2020-1-11 07:00 |

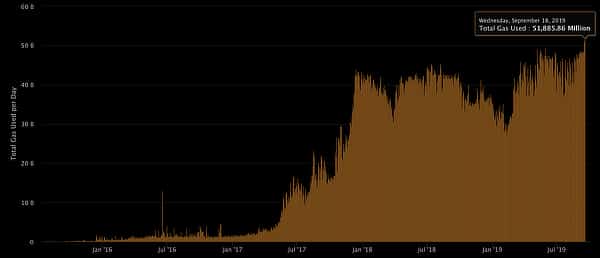

While cryptocurrencies are still far below where they were at the end of 2017, analysts are getting bullish on Ethereum, Bitcoin, and other digital assets. The bull case for ETH, at least, was proven just recently with a metric suggesting that the network has seen rampant growth over recent months, which is likely to wrest prices higher with time. Related Reading: A Big Plunge to Sub-$100 for Ethereum Is Imminent If This Happens Ethereum Metrics Bullish A Twitter user recently shared the below chart, writing that “Ethereum’s network growth is on an upward trend.” Indeed, per their chart, network growth, defined by the number of new addresses created each day, has recently surged to levels not seen since the top of 2019’s bull run. Ethereum's network growth is on an upward trend. pic.twitter.com/rsjGAA0Ura — Adam Ship (@AdamSophrosyne) January 8, 2020 Although the number of new Ethereum addresses may not seem to related to ETH’s price on the surface, the user’s chart shows that there is a clear correlation between the two metrics, with address count growth seemingly preceding price action. Due to this historical correlation, the rapid growth seen in this metric could imply that the second-largest cryptocurrency has extreme upside potential ahead of itself, upside that may take it back towards $200 and $300. Fundamental Factors Are Bullish It isn’t exactly clear what is driving the dramatic growth of the Ethereum address count, there seem to be a few theories. One of the foremost of these being the rise of decentralized finance (DeFi). According to Ethereum statistics website DeFi Pulse, there is $667.3 million worth of digital asset value — including just under three million Ether — locked in DeFi applications on the blockchain, which is up from approximately $240 million in January of this year. Ethereum’s booming address count comes hot on the heel of the revealing of other positive fundamental factors that may only drive ETH and ERC token demand in the future. Just today, it was announced that Stephen Dinwiddle is launching an Ethereum-based bond that represents himself. The Brooklyn Nets player tweeted on January 10th, “The Spencer Dinwiddie bond launches January 13th. I’ll also be taking 8 fans to ASW with me.” The bond will be issued on the Ethereum blockchain and will be managed by a digital transfer agent, said Securitize chief executive Carlos Domingo, who partnered with Dinwiddie to make this interesting trend in crypto and sports take place. All this suggests that the demand for ETH could increase in the future, creating a case for price upside should that demand outweigh the supply of sellers. Featured Image from Shutterstock The post appeared first on NewsBTC. origin »

Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) íà Currencies.ru

|

|