2023-11-7 13:45 |

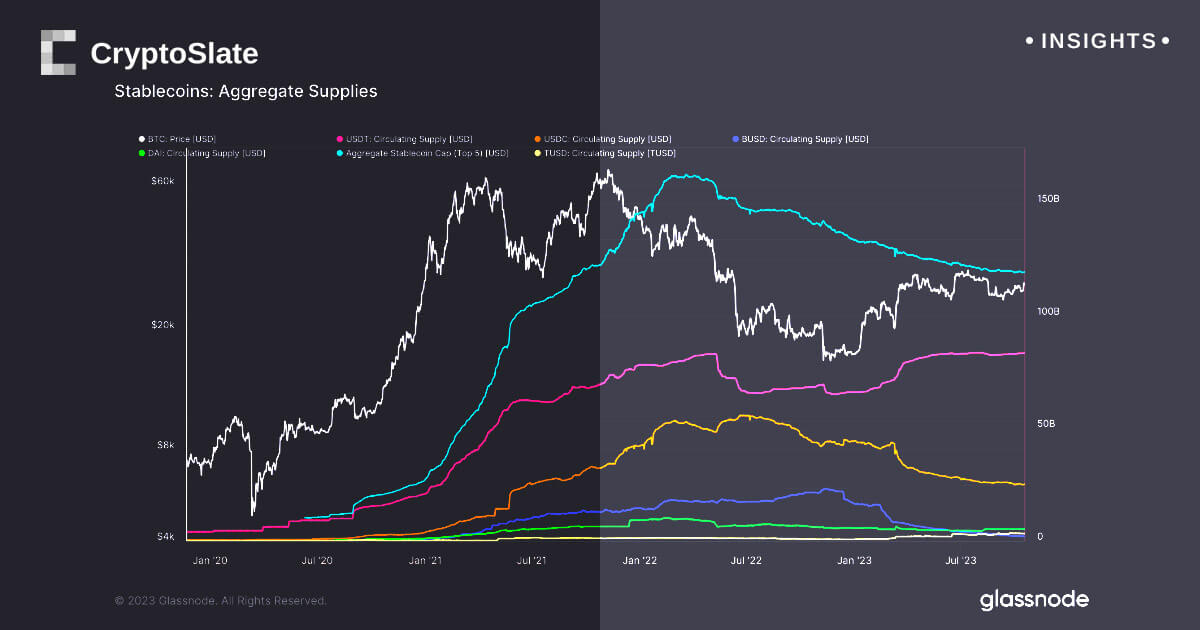

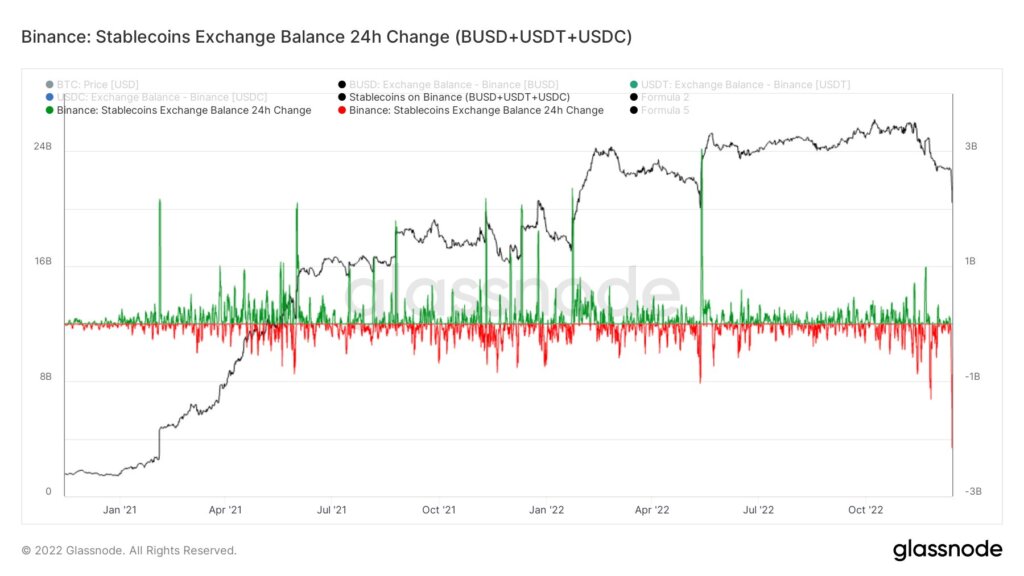

The supply of Binance’s USD (BUSD) stablecoin has declined by more than 90% to under 2 billion after peaking at an all-time of nearly 23 billion in November 2022, according to CryptoSlate’s data. BUSD supply sits at around 1.88 billion as of press time.

Graph showing the supply of BUSD in 2023 (Source: Glassnode)Curve’s BUSD V2 pool also reveals that crypto traders are showing a preference for other stablecoins as the pool’s dashboard is heavily imbalanced.

The BUSD V2 dashboard shows that the embattled stablecoin accounted for roughly 67% of the pool’s $970,000 reserve, while USDT made up 7.5%. The other stablecoins in the pool — USD Coin (USDC) and DAI — make up the balance.

Table showing the trading volume for BUSD in 2023 (Source: CoinCodex)Data from CoinCodex further shows that BUSD’s trading volume has rapidly tanked within the past year with its average monthly volume falling to $1.25 billion in October from a peak of $9.5 billion recorded in February.

Why BUSD supply fellBUSD’s supply fall can largely be attributed to regulatory actions that prompted a swift exodus of the troubled stablecoin within the crypto community, causing its circulating supply to reduce drastically.

In February, the New York Department of Financial Services ordered Paxos to stop minting the stablecoin.

Its fate was sealed in June when it was labeled as a security by the U.S. Securities and Exchange Commission (SEC) in its lawsuit against Binance.

Both Binance and Paxos vehemently rejected this SEC classification.

Binance advises on alternativesAs BUSD faces an impending discontinuation, Binance has advised its users to transition their holdings into First Digital USD (FDUSD), a stablecoin introduced by Hong Kong-based First Digital Group in late July.

This recommendation has prompted a remarkable upswing in FDUSD’s market supply, now at an all-time high of $682 million. However, the adoption of this stablecoin is still somewhat limited, primarily because it is exclusively available on the Binance platform, lacking broader exposure on major crypto exchanges.

Before promoting FDUSD, Binance also advocated for the Justin Sun-associated True USD (TUSD). TUSD has emerged as one of the fastest-growing stablecoins this year, with a market capitalization exceeding $3.4 billion, largely attributed to early support from Binance.

The post BUSD supply drops below $2B following regulatory controversies appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance USD (BUSD) на Currencies.ru

|

|