2025-12-24 16:10 |

Major market participants have continued to increase their exposure to Ethereum (ETH), investing millions of dollars in the second-largest cryptocurrency.

This comes despite recent price weakness that has pushed the asset down nearly 3% just this week alone. The divergence suggests that while price action remains under pressure, long-term conviction among institutional and whale investors appears intact.

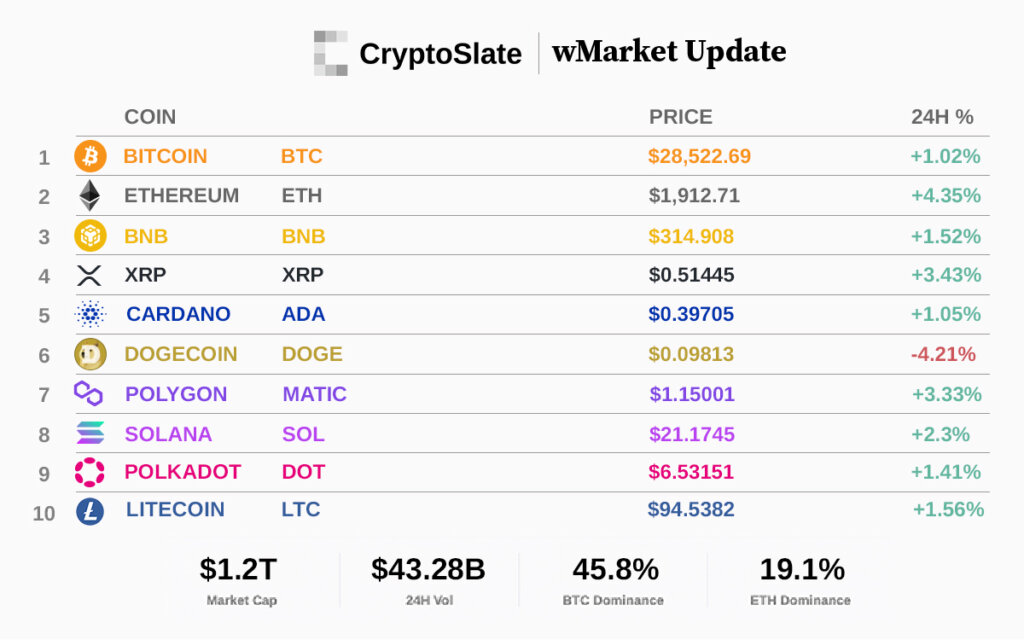

Price Weakness Fails to Deter Major BuyersBeInCrypto Markets data showed that Ethereum has continued to struggle amid a broader market downturn. At the time of writing, ETH was trading at $2,929.23, down 1.06% over the past 24 hours.

Ethereum (ETH) Price Performance. Source: BeInCrypto MarketsWhile the decline has unsettled some investors, others appear to be treating this as a buying opportunity. Blockchain analytics firm, Lookonchain, highlighted that BitMine Immersion Technologies purchased 67,886 ETH, valued at approximately $201 million.

This followed an earlier acquisition just one day prior, when the firm acquired 29,462 ETH worth $88.1 million from BitGo and Kraken. The consecutive purchases align with the firm’s broader accumulation strategy.

Last week alone, BitMine acquired a total of 98,852 ETH, pushing its overall Ethereum holdings past the 4 million mark. With Ethereum’s trading price just slightly above BitMine’s average entry of $2,991, the company appears unfazed by recent price swings.

Big Money Moving Into ETH 👀

Tom Lee has already bought ~$953M worth of $ETH this month, surpassing November’s total investment — and we’re not even done with the month yet. pic.twitter.com/lCAuxN9Iiw

Another notable buyer was Trend Research. The secondary investment entity led by Jack Yi, founder of LD Capital, acquired 46,379 ETH today. The purchase brought the institution’s total holdings to roughly 580,000 ETH.

“They started bottom-fishing ETH in early November at around $3,400. Up to now, they have accumulated a total of 580,000 ETH (about $1.72 billion), with an estimated average cost of around $3,208. This means they are currently sitting on an unrealized loss of approximately $141 million,” EmberCN reported.

In a public statement, Yi revealed that the firm is preparing another $1 billion for ETH purchases. He also advised against shorting Ethereum.

Large on-chain whales have also remained active. The wallet known as the “66k ETH Borrow” whale, who had previously accumulated 528,272 ETH worth about $1.57 billion, added another 40,975 ETH, valued at roughly $121 million.

“Since Nov 4, this whale has bought a total of 569,247 ETH ($1.69 billion), of which $881.5 million of the funds used to buy ETH were borrowed from Aave,” Lookonchain noted.

Meanwhile, Fasanara Capital used a leveraged strategy. The firm acquired 6,569 ETH worth $19.72 million over two days before depositing it into the Morpho protocol. It borrowed $13 million USDC to buy more Ethereum.

