2024-12-10 11:36 |

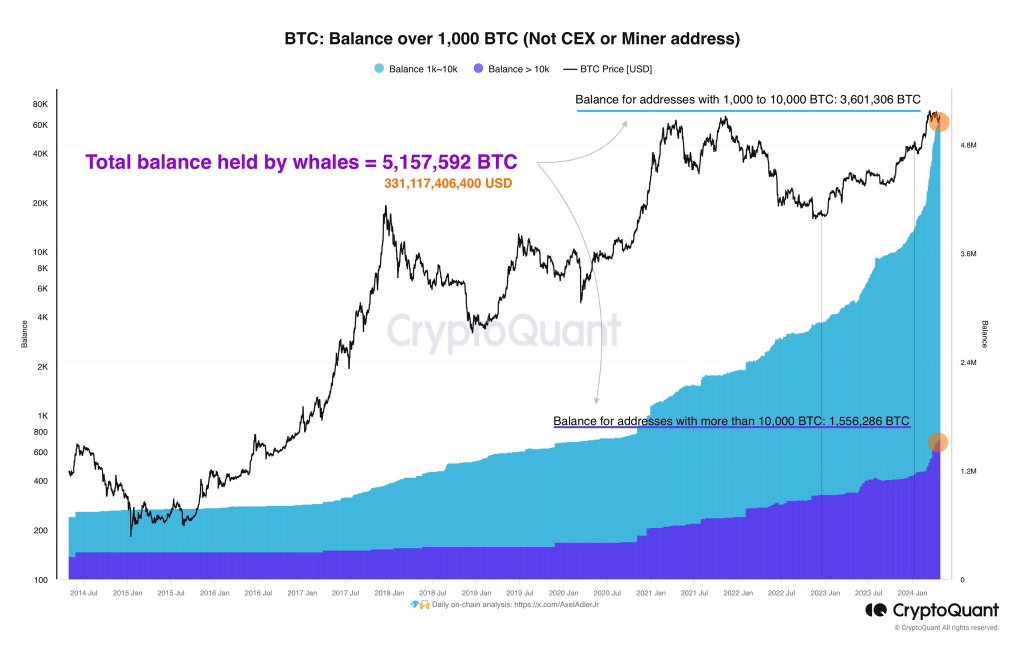

Bitcoin whales are ramping up their accumulation efforts, purchasing an additional 20,000 BTC—valued at $2 billion—in the past 24 hours.

This surge in large-scale buying reflects growing confidence among major holders in Bitcoin’s long-term prospects.

#Bitcoin whale accumulation is going parabolic. They just bought another 20,000 $BTC in the last 24 hours, valued at $2 billion! pic.twitter.com/jkbTPvr0rt

— Ali (@ali_charts) December 6, 2024

Historical patterns suggest that Bitcoin’s local price tops often occur around the Short-Term Holder Cost Basis, adjusted by +1 standard deviation. Currently, that level is set at $112,926, indicating a potential resistance zone if the trend continues.

Local #Bitcoin $BTC tops are usually reached around the Short-Term Holder Cost Basis +1 standard deviation. That level currently stands at $112,926! pic.twitter.com/qeLvtIcaX0

— Ali (@ali_charts) December 6, 2024

Institutional interest in Bitcoin remains strong as well. Marathon Digital (@MARAHoldings) acquired another 1,300 BTC worth approximately $130.66 million in just seven hours. This move underscores the appetite among corporate entities to bolster their Bitcoin reserves.

Marathon Digital(@MARAHoldings) acquired another 1,300 $BTC($130.66M) in the past 7 hours!https://t.co/etgIlc5fdz pic.twitter.com/NFwT5huRfB

— Lookonchain (@lookonchain) December 7, 2024

Bitcoin Spot Market Continues SurgeDespite some hesitancy in the futures market, Bitcoin’s spot market has displayed resilience against price fluctuations. Holders appear unshaken, maintaining composure unless prices fall below the critical $89,000 mark. Analysts identify a support zone between $90,000 and $93,000, which could act as a stabilizing factor or even trigger a rebound.

Bitcoin's spot market stands strong against price dips, with holders staying calm unless prices plunge below $89,000.

Meanwhile, futures demand lags despite enticing funding rates.

A critical support zone between $90,000 and $93,000 may either steady the ship or spark a… pic.twitter.com/XE0sGFoON7

— Kyledoops (@kyledoops) December 6, 2024

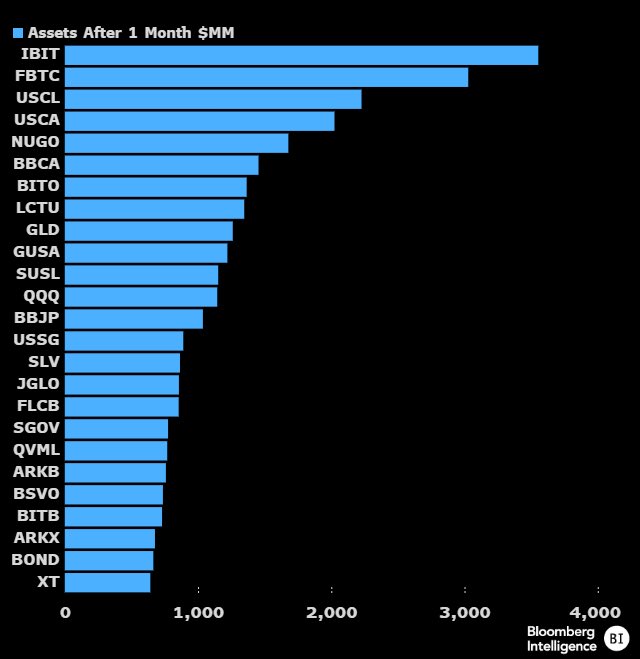

The momentum extends to Bitcoin spot ETFs, which recorded a net inflow of $377 million on December 6. This marks seven consecutive days of positive inflows, signaling robust demand among investors. BlackRock’s IBIT ETF contributed significantly, with an average daily inflow of $257 million, while Fidelity’s FBTC ETF added $120 million per day.

Bitcoin spot ETF had a total net inflow of $377 million on December 6, and continued to have net inflow for 7 consecutive days. BlackRock ETF IBIT had a net inflow of $257 million per day, and Fidelity ETF FBTC had a net inflow of $120 million per day. https://t.co/59u0BnEqLG pic.twitter.com/aeKNLzRPoy

— Wu Blockchain (@WuBlockchain) December 7, 2024

With a combination of whale accumulation, institutional activity, and strong ETF inflows, Bitcoin’s market outlook appears increasingly optimistic. These developments suggest a growing confidence in Bitcoin’s position as a leading digital asset, even amid a challenging economic landscape.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !

Image Source: fellowneko/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|