Cohorts - Свежие новости [ Фото в новостях ] | |

XRP Price Jumps Nearly 20% As Whales Buy Aggressively

XRP has staged a sharp rebound after a steep sell-off rattled investor confidence across the market. The token had suffered heavy losses, triggering fear-driven exits among retail holders. However, select investor cohorts viewed the decline as an opportunity. дальше »

2026-2-7 07:05 | |

|

|

Ethereum ETF End 2025 With $67 Million Inflows, Price Stagnates Under $3,000

Ethereum price has moved sideways since late December 2025, struggling to establish a clear trend. ETH has repeatedly tested resistance without confirmation. Despite muted price action, sentiment across several investor cohorts has improved, suggesting consolidation may be nearing an end as market confidence slowly rebuilds. дальше »

2026-1-1 11:00 | |

|

|

XRP: ETF 'green days' fade as leverage hits $450mln – This hints at...

Despite a lovely (yet trimmed) patch of green ETF inflows, Ripple's XRP is moving against the grain. Key cohorts are cutting down exposure, and Open Interest (OI) is in freefall. This change in tonThe post XRP: ETF 'green days' fade as leverage hits $450mln – This hints at... appeared first on AMBCrypto. дальше »

2025-12-28 12:00 | |

|

|

Bitcoin Critical Holders’ Profit Crashes To Monthly Low: Will Price Further Suffer?

Bitcoin has shown mixed price action in recent sessions, marked by sharp fluctuations and tentative recovery attempts. BTC rebounded after a brief breakdown, yet momentum remains fragile. A key concern is weakening confidence among one of Bitcoin’s most influential cohorts, which could complicate efforts to sustain a broader price recovery. дальше »

2025-12-22 01:27 | |

|

|

Bitcoin: As 2 major groups return, is BTC ready for a strong rebound?

Key Takeaways Whale and retail cohorts accumulate Bitcoin as price holds above ascending $110K trendline. Rising network activity and Stock-to-Flow ratio reinforce Bitcoin’s long-term bullish strucThe post Bitcoin: As 2 major groups return, is BTC ready for a strong rebound? appeared first on AMBCrypto. дальше »

2025-8-7 22:00 | |

|

|

Bitcoin whale accumulation returns: Can traders survive the $120K shakeout?

Key Takeaways All wallet cohorts are accumulating, while the stock-to-flow ratio signals tightening Bitcoin supply. Exchange inflows and high-leverage clusters near $120K point to looming volatility. дальше »

2025-7-22 01:00 | |

|

|

Crypto’s killer app is the first 60 seconds: Fix onboarding or forget adoption | Opinion

Ecosystems with the shortest gap between “discover” and “first on-chain action” grow the healthiest long-term cohorts. дальше »

2025-7-3 11:53 | |

|

|

Dogecoin: 100M DOGE whale transfer sparks interest, yet buyers hold back

The Dogecoin capitalization discrepancy gave some insights into market sentiment. Two whale cohorts exhibited some accumulation, while other groups remained hesitant to buy. DogecoinThe post Dogecoin: 100M DOGE whale transfer sparks interest, yet buyers hold back appeared first on AMBCrypto. дальше »

2025-5-5 00:00 | |

|

|

Shiba Inu's widespread dumping from 2 key groups - Sell pressure rising?

Shiba Inu faced heavy sell pressure as whales offloaded 359 billion tokens in a single day. SHIB saw broad-based selling as all market cohorts rushed to exit positions. As Shiba Inu [SHIB] sThe post Shiba Inu's widespread dumping from 2 key groups - Sell pressure rising? appeared first on AMBCrypto. дальше »

2025-5-4 07:00 | |

|

|

Bitcoin sell-off puts mid-term holders under pressure: Glassnode

Bitcoin’s downside pressure has seen sell-off dynamics shift from newer coins to older cohorts, with the gradual capitulation coming amid broader market weakness. On-chain metrics and data insights platform Glassnode says Bitcoin (BTC) Bitcoin’s downside pressure has seen sell-off dynamics… дальше »

