2020-10-23 16:51 |

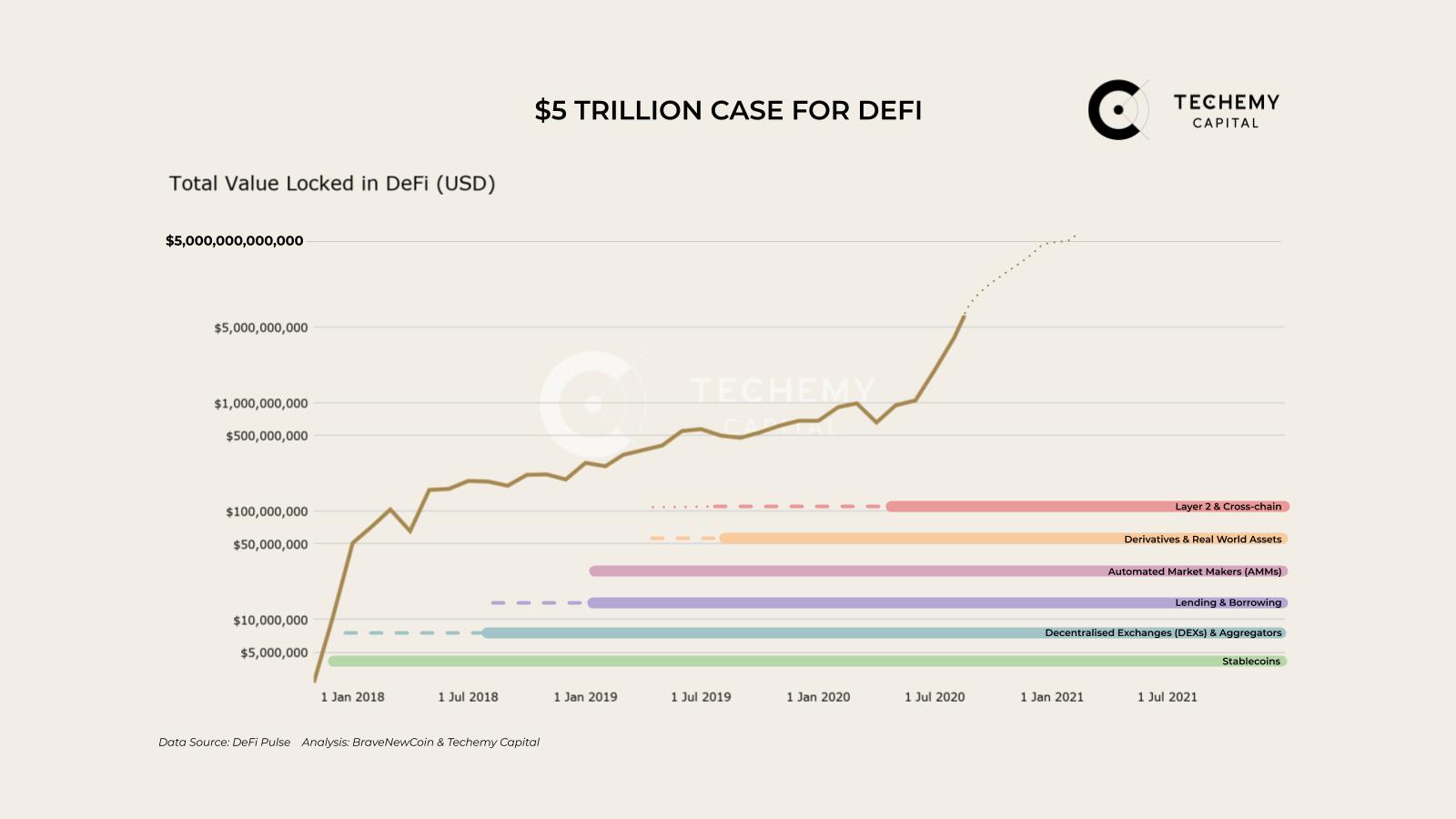

The decentralized finance (DeFi) sector has experienced massive growth in the past few months, and the total value locked in DeFi now stays around the $10 billion benchmark, a true milestone.

It is also safe to say that there’s room for DeFi to grow even more, as the TVL reached more than $11 billion at one point, this year. It’s impossible to predict the dynamic of DeFi’s development, since nobody could have predicted the meteoric rise DeFi projects experienced just last summer.

While it is hard to define where the glass ceiling might be for the sector, we can look over its weaker points and suggest possible ways to improve the things.

To do so, we should probably highlight the flaws that are evidently handicapping a truly global DeFi adoption.

Hopping over DeFi speedbumpsWhen it comes to improvement, there needs to be a clear development path that should stick to the values that brought DeFi to the dance in the first place.