Ethereum Whales Split as Buying and Selling IntensifyHowever, not all major players are accumulating, with some opting to reduce positions. BeInCrypto reported that Arthur Hayes sent 682 ETH, valued at approximately $2 million, into Binance today.

Lookonchain stated that the executive has sold 1,871 ETH worth $5.53 million in the past week, while buying Ethena (ENA), Pendle (PENDLE), and ETHFI.

“We are rotating out of ETH and into high-quality DeFi names, which we believe can outperform as fiat liquidity improves,” Hayes wrote on X.

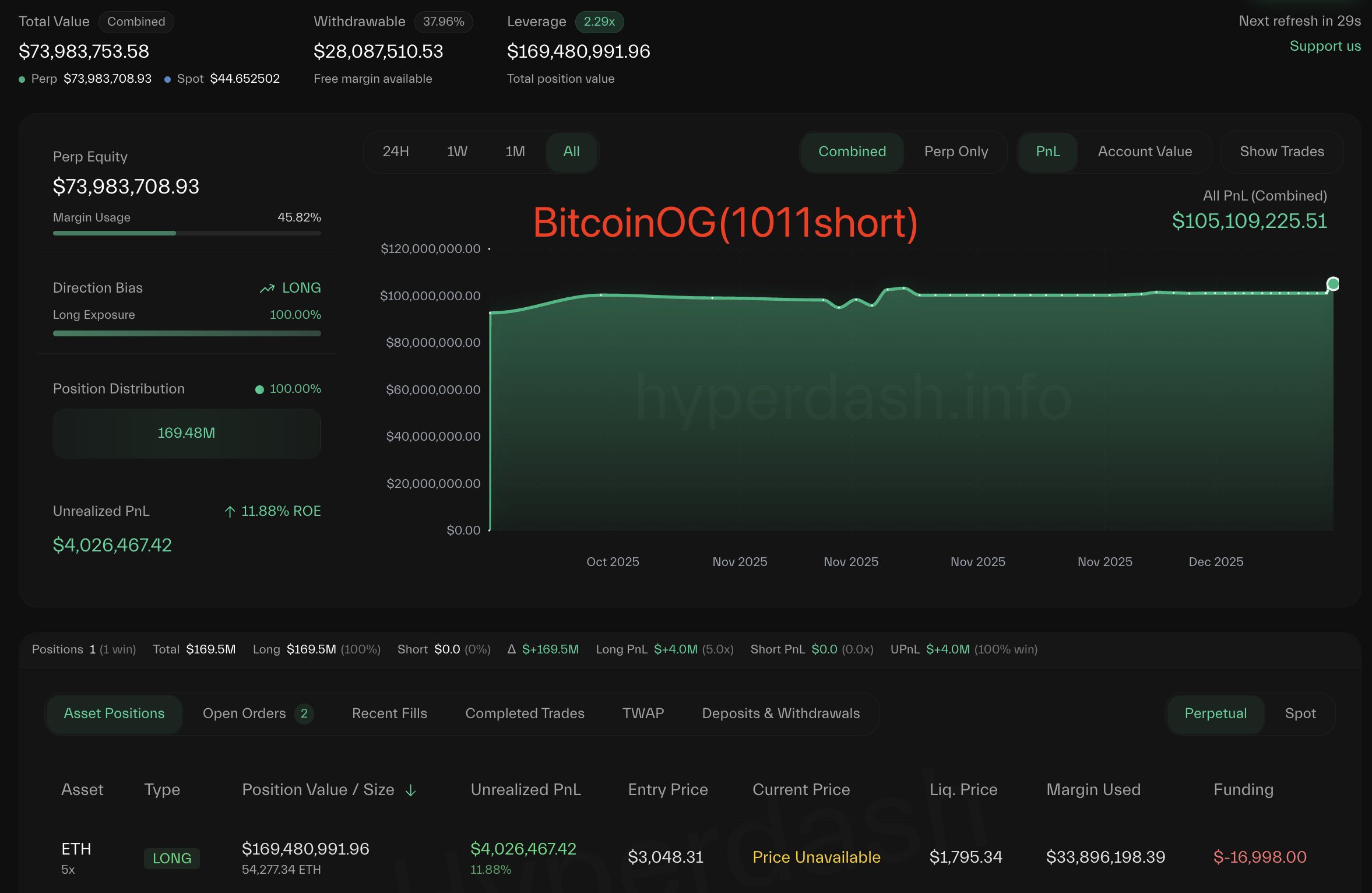

Adding to the selling pressure, Onchain Lens reported that the Bitcoin OG whale had deposited 100,000 ETH, worth approximately $292.12 million, into Binance. Such large exchange deposits are often interpreted as potential preparation for selling, though they do not always result in immediate liquidation.

Previously, ETHZilla also disclosed that it offloaded 24,291 ETH for approximately $74.5 million to repay senior secured convertible debt. Despite these opposing flows, BeInCrypto noted that selling activity among long-term Ethereum holders has collapsed by more than 95%.

The post BitMine and Trend Research Lead Latest Ethereum Buying Spree Amid Market Weakness appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|