2025-4-9 19:51 | |

|

|

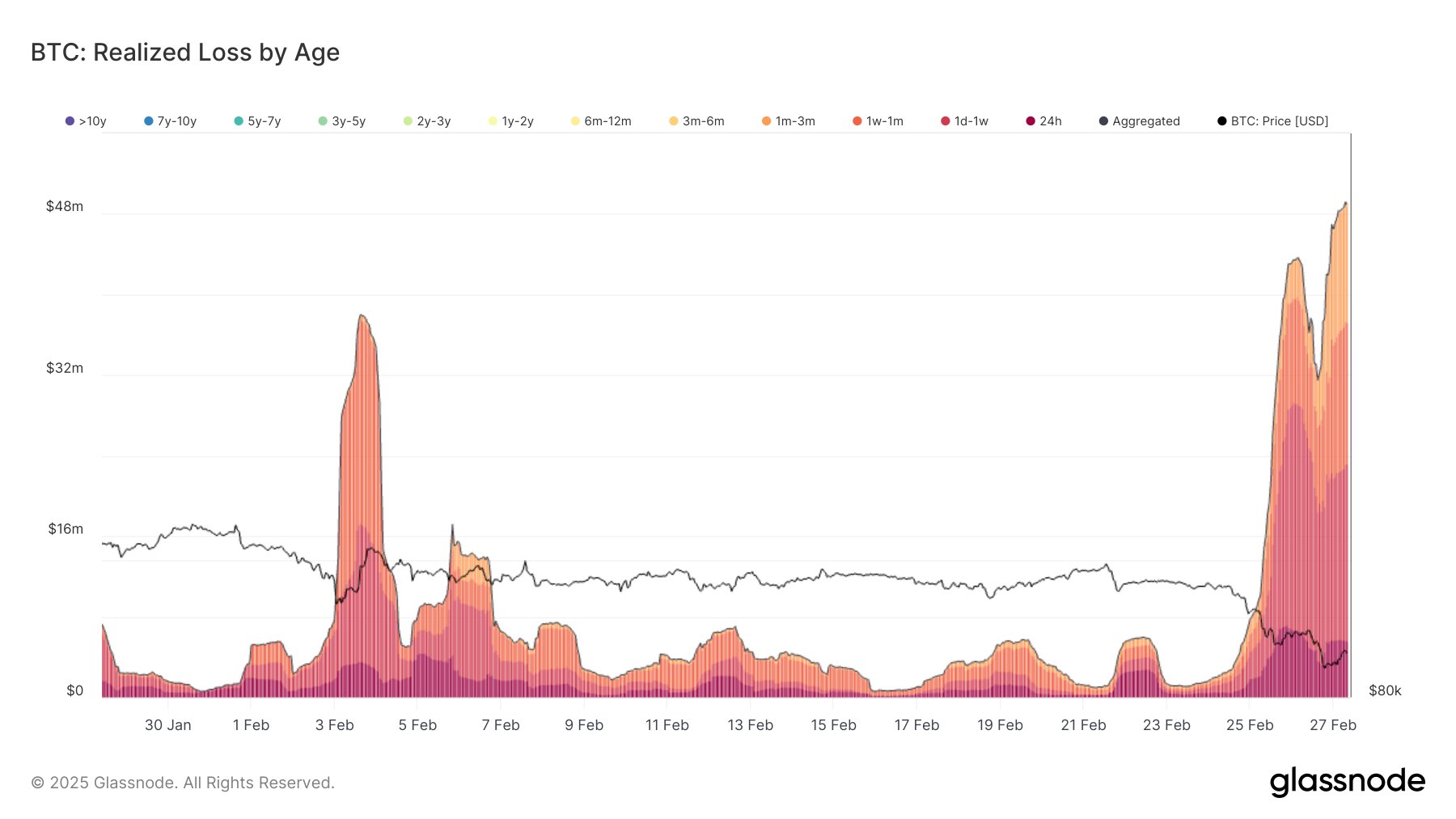

Bitcoin’s $2.16 Billion Capitulation: Who Sold At The Biggest Loss?

The on-chain analytics firm Glassnode has broken down which Bitcoin investor cohorts sold at the biggest loss during the latest price crash. Recent Bitcoin Buyers Have Combined Realized $2.16 Billion In Loss Recently In a new post on X, Glassnode has discussed what the capitulation event triggered by the Bitcoin price crash has been like. […] дальше »