At its core, DeFi looks to build an ecosystem where everyone can operate without the presence of a central authority, and where everyone works in a transparent and permissionless way.

One of the bigger selling points here is that low-income people — who are isolated from the current financial system — could easily access financial services.

Unfortunately, this statement has not held up well for three reasons, so far.

Underwhelming UX and overwhelming mechanicsThe first one is the high knowledge barrier to entry and a complicated model of operations.

As of now, most applications and exchanges look like they have been made by crypto people for crypto people, gatekeeping the newcomers and welcoming only experienced users.

Ideally, novices should not feel overwhelmed when they enter this new space, because there’s already a lot to unwrap before you get ready to start. While nobody rules out the importance of research, unease entry does not fall in line with the idea of attracting more regular users.

For a visible example, let’s look over the Curve’s main page. It is not a fancy looking place, giving off strong ‘90s vibes. It should not look glossy either, but in the current state, it would be complicated to imagine a lot of people feeling comfortable there.

Uniswap and Balancer do a better job with it, having cleaner interfaces, but perhaps simplifying the process a bit too much.

The right balance is necessary to guide users correctly. At this point, you have to put in extra efforts to use DeFi applications, and it may be hard to convince users to switch over in order to reach mass adoption.

Pocket-burning Ethereum gas feesIt must be said, DeFi’s phenomenal rise did not come without a slew of negative issues.

Ethereum transaction fees have spiked, all thanks to the rise in the number of on-chain transactions carried out by all the new protocols that have sprung on the scene in recent months.

Gas prices respond to the limited number of transactions that can be facilitated using one block. In the current environment, miners choose higher priced transactions, thus increasing effective gas prices, and those can look intimidating to anyone but the cream of the crop.

High transaction fees “price out” many from activities on DeFi platforms, once again failing to make it a viable financial services alternative for regular users. Beside that, gas prices also raise some serious concerns about the network stability, and the usability of some smart contracts.

The perception of Ethereum as a smart contract platform has been tested with this problem, as crypto was often favored for its adequate processing fees compared to SWIFT and PayPal.

Add to that a fairly pricey fee of smart contract execution, that can take up to $50 for a simple token swap, and you have a serious hurdle that many won’t ignore, and rightfully so.

Impermanent loss turns permanent most of the timeWhile traders suffer from the rising gas fees, liquidity providers have other growing pains.

Providing liquidity probably shouldn’t be on your “to do” list when you are only getting around decentralized exchanges such as Uniswap, but we should still mention the main risk associated with this activity — the impermanent loss.

This term can be explained as a situation where you withdraw less from the liquidity pool than you would have if you just held the tokens in your wallet. Impermanent loss happens when the price of one provided asset significantly increases compared to the other asset.

People commit their funds into liquidity pools to get trading fees paid by users, but it often doesn’t go according to the plan. One of the main reasons for that is people called arbitrageurs. They are required to buy underpriced assets or sell overpriced assets until offered prices match external markets, as AMMs don’t adjust their prices relative to price changes on external markets automatically.

Arbitrageurs have the opportunity to earn profits while balancing the AMMs, effectively taking money from liquidity providers, and often leaving them with nothing.

Automated market makers are tricky for users of all knowledge levels, let alone hopeful upstarts.

Other challenges DeFi must overcomeBy challenging the status quo, DeFi has to address some of its own issues and build on top of the present foundation.

We have reviewed three major issues that keep most of us at bay, but there are more problems to discuss such as an inherently slower performance of blockchains compared to centralized financial systems. Provided applications have to be optimized accordingly, and this responsibility falls on the shoulders of developers.

Speaking of developers, their DeFi applications carry the responsibility of intermediaries, and thus have to decrease the high risk of user error, which is a tall task when we take into consideration how immutable blockchains are.

Aside from that, provided applications have to carry undisputed value and clearly explain its use case. Finding the application that can satisfy the needs of the customers is a challenge in a vibrant and cluttered ecosystem such as DeFi, so it’s in the best interest of developers to translate their values in a comprehensive manner.

It may seem like DeFi is a long way from catching up to the traditional financing system, and the ambitious task of taking over is only a far-reaching prospect, but the progress made in the last year instills a lot of hope.

The implications of a decentralized system are worth the effort, and with a growing community of enthusiastic visionaries, nothing seems impossible.

NOTE: The views expressed here are those of the author’s and do not necessarily represent or reflect the views of BeInCrypto.

Written by Evgen Verzun, a cybersecurity expert, serial entrepreneur, and the founder of HyperSphere.ai, a decentralized cyber-secure cloud that allows to monetize users’ data and computing resources. Evgen has over 15 years of experience in professional communications, developing security systems for mission-critical projects.

The post How DeFi Should Evolve to Become Global Financial System appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|