2023-12-6 22:50 |

Quick Take

The recent Bitcoin price surge, up over 53% since Oct. 14, has been accompanied by a distinctive accumulation pattern among various wallet cohorts.

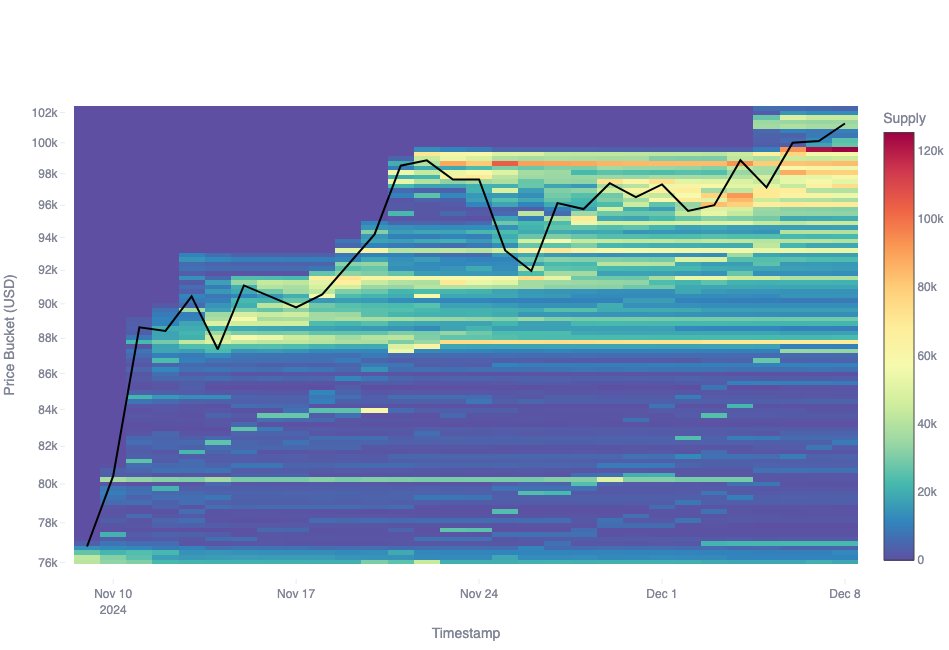

The Accumulation Trend Score, a metric that measures the relative strength of coin accumulation by entity balance size, has shown intriguing trends. From mid-October to mid-November, the accumulation trend score was 1, indicating strong accumulation across all cohorts. This period, marked by a ‘deep blue accumulation’, reflects a high degree of engagement from participants in the market.

Accumulation Trend Score: (Source: Glassnode)Interestingly, the two weeks following this accumulation period saw a shift in behavior among the so-called ‘whales’ – entities that own 10,000 BTC or more. Despite the ongoing surge in Bitcoin’s price, which reached a peak of $42,300, these whales began to distribute coins, moving away from their previous accumulation trend.

Accumulation Trend Score by Cohort: (Source: Glassnode)However, as of now, we are seeing a reversion to accumulation among these whales, with the notable difference that they are buying at higher prices. This implies a continued confidence in Bitcoin’s prospects despite the increased price point. Overall, aggressive coin accumulation is still observed across all cohorts, painting a picture of an engaged and active market.

The post Bitcoin whales resume accumulation, signaling confidence in market rally appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|