2025-2-28 10:00 | |

|

|

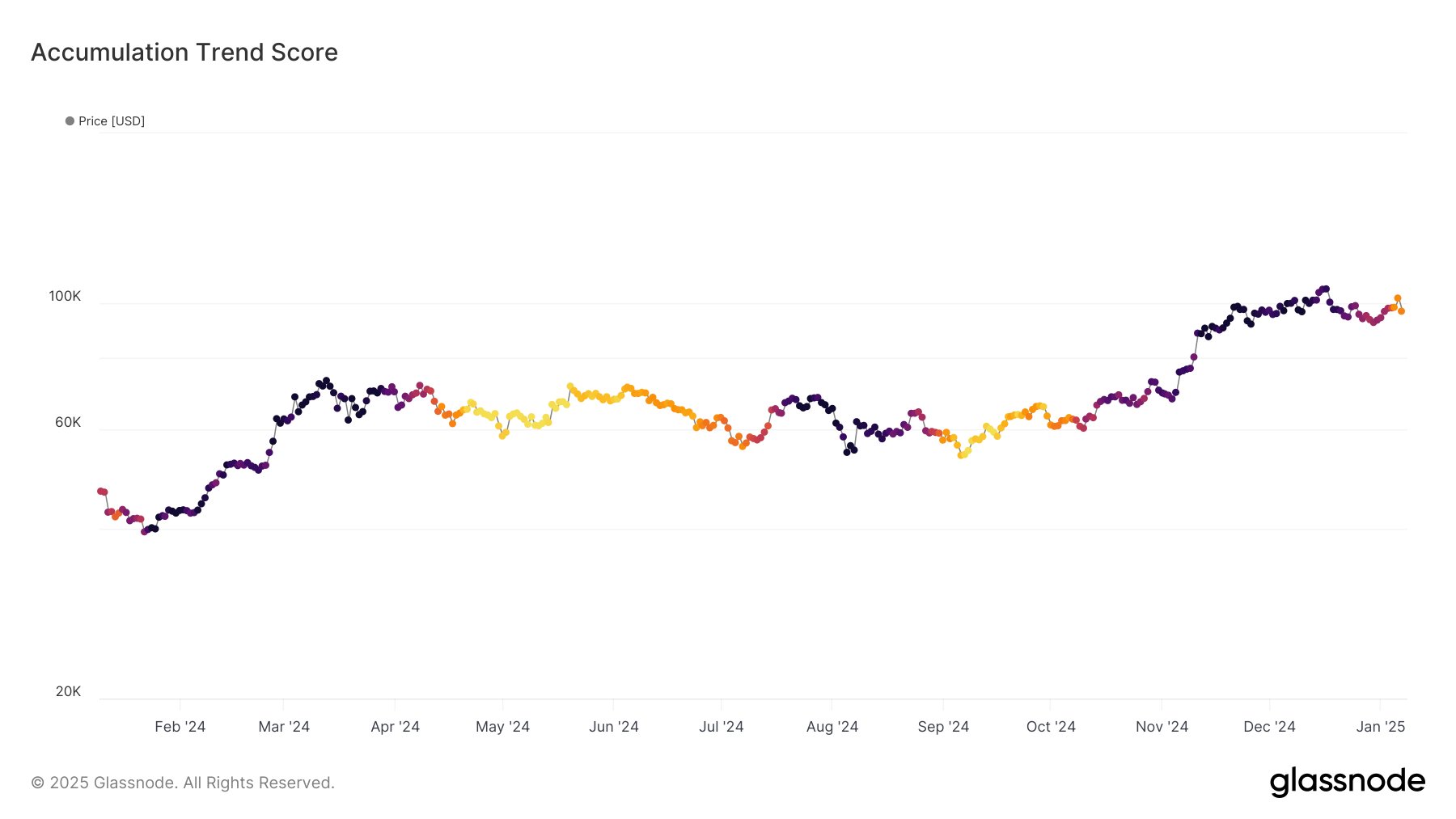

Bitcoin Accumulation Trend Score Turns Red: More Decline Coming?

On-chain data shows the Bitcoin Accumulation Trend Score has observed a decline recently, a sign that investor cohorts have taken to selling. Bitcoin Accumulation Trend Score Is Currently Sitting At 0. дальше »

2025-1-10 12:30 | |

|

|

Bitcoin slumps to $92,000 as long-term holders cash out: What’s next?

Bitcoin faced selling pressure from cohorts of longer-term holders The short-term holder (STH) profitability was low, and accumulation from STH was evident Bitcoin [BTC] saw a move to $108k The post Bitcoin slumps to $92,000 as long-term holders cash out: What’s next? appeared first on AMBCrypto. дальше »

2025-1-1 04:00 | |

|

|

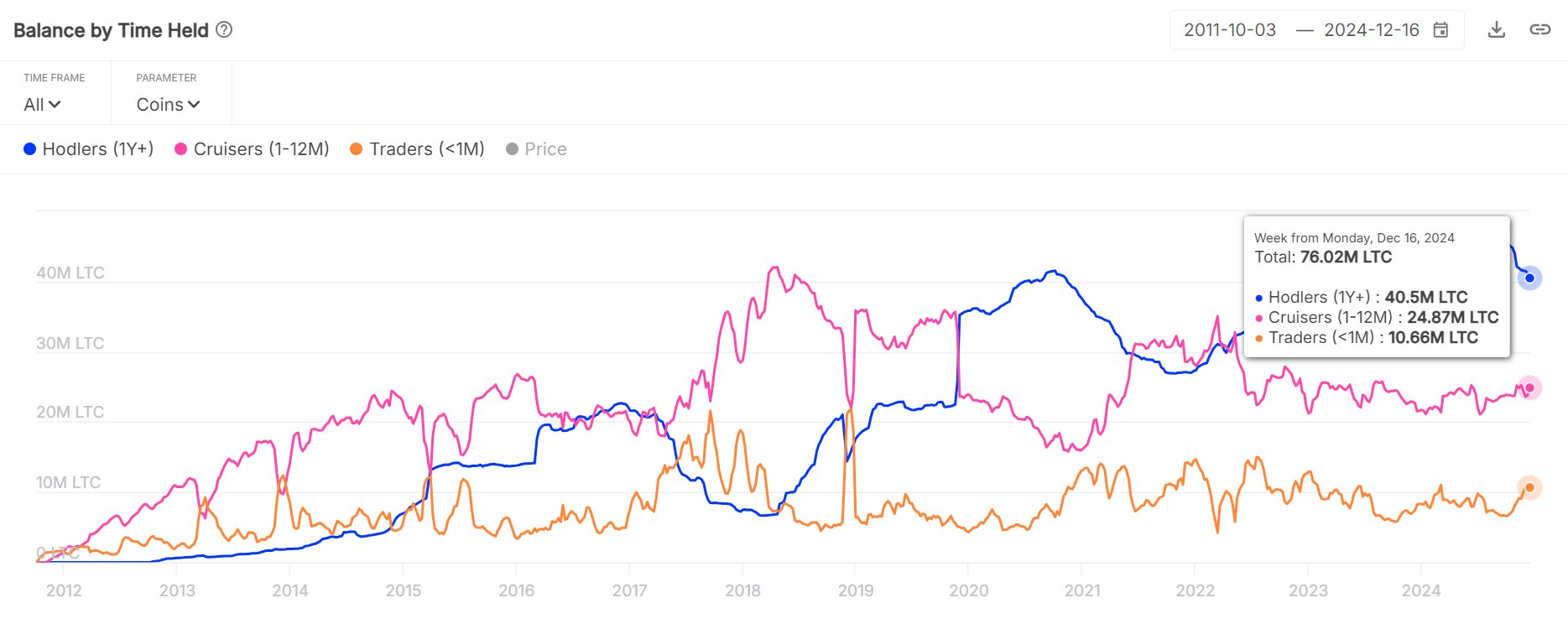

Litecoin HODLing Strong Despite 15% Crash: 54% Of Supply Dormant Since 1+ Years

On-chain data shows HODLing behavior on the Litecoin network has remained strong recently despite the plunge that LTC’s value has observed. Litecoin HODLers Currently Control The Majority Of Supply In a new post on X, Litecoin’s official handle talks about how the asset supply is distributed between its different cohorts right now. The investors have […] дальше »

