2020-1-2 20:00 |

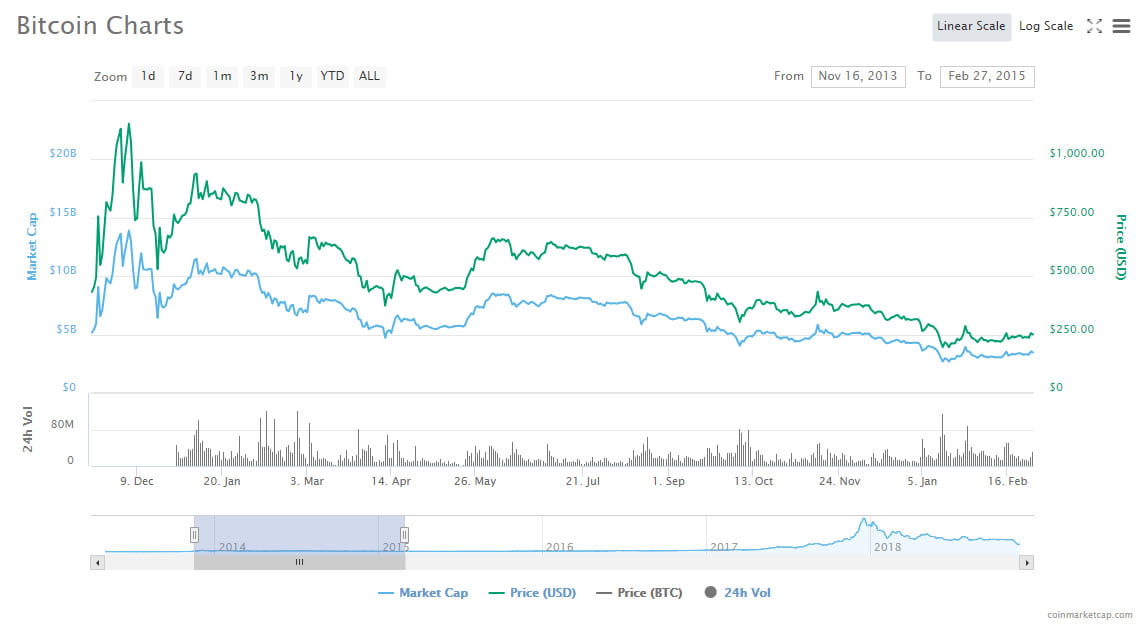

A fall in an important Bitcoin-related metric with ties to overall crypto market sentiment over the past couple of weeks, suggests that recent price action across the crypto market has traders and investors increasingly fearing that the bottom isn’t in for Bitcoin, and may be adjusting their expectations and preparing positions in anticipation of the market falling further into the downtrend. Are Crypto Traders Reconsidering That The Bottom Is “In?” Crypto traders and analysts will use any information or statistics available to them in order to attempt to gain a competitive advantage over others in the market, such as predicting when trends are about to reverse. After months of downtrend, traders are attempting to do just that, and “knife-catch” the bottom, and are using any tools they can get their hands on to figure out if that bottom is indeed in. Related Reading | The Biggest FUD and FOMO Moments in Crypto 2019 These tools consist of fundamental analysis, such as stock-to-flow models, hash rate, and network transactions, and technical analysis using indicators, chart patterns, and more. Some more advanced analysts also look at the ratio and balance of long versus short positions, platform by platform, to get a good grasp of overall market sentiment and how traders are positioning themselves ahead of the next major price movement. Bitifinex Longs Begin to Fall After Reaching All-Time High After Bitcoin price touched $6,500, long positions on the popular cryptocurrency trading platform began to spike as traders began to consider the bottom could be in at least for the short-term. Interesting coincidence:– after $BTC first time touched 6500$, longs on Bitfinex started to grow (insanely);– after BTC touched 6500$ second time, longs started to decline.People thought that it is the bottom initially and now they are not that sure anymore?$BTCUSD #bitcoin pic.twitter.com/5USN6wP5n2 — CryptoHamster (@CryptoHamsterIO) January 1, 2020 However, Bitcoin has failed to produce a strong bounce, and has instead made repeated trips to retest lows, and has even set a new lower low since. The recent price action has caused the long metric to begin to fall for the first time in over a month – after recently reaching the highest point its ever been – suggesting that crypto traders are reconsidering that the bottom may not actually be in, and Bitcoin could be at risk of falling lower. The idea that a bottom is “in” in a financial market, is only possible in hindsight. Because Bitcoin only one year ago was trading at $3,000, and after a strong rally has fallen back to prices just above $6,000 has crypto traders not only wondering if a local bottom is in, but if the bear market bottom in its entirety is in. Some steadfast analysts remain unfazed in their conclusion the bottom is in, while others are now expecting Bitcoin to fall to prices of $1,000, bankrupting companies across the crypto industry and leaving the industry itself in shambles. Related Reading | Bitcoin Price Yearly Candle Shows Failed Rally, Longest Wick on Record Given how uncertain the market is for Bitcoin and crypto, it’s no surprise that many traders are beginning to fear the worst and are changing their strategy as a result. The post appeared first on NewsBTC. origin »

Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|