2018-10-23 15:57 |

Joseph Lubin is not distracted by falling prices saying it is not a perfect metric to measure the resilience of the market. In his view, the rising number of projects and adoption is a proper indicator of a firm market. This outlook is positive for Ethereum and ETH whose developers have had to postpone the Constantinople hard fork to early 2019.

Latest Ethereum NewsAfter wading through a deluge of FUD, possible boom and busts and tough government measures, the crypto sphere is stronger and better. It has to be because for a technology that is less than a decade old–Ethereum celebrated its third anniversary on July 30 of this year, there is a lot of potential. Then again, the fall and rise, the fear and the boom of cryptocurrencies is part of the larger web characteristic of every tradable market out there.

This is why, Joseph Lubin, the Co-Founder of the Ethereum is upbeat about ETH gauging his optimism not on price but the number of blockchain based projects and the level of technology adoption. While talking to CNBC, Joseph went on and talked about regulatory intervention and how most blockchain based projects don’t need to operate under any form of regulation.

Though he acknowledged that regulators might be keen on bogging down blockchain projects as Bitcoin that transfer value, he opined that what is important for the market for the market to flourish is the adoption of self-regulation. This way, participants would be inclined more on building blockchain infrastructure that meet the demand of different applications and systems.

Lubin went on and said that government are beginning to understand the value of blockchain and what they can draw from it. This is why certain jurisdictions as Malta and Switzerland are applying favorable laws that are pro-blockchain and could spur similar adoption across countries.

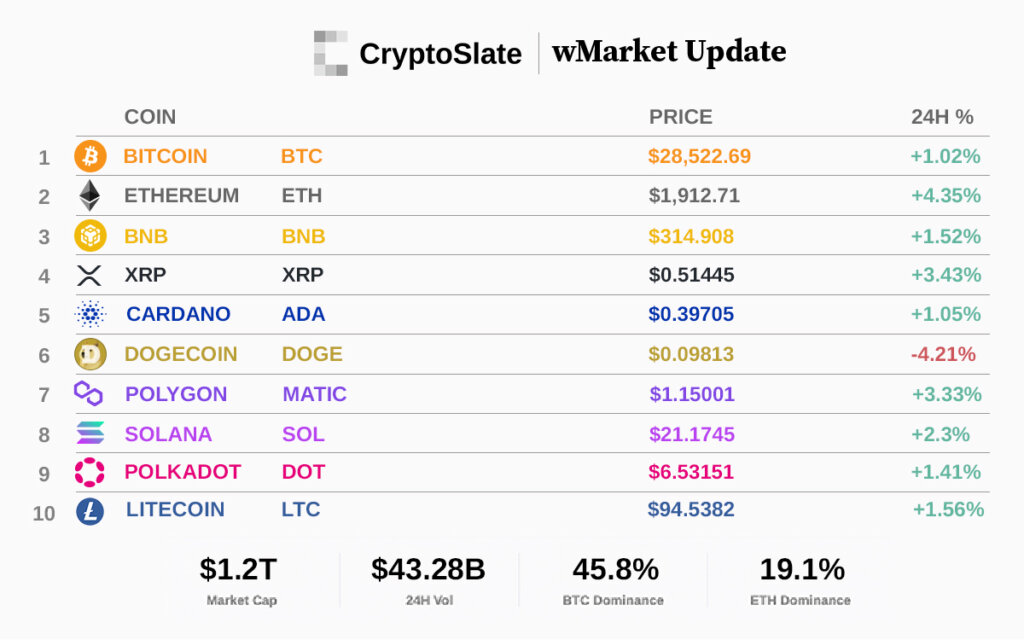

Ethereum (ETH) Price Analysis Weekly ChartIn the face of violent sell off, ETH is having a hard time following through last week’s events. It’s down three percent in the last week and could lose more if this sell off continue. Note that the consolidating market mean our last Ethereum trade plan is live because none of our trading conditions have been met. To reiterate, bulls will only be in charge once we see gains above $250 and later $300.

While bears would be in control should there be declines below the psychological $200 and $160. Since prices are stuck within week ending Sep 9 high low inside a $30 range set by close of last week, we suggest risk-on, conservative type of traders to hold off their trading activities until there are visible gains above key resistance or support levels.

Overly, we remain optimistic that bulls have an upper hand all due to Fibonacci retracement rules padded mostly by the current deep correction that threaten to reverse 2017 gains.

Daily ChartThe consolidation in higher time frames is clear in the daily chart. Here, it is clear that bulls are in charge and as prices range, we expect a follow through of Oct 15 bulls.

As such, our trade recommendation is simple for aggressive traders: buy at spot with stops at Oct 15 lows at $190. First targets remain at $250 and later $300.

As aforementioned declines that would see our stops hit would revert our stand back to neutral as traders wait for our main sell trigger at $160 to be hit.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|