2024-12-24 00:30 | |

|

|

Bitcoin ‘Well-Positioned’ To Break $100,000 Barrier Despite Short-Term Volatility: Report

According to a recent report by Bitfinex, Bitcoin (BTC) breaking through the psychologically significant $100,000 barrier will largely depend on the actions of two key holder cohorts – long-term holders (LTH) engaging in profit-taking and short-term holders (STH) driving demand. дальше »

2024-12-4 12:00 | |

|

|

Beacon Launches Its Fourth Web3 Accelerator Program, The Largest Cohort Yet

Beacon, an early-stage web3 accelerator, is excited to launch its fourth biannual three-month program, which provides startups with resources, mentorship, and capital. Beacon has selected 17 promising companies, the largest cohorts to date comprising the highest profile firms. дальше »

2024-9-14 18:26 | |

|

|

Bitcoin accumulation surges as miners and retail investors show confidence

Quick Take As of Aug. 20, the Bitcoin market is witnessing a significant shift towards net accumulation, with 70,000 BTC being accumulated across various cohorts over the past 30 days. CryptoSlate highlighted this trend on Aug. дальше »

2024-8-21 03:00 | |

|

|

Retail Bitcoin cohorts evolve from ‘dumb money’ to ‘smart money’

Quick Take In investing and trading, retail investors are often perceived as the “dumb money,” while institutional investors are seen as the “smart money. ” Historically, this perception has been evident in Bitcoin cycles. дальше »

2024-6-21 14:00 | |

|

|

Bitcoin Demand: Investors Buying BTC At 5.5x The Rate Of Miner Production

On-chain data shows that Bitcoin investors have recently been scooping up supply equal to 5.5 times what the miners have produced. Bitcoin Investor Cohorts Have Been Busy Accumulating Recently In a post on X, analyst James Van Straten discussed the accumulation that Bitcoin investor cohorts have been participating in and how it compares with the […] дальше »

2024-6-8 07:00 | |

|

|

Over 46% of Bitcoin’s circulating supply hasn’t moved in 3+ years

Quick Take The Glassnode supply last active (SLA) chart overlays multiple cohorts, each representing a percentage of the circulating supply based on the duration since the coins were last active. These cohorts include 1+ years, 2+ years, 3+ years, and 5+ years. дальше »

