2024-6-5 20:36 |

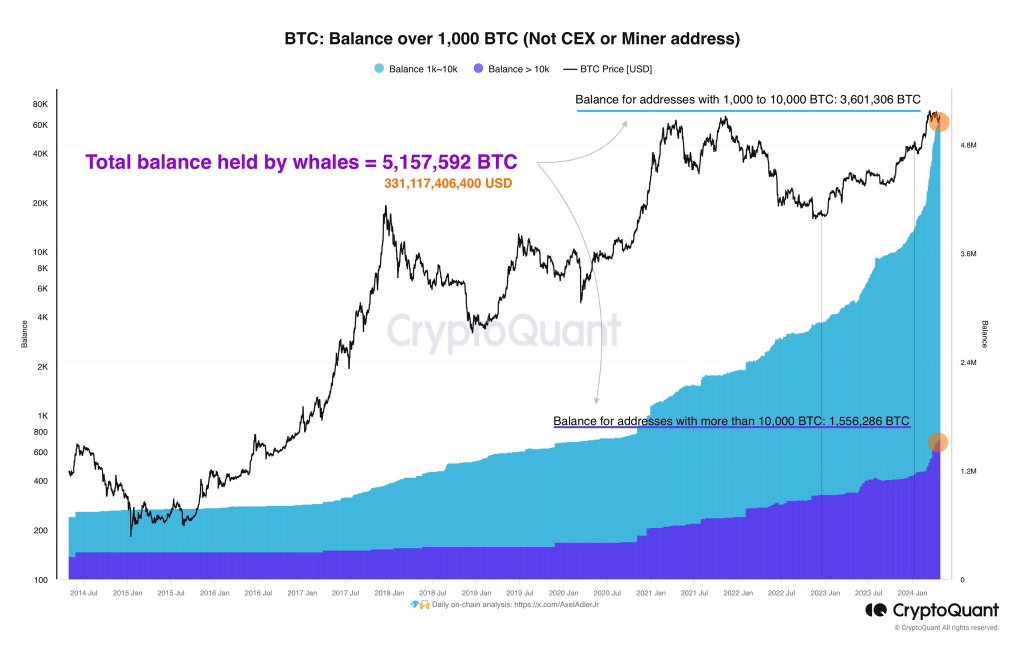

The crypto market is always full of rapid changes and unpredictable patterns. Recently, Bitcoin whales have made headlines with unusual transaction activities, raising questions about their next strategic moves. They have been buying huge amounts of Bitcoin from exchanges, which might be a bullish sign.

Increased Whale ActivityBitcoin whales have ramped up their accumulation, which is uncommon for this stage of the market cycle. Generally, whale activity quiets down during long-term bullish trends, picking up only when the market nears its peak and prices start to decline. However, the current scenario may suggest something different.

Despite the unusual whale behavior, technical data looks positive. The realized price gradient oscillator, a crucial tool for measuring market momentum relative to the realized cap, shows bullish signs. For Bitcoin to sustain its upward trajectory and avoid a pattern similar to the 2021 bull run, the oscillator must move past a value of 3. It stands at 1.38, indicating that the bulls still have room to drive the market higher.

Recently, Bitcoin has been close to its new all-time high but saw a 4% pullback that revisited the $69,000 level. Investors kept purchasing through April and the first half of May, even as prices didn’t move much. This signals a potential pattern that could send Bitcoin on a 300-day bull run.

Insights from Leading AnalystsCrypto analysts also shared their opinions on the situation and provided insightful on-chain analysis. Axel Adler talked about the current momentum through the price gradient oscillator, which is important to track when trends begin to fade.

Willy Woo pointed out that significant Bitcoin accumulation has occurred over the last eight weeks despite a lack of clear higher timeframe trends. This has caused some panic among retail investors despite the strong demand for Bitcoin. Woo is confident it’s about time for BTC to break past its all-time high.

One of the most intriguing aspects of the current market is the increasing exchange whale ratio in April and May. Again, this is rare during a bull run, as whales typically accumulate on the low. The current trend suggests that whales are preparing for significant moves, which could send the markets either way in the short term.

What Lies Ahead for Bitcoin?The increased whale activity raises several possibilities for Bitcoin’s future. While some investors may be wary, the substantial outflows from exchanges suggest that the top is not yet in place, supporting the argument for continued bullish momentum.

Many investors are always interested in whale transactions. Their purchases appear bullish, but Bitcoin’s future remains uncertain. Everyone will keep an eye on the actions of these whales, as they could provide critical insights into the market’s direction in the coming months.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|