2021-10-18 20:00 |

Bitcoin whales are not slowing down on their accumulation tour despite rising prices. Bitcoin has now hit $62K for the first time in five months and the market has rejoiced over this milestone. With more growth expected in the coming weeks, investors are making sure that they do not miss out on what the digital asset has to offer in terms of value.

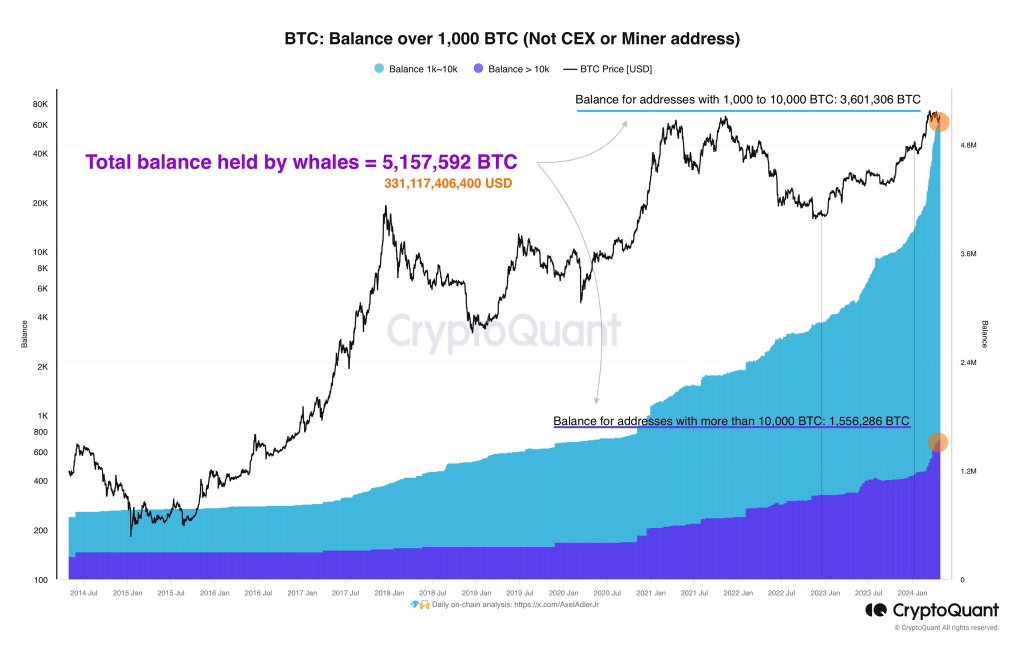

BTC is now the de facto internet store of value, so investors are FOMO-ing into the asset. This has translated to a higher price for BTC. However, the majority holding is still skewed in favor of the whales. These addresses which hold 100 to 1,000 BTC on their balances are increasing the share of the total circulating supply which they command, and data shows that there has been an uptick in the number of whale addresses holding 100 to 1,000 BTC.

Related Reading | Bitcoin Breaks $60,000 Ahead Of SEC ETF Approvals

Addresses Holding 100 To 1,000 BTC Jumps 1.9%A recent report from Santiment showed that the number of addresses holding between 100 and 1,000 BTC on their balances had grown in the past five weeks. A reported 254 new addresses had increased their holdings to join this category of whales, who now hold about 21.3% of the total bitcoin circulating supply.

BTC price trading north of $61K | Source: BTCUSD on TradingView.comThe 254 new addresses represent a 1.9% increase in the number of these whale holders, signaling more accumulation sentiment among bitcoin investors in the recent weeks. It is one of the fastest whale address growth in the history of the digital asset and as buy pressure continues to mount, it is expected that more addresses will add to their holdings to get above 100 BTC.

“The number of #Bitcoin addresses holding between 100 to 1,000 $BTC has grown substantially over the past five weeks. 254 more of these whale addresses now exist compared to five weeks ago, which is a notable 1.9% increase in this short time period. The number of #Bitcoin addresses holding between 100 to 1,000 $BTC has grown substantially over the past five weeks. 254 more of these whale addresses now exist compared to five weeks ago, which is a notable 1.9% increase in this short time period.” – Santiment report

Majority Of Bitcoin Holders Are In ProfitThe profit margins seen from bitcoin investors have contributed to the accumulation patterns witnessed in the asset. Glassnode reported that the majority of bitcoin holders are in profit given the recent price surge. It is estimated that 99.02% of the entire circulating supply of BTC is in profit.

Related Reading | Strike Launches New Feature To Allow Users Convert Salaries To Bitcoin

With bitcoin only about $3,000 less than its previous high, the analytics firm reported that there is only 0.98 BTC left in circulation that was spent at a higher price. These are the coins that were spent by investors between the $62K to $64K price ranges, and with the price of the digital asset targeting new all-time highs, it may not be long until 100% of BTC in circulation are held at a profit.

Featured image from Analytics Insight, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|