2024-5-11 15:45 | |

|

|

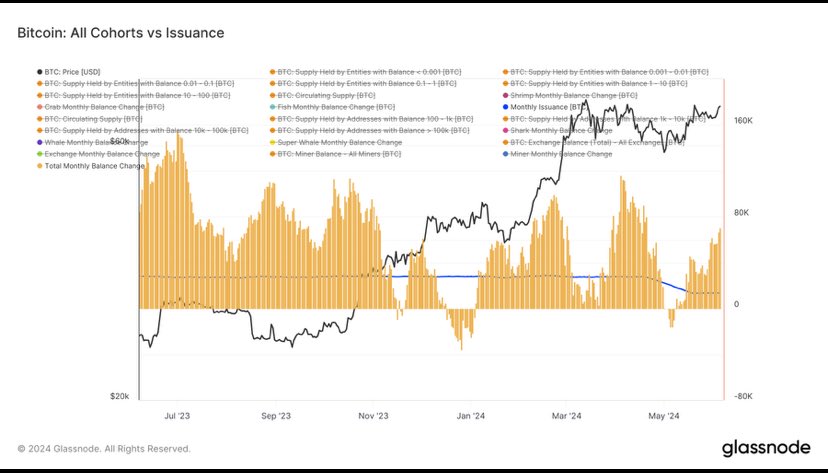

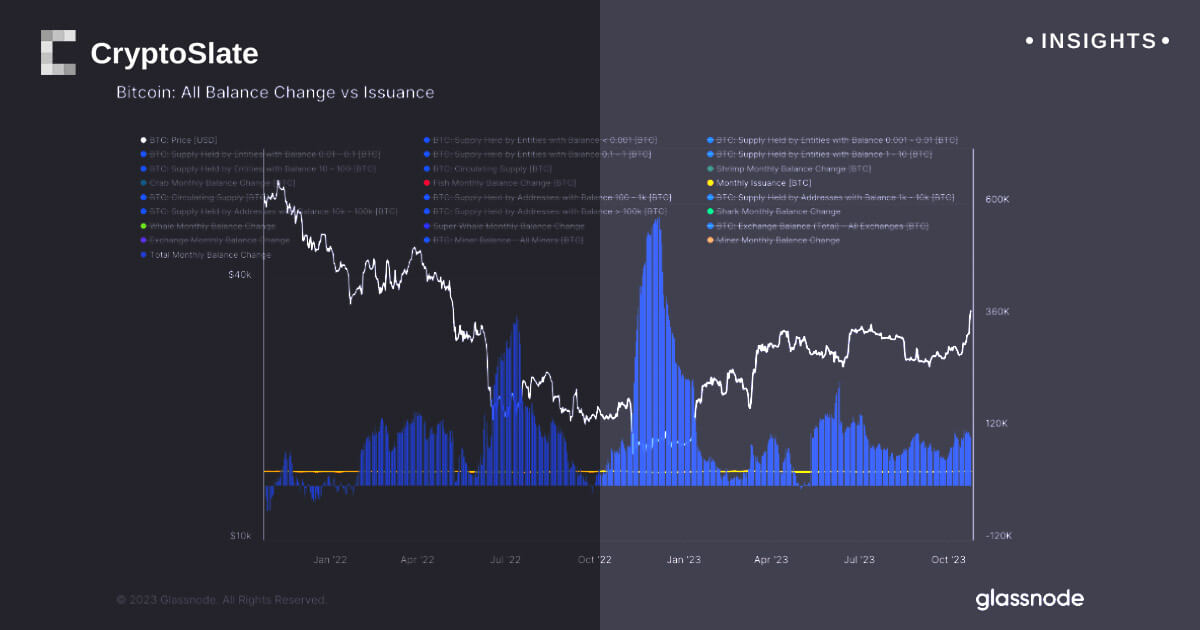

Bitcoin accumulation fails to keep pace with issuance

Quick Take Over the past 30 days, entities across all cohorts have accumulated just over 10,000 BTC. This rate of accumulation has not kept up with the approximately 19,000 BTC issued during that same timeframe. дальше »

2024-5-9 17:24 | |

|

|

Worried about Dogecoin's 30% drop? Analysts predict...

DOGE's current trajectory was similar to its pre-2017 and 2021 bull market phases. Several user cohorts were accumulating DOGE, possibly motivated by history. Much to the