance that is now being mounted at $17,000 would be just the trigger needed for bitcoin to mark a strong finish. From there, $17,500 remains a good target and the bulls can easily maintain this momentum into the new year.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Interest (BCI) на Currencies.ru

|

|