2024-6-13 20:00 |

Data of an on-chain indicator could suggest Bitcoin is currently not at a stage where its price would be at a significant risk of facing correction.

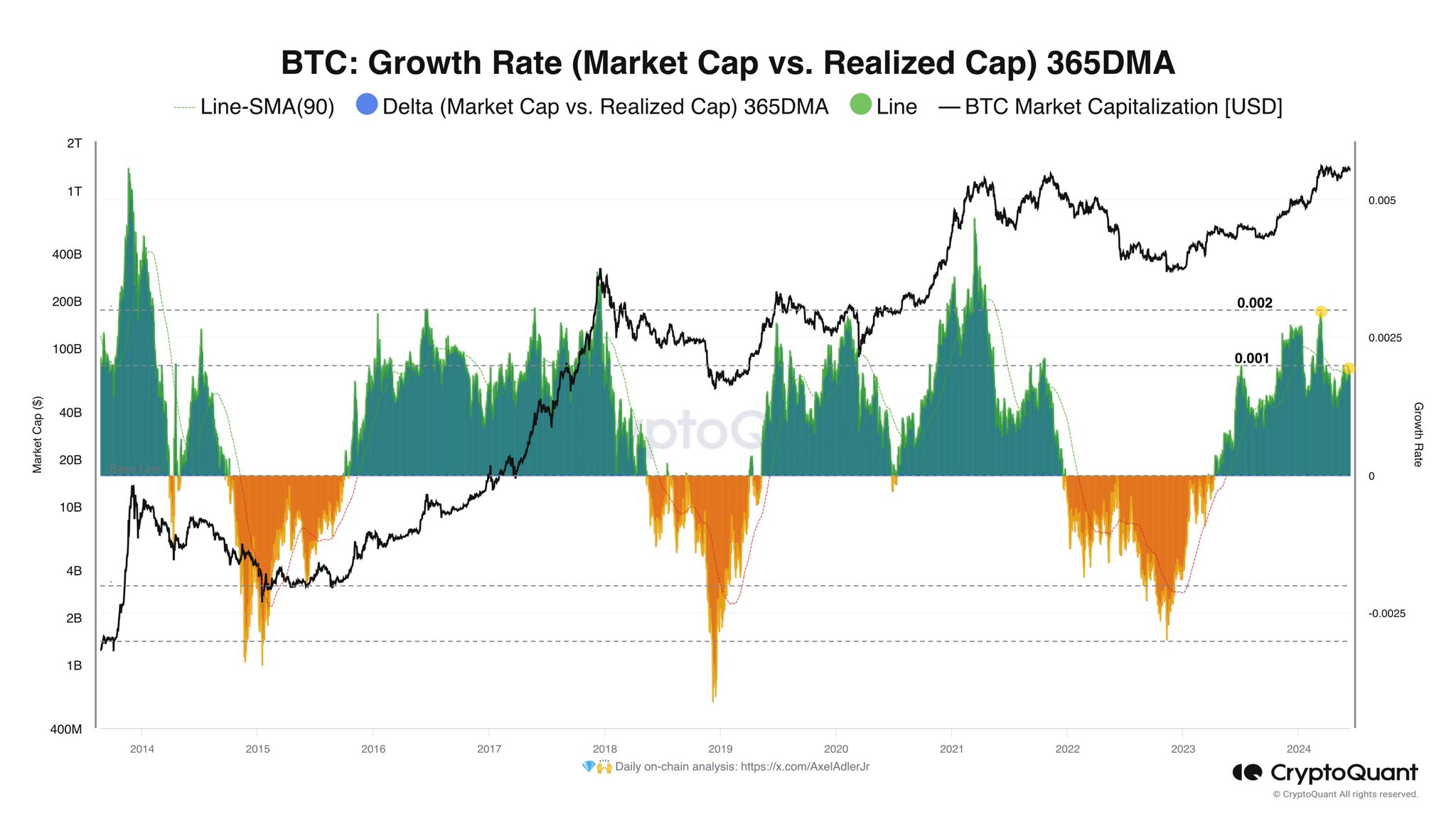

Bitcoin 365-Day MA Growth Rate Is Sitting Below Historical Overheated ZoneIn a post on X, CryptoQuant author Axel Adler Jr has discussed about the recent trend in the “Growth Rate” metric for Bitcoin. The Growth Rate basically keeps track of the difference between the changes happening in the Bitcoin Market Cap and Realized Cap.

The Market Cap here is naturally just the simple valuation of the cryptocurrency’s total circulating supply at the current spot price. The Realized Cap, on the other hand, is a bit more complex.

The Realized Cap is an on-chain capitalization model for the asset that takes the “real” value of any coin in circulation to be the same as the price at which it was last transferred on the blockchain.

As the last transaction of any coin was likely the last instance of it changing hands, the price at its time would act as its current cost basis. Since the Realized Cap sums up this price for all tokens of the asset, it essentially calculates the sum of the cost basis of each coin in the circulating supply.

In other words, the Realized Cap measures the total amount of capital that the investors have used to buy their Bitcoin. The changes in the Realized Cap would, therefore, represent the capital inflows or outflows happening for the cryptocurrency.

As the Growth Rate keeps track of how changes in the Realized Cap are reflecting in the Market Cap, it basically tells us about how reactive the market is being to capital flows.

Now, here is a chart that shows the trend in the 365-day moving average (MA) of the Bitcoin Growth Rate over the last decade or so:

As is visible in the above graph, the 365-day MA Bitcoin Growth Rate has been at positive levels since early 2023. When the indicator has green values, it means that the Market Cap is growing at a rate faster than the Realized Cap.

At present, the indicator is sitting at the 0.001 mark, which is a relatively high level. Thus, it would appear that capital inflows have been rapidly driving up the price recently.

Historically, during periods of euphoria in the market, where Market Cap has exploded relative to the Realized Cap, tops have become more probable to take place.

From the chart, it’s apparent, though, that the recent levels of the metric, although high, have still been below the 0.002 mark beyond which corrections have become likely in the past.

The Bitcoin all-time high (ATH) back in March, which has continued to be the top for the rally thus far, had also occurred when the Growth Rate had surged above this level.

BTC PriceBitcoin had slipped under the $67,000 mark yesterday, but the asset has since seen a recovery push that has now taken its price back above $69,300.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|