community's relief,The post Worried about Dogecoin's 30% drop? Analysts predict... appeared first on AMBCrypto. дальше »

2024-5-3 01:00 | |

|

|

XRP's 20% monthly drop - Here's what it means for you next

XRP has tanked 20% on a year-to-date (YTD) basis. Key whale cohorts were seen accumulating XRPs at discount. Payment-focused cryptocurrency Ripple [XRP] extended its losing streak, taking The post XRP's 20% monthly drop - Here's what it means for you next appeared first on AMBCrypto. дальше »

2024-5-1 03:00 | |

|

|

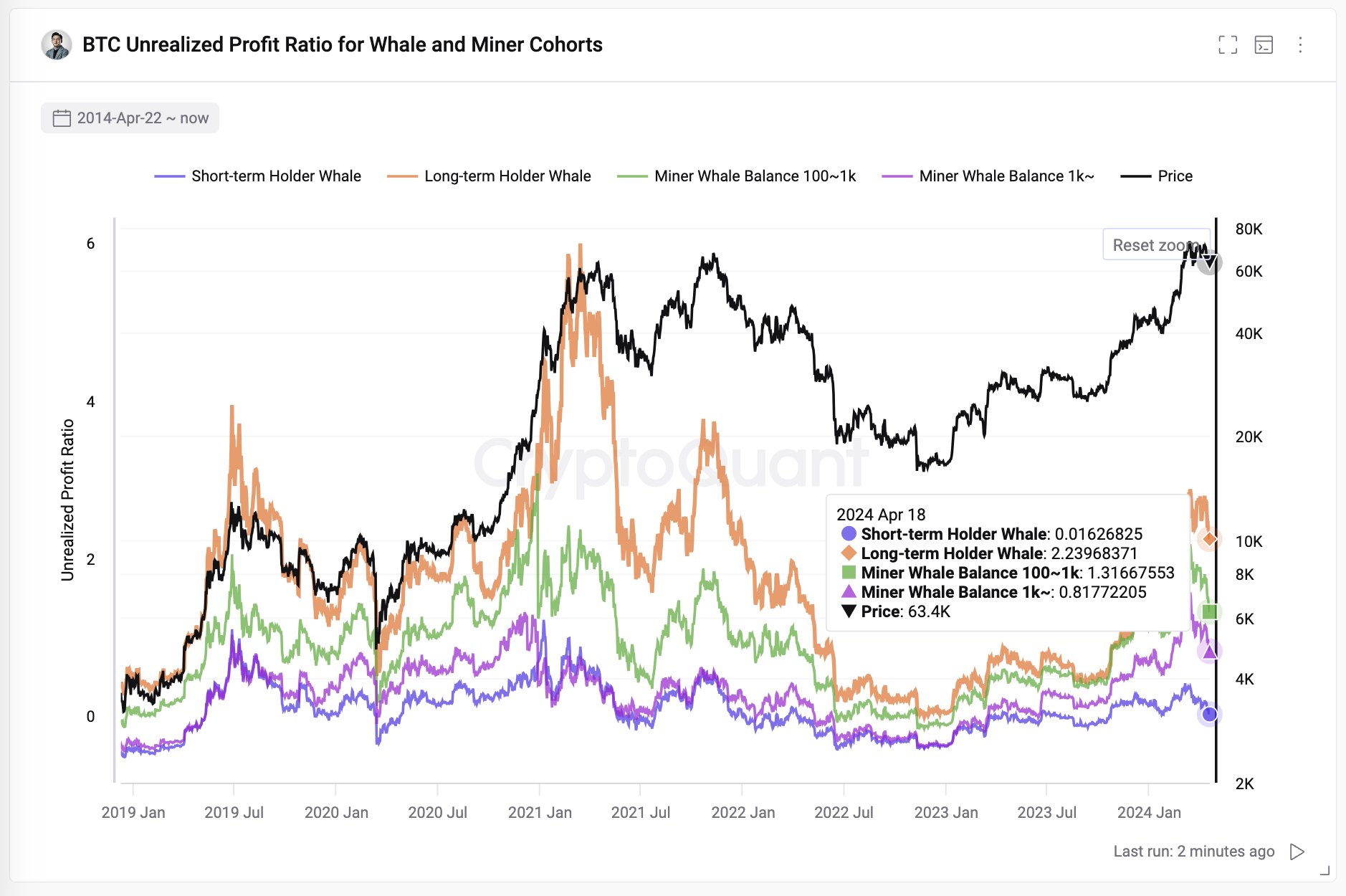

By The Numbers: How Much Profits Are Bitcoin Whales & Miners Holding?

