2022-2-10 12:00 |

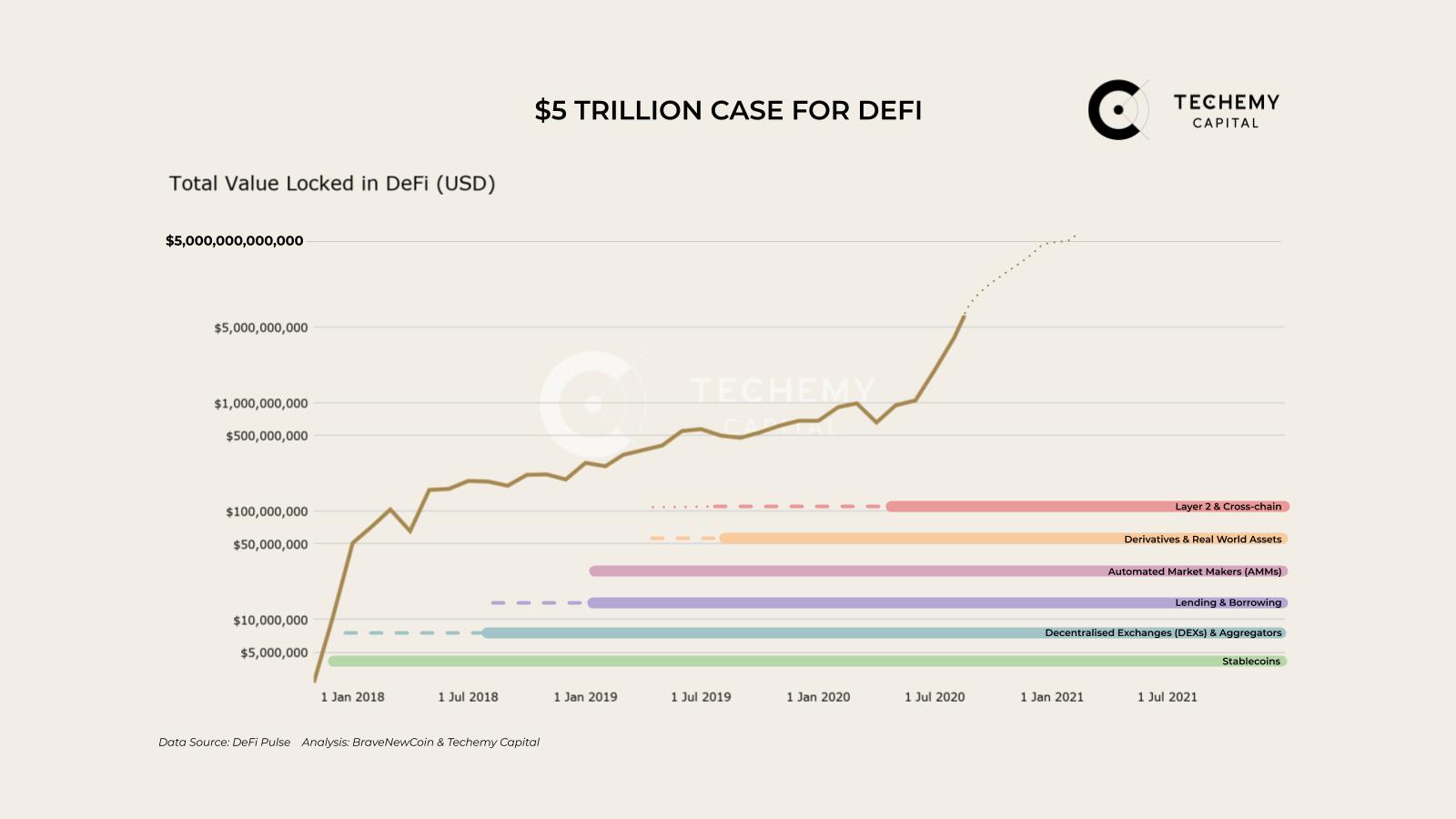

Defi became a $100 billion sector last year, propelled by the success of endless protocols devoted to lending, trading, savings and investment. Despite recent market choppiness, many crypto investors and commentators believe the industry will continue its astronomic growth – with one boldly predicting that DeFi could achieve a market cap of $800 billion by the end of 2022.

To achieve such a lofty goal, improving interoperability and scalability will be critical. And while some DeFi specialists are only too happy putting their esoteric knowledge to work, something must also be done to lower barriers to entry. All too often, DeFi neophytes are discouraged by the many pain points and stumbling blocks they encounter, from the hassle of moving assets between chains to the numerous bugs buried in smart contract code. For many, it’s just not worth the effort.

Now, a new project is promising to simplify DeFi’s complexities and democratize access to the sector’s finest investment opportunities. Founded by a team of software veterans from Google, AWS and Netflix, Aperture is a cross-chain platform that offers integrated bridge solutions and a community-driven ‘strategy marketplace’ geared towards yield farming.

Investors Back ‘Gateway to DeFi 2.0’Based in Silicon Valley, Aperture recently closed a $5.3 million seed and strategic funding round led by a quartet of leading investment firms (ParaFi Capital, Arrington Capital, Costanoa Ventures and Divergence Ventures). What’s more, capital came from a panoply of notable hedge funds and family offices operating in the fast-growing blockchain space, among them Rarestone Capital, Krypital Group, PrimeBlock Ventures, Athena Ventures, Metaline, Double Peak, Stakely Venture Capital and others. Terraform Labs CEO Do Kwon came on board as an angel investor.

Aperture Co-founder and CEO Lian Zhu calls the platform a “gateway to DeFi 2.0,” explaining that it seeks to systematically eradicate the long-standing inefficiencies that have become a hallmark of the industry.

Aperture will enable retail and institutional users to capitalize on the various yield-bearing opportunities that exist across the cryptosphere, saving them the trouble of obsessively combing through and checking various individual protocols living on different chains. Integrated bridge solutions will make asset conversion easy, meaning users can proactively take advantage of opportunities on other networks even if they don’t own assets native to that chain.

“On-chain investment opportunities have complexified 100x in the past year, as strategies now involve multiple chains, advanced financial derivatives, and head-to-head competition with professional trading firms,” notes Calvin Liu, investor and former Strategy Lead at Compound.

“The Aperture team is building an industry-leading cross-chain strategy development platform for democratizing access to the best risk-quantified opportunities across all of crypto. We’re really excited for their launch and think users will find a ton of value in the product suite.”

Liu’s comments were echoed by Rarestone Capital’s Founding Partner Camron Miraftab, who said the company is “excited to be backing a rockstar team on its mission to harmonize liquidity across various networks in one place, and ultimately reduce technical barriers to entry for the next wave of institutional-grade market participants.”

The first iteration of Aperture will be a private beta release scheduled to launch on February 7th, before the public V1 launch in March. The beta will feature an automated delta-neutral strategy with liquidation protection based on well-known DeFi protocols Anchor, Mirror, and Spectrum. This particular advanced portfolio strategy involves multiple positions that balance positive and negative deltas, enabling users to bet both for and against the same thing using tokenized derivatives.

With a $5.2m war chest now in its possession, Aperture will be keen to cement itself as a user-friendly portal to the DeFi world. Some of the capital is likely to be ring-fenced for team expansion and networking; the more protocols connected to the Aperture ecosystem, the more attractive it will be to the DeFi community. It all starts with the beta release, which should confirm for traders whether Aperture lives up to its lofty ambitions.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|