2022-12-11 22:10 |

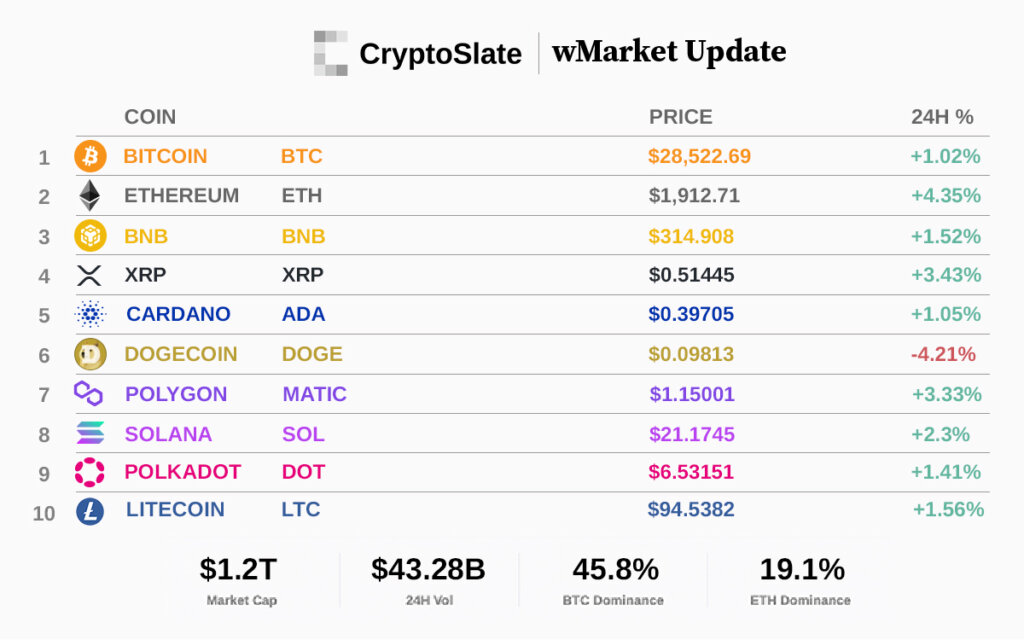

Despite taking a painful hit in the wake of FTX’s collapse last month, Ethereum has offered traders some respite in the form of a sideways trading market.

The world’s second-largest cryptocurrency by market capitalization has essentially been flat in the past week, barely nudging beyond 3% on either side as traders take a risk-off approach ahead of next week’s FTX Capitol Hill hearings. Notably, since tapping a multi-monthly low on November 22, Ether has recovered by about 16%, suggesting the early makings of a potential uptrend.

Whales Scoop More Ether at Discounted PricesDespite actual on-chain activity and utility still looking unimpressive, part of what has kept Ethereum buoyed is key whale accumulation. According to crypto data analytics firm Santiment, in the past month, Ethereum addresses holding 100 to 1m coins have accumulated back 1.36% of the overall supply (about 1.63 million Ether). Accordingly, this cohort added 561,000 Ether worth about $690 million between December 5th and 6th.

It is important to note that this group owns two-thirds of Ether’s overall supply and has been vital in helping reduce bear pressure from traders exiting positions at best available bounces during this crypto winter.

“Due to this rise in large address interest in ETH again, we can consider this metric as a bullish argument,” wrote Santiment.

Exchange Outflows on The RiseTo support the accumulation narrative, Ethereum exchange balances have also been falling. According to the firm, the supply of Ethereum sitting on exchanges “has fallen massively” in just the past month. According to data from “IntoTheBlock”, Ether outflows in the past seven days totalled $4.78 billion compared to inflows at $3,92 billion. It is even more satisfying to see that the 12.1% of ETH on exchanges is now at a 4-year low, further supporting the bullish argument.

“The last thing we’d want to see, especially after a 75%+ drop in 13 months, is for supply to be moving on to exchanges, implying more sell-offs could be waiting,” wrote the firm. “It isn’t to say that future sell-offs can’t be around the corner, but the more the supply of ETH on exchanges declines, the better of a case that can be made that we’re nearing a bottom.”

Despite the positive indicators, strong opinions around Ethereum seem to have dwindled, as depicted by funding rates remaining relatively flat for ETH post the FTX-collapse recovery. Ethereum’s market sentiment indicator from “IntoTheBlock” shows that a majority of traders are neutral on the overall market direction. It will be necessary for this indicator to show either a bit of greed or fear bias to conclude how the next exchange liquidations will impact ETH prices.

As of writing, Ether was trading at $1,272 after a 0.16% increase in the past 24 hours, according to CoinMarketCap data.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|