Based on on-chain data, here’s how much unrealized profit the various Bitcoin whale and miner groups are holding right now. Bitcoin Whale & Miner Profits Compared Across Cohorts In a new post on X, CryptoQuant founder and CEO Ki Young Ju discussed the total unrealized profits currently held by the various on-chain cohorts. Ju has […] дальше »

2024-4-20 08:00 | |

|

|

Bitcoin’s looming halving event prompts massive accumulation

Quick Take The aggregate accumulation by various Bitcoin cohorts, ranging from shrimps (holding less than one BTC) to super whales (10,000+ BTC), has surpassed the monthly issuance, painting a bullish picture for the future of BTC. дальше »

2024-4-12 18:18 | |

|

|

Bitcoin accumulation hits decade high among ‘Shark’ cohort

Quick Take The digital asset market is witnessing an accelerated phase of Bitcoin (BTC) accumulation across two distinct cohorts: Shrimps and Sharks. The “Shrimp cohort” refers to retail investors holding less than one Bitcoin who have traditionally increased their holdings steadily. дальше »

2024-3-29 04:00 | |

|

|

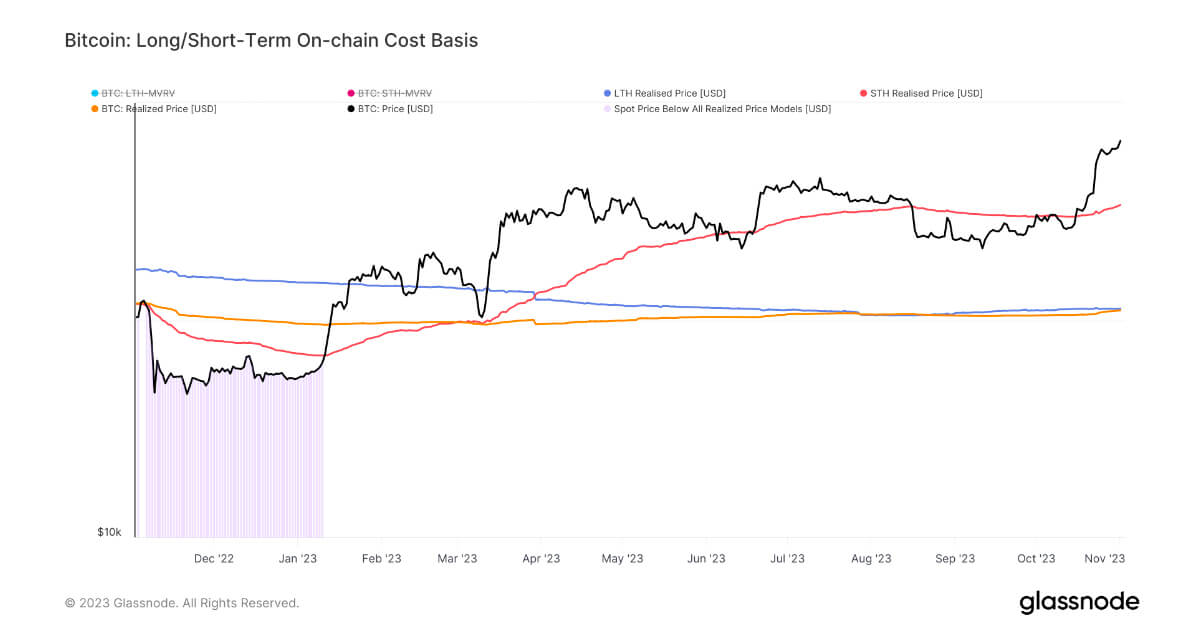

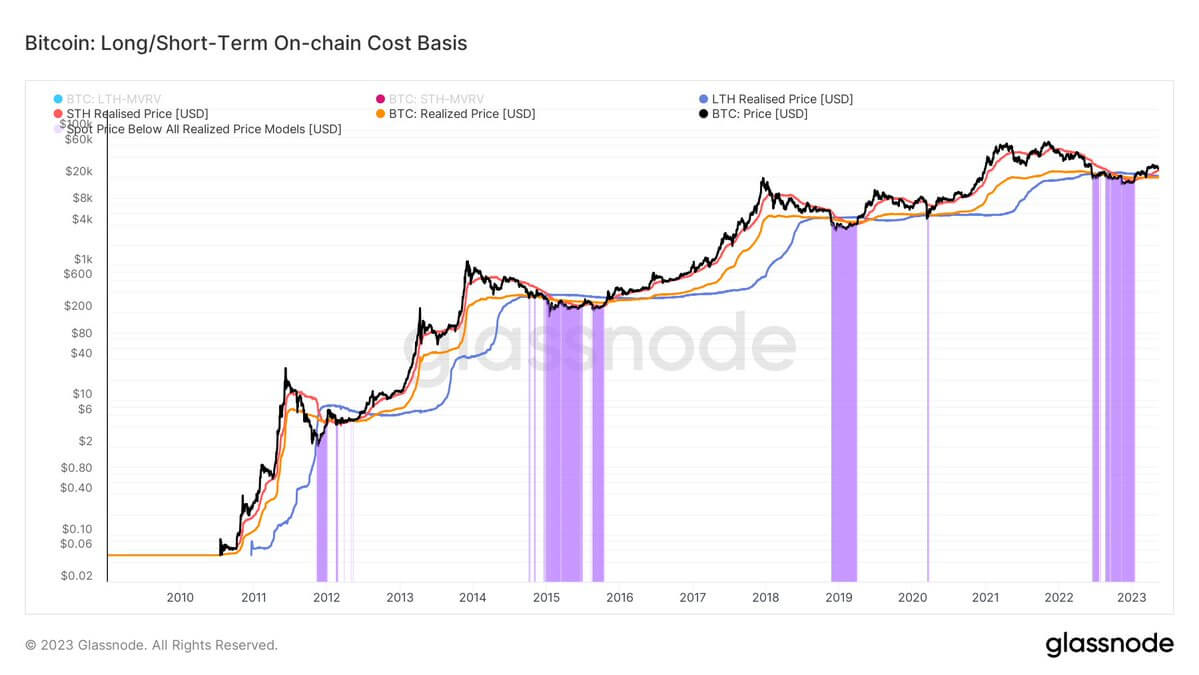

Recent Bitcoin buyers show unyielding optimism, pushing cost basis upward despite price surges

Quick Take Utilizing data from Glassnode to estimate a market-wide cost basis reveals intriguing trends in the average price at which coins are withdrawn from exchanges. The information, segregated into cohorts, uncovers an upward trajectory on a cost basis, indicating a trend of purchasing Bitcoin at incrementally higher prices. дальше »

2024-3-24 22:13 | |

|

|

Bitcoin short-term holder realized price growth hits a speed bump

The realized Bitcoin price represents the average on-chain acquisition cost. It’s a handy metric as it perfectly gauges the market’s valuation baseline at any given point. When dissected through the lens of short-term and long-term holders, it provides insights into the cohorts’ investment horizons and their acute effect on Bitcoin’s price. дальше »

2024-3-22 18:30 | |

|

|

From shrimps to whales: Who’s buying and selling during this rally?

The distribution of Bitcoin’s supply across various cohorts — shrimps, crabs, fish, sharks, and whales — can help us understand how each market segment behaves. Shifts in Bitcoin’s supply among these groups are heavily correlated with price movements and broader market trends, which is why understanding them is essential when analyzing the market. дальше »

2024-3-15 01:00 | |

|

|

Brave Browser introduces BAT reward payouts via the Solana blockchain

Brave Browser revealed its initial rollout on self-custody BAT reward payouts. Notable, the network has selected the Solana (SOL) blockchain due to its low fees and high speed. Basic Attention Token rewards on Solana will start with a few cohorts of early Brave users before the global rollout. дальше »

2024-2-24 16:37 | |

|

|

How DOGE's cult status keeps it alive

Non-zero DOGE addresses have been growing at the fastest rate ever. There was no noticeable increase in addresses belonging to whale cohorts. Dogecoin [DOGE] has gone off the boil in recent The post How DOGE's cult status keeps it alive appeared first on AMBCrypto. дальше »

2024-2-7 04:30 | |

|

|

Bitcoin whales resume accumulation, signaling confidence in market rally

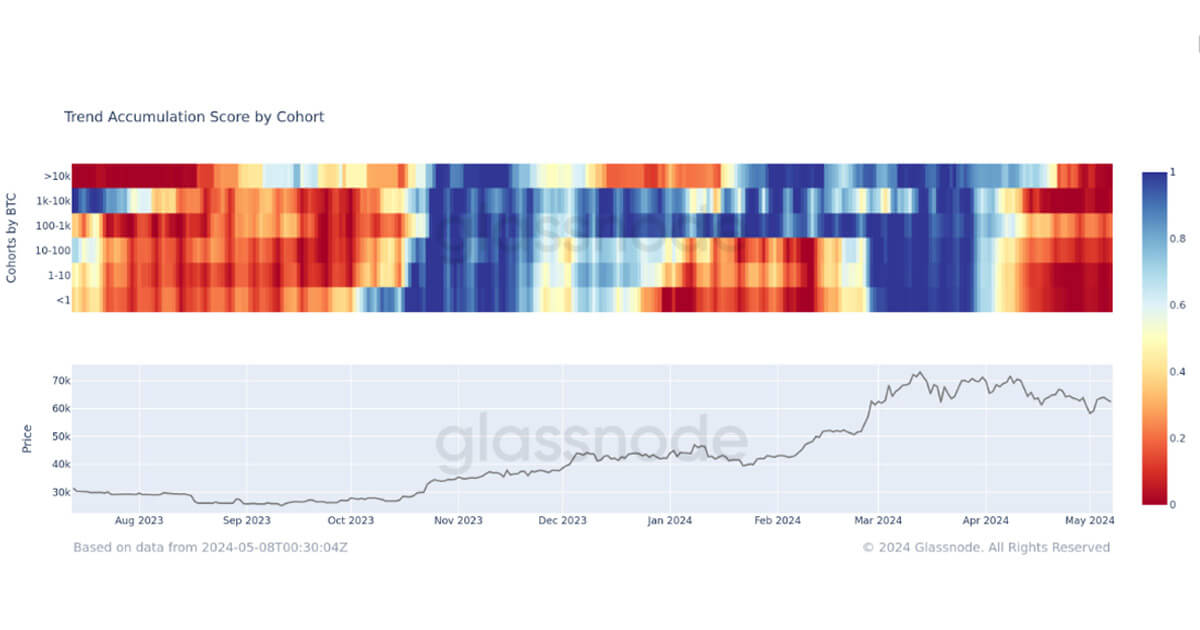

Quick Take The recent Bitcoin price surge, up over 53% since Oct. 14, has been accompanied by a distinctive accumulation pattern among various wallet cohorts. The Accumulation Trend Score, a metric that measures the relative strength of coin accumulation by entity balance size, has shown intriguing trends. дальше »

2023-12-6 22:50 | |

|

|

All Bitcoin cohorts are in profit for the first time since October 2021

Quick Take Recent CryptoSlate analysis revealed a significant shift in the crypto market sentiment influenced by profitable Bitcoin withdrawals from exchanges. The average withdrawal prices for cohorts categorized by date paint an intriguing picture of the market-wide cost basis. дальше »

2023-11-10 15:50 | |

|

|

Potential Bitcoin bull run predicted by closing gap between realized and long-term holder prices

Quick Take The Bitcoin market is currently exhibiting signs of a potential bull run, as evidenced by the dynamics of the realized prices among different investor cohorts. The realized price, reflecting the aggregate price at which each Bitcoin was last spent on-chain, currently stands at $20,638. дальше »

2023-11-2 14:45 | |

|

|

Resurgence of Bitcoin ‘whales’ signals confident market movement

Quick Take Bitcoin has been witnessing an exceptional accumulation across all cohorts in Oct. 2023, a trend that has not been seen this year. CryptoSlate’s analysis on Oct. 19 unearthed that this accumulation reached its zenith in July, right before Bitcoin began its upward trajectory from $30,000. дальше »

2023-11-1 13:45 | |

|

|

Bitcoin supply absorption by various cohorts suggests impending halving event not fully priced in

Quick Take A deep dive into Bitcoin’s issuance reveals a fascinating trend as the next Bitcoin halving event approaches. The current monthly issuance of Bitcoin stands at 27,000 BTC, calculated from 900 Bitcoin mined each day over 30 days. дальше »

2023-10-26 16:45 | |

|

|

Bitcoin’s pivot around $26.6k: key price level shapes trading behavior

Quick Take A detailed examination of Bitcoin’s trading behavior reveals a pivotal price level around $26. 6k. Over the last three years, cohorts from 2020, 2022, and 2023 have recorded realized prices closely aligning with this benchmark. дальше »

2023-9-15 14:00 | |

|

|

Bitcoin accumulation sees slowdown amid August market downturn

Quick Take The Accumulation Trend Score, created by Glassnode, offers a detailed breakdown of the cryptocurrency acquisition behavior of different entity wallet cohorts. The algorithm calculates this score by evaluating the size of these cohorts and the quantity of Bitcoin they amassed during the last fortnight. дальше »

2023-8-28 04:00 | |

|

|

Wen moon? Bitcoin halving cycle hints at Q4 as smart money 'buys the rumor'

Bitcoin miners and "smart money" are the investor cohorts to watch when it comes to late 2023 BTC price action, says Filbfilb.

дальше »2023-8-26 16:31 | |

|

|

Bitcoin faces crucial resistance as submerged cohorts of hodlers affect market sentiment

Quick Take Information drawn from recent data analysis underscores the significant resistance that Bitcoin is encountering, with a price range from $26,419 up to $26,773. This resistance is critical because three different cohorts of average withdrawal prices are currently tagged as underwater, meaning that the current price is below the average price at which the […] The post Bitcoin faces crucial resistance as submerged cohorts of hodlers affect market sentiment appeared first on CryptoSlate. дальше »

2023-8-25 01:00 | |

|

|

Bitcoin realized prices by cohort indicate DCA strategies in progress

Quick Take Bitcoin’s consolidation at the $30,000 mark does not put many investor cohorts in a loss situation, as the dollar-cost averaging (DCA) strategy continues to be implemented. Dollar-cost averaging is the concept of purchasing an asset on a regular basis without prejudice to the market value at the time of the trade. дальше »

2023-7-18 13:42 | |

|

|

Bitcoin whales resume accumulation following brief respite

Quick Take The accumulation trend score shows the behavior of all cohorts that are either accumulating or distributing Bitcoin. Bitcoin whales with 10,000 BTC or more have accumulated Bitcoin for the better part since April 2023, while Bitcoin has been under $30,000. дальше »

2023-5-24 13:13 | |

|

|

Bitcoin’s next bull catalyst: realized price flipping in June, just $800 from long-term holder threshold

Quick Take CryptoSlate has extensively covered the realized price and cost basis of cohorts throughout the bear market, and we are looking at the transition of a bull market. The next bullish Bitcoin catalyst is for the realized price to get above Long Term Holder realized price — which is now less than an $800 […] The post Bitcoin’s next bull catalyst: realized price flipping in June, just $800 from long-term holder threshold appeared first on CryptoSlate. дальше »

2023-5-16 12:00 | |

|

|