2020-7-26 01:17 |

Ethereum-based decentralized finance (DeFi) has taken the crypto world by storm in recent months as interest among investors continues to rise. The total value locked in the DeFi markets has grown at a fast clip to the extent of recently hitting an eye-popping $4 billion.

The price of ether has not been left far behind as it reaches $300 amid a market-wide rally. The world’s second-largest crypto has surged approximately 22% in the last 72 hours to break above the $300 level.

DeFi Is On FireThe DeFi market is exploding. Notably, DeFi tokens have been registering massive increases in price, prompting listing by various top cryptocurrency exchanges.

The value locked in DeFi has also been on an upward trajectory. For those unaware, the value locked refers to the amount of money running through the ethereum smart contracts. This metric has been smashing highs after highs. On July 21, the total value locked in DeFi protocols hit $3 billion. The momentum did not falter as it reached a new all-time high of $4.11 billion four days later (July, 25) according to data from aggregator DeFi Pulse. At $4 billion, the total value has basically grown fivefold since the start of the year.

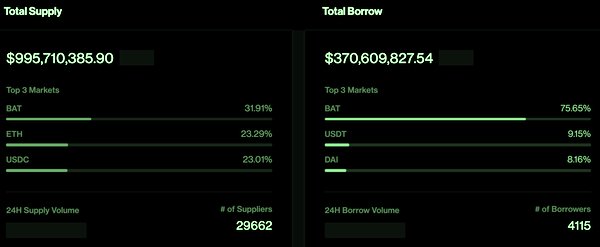

The three top decentralized peer-to-peer DeFi protocols dominating this space are Maker, Aave, and Compound. Stablecoin project Maker is the largest DeFi protocol with $875 million locked in its contracts. Aave comes in second at $639 million and Compound at $616 million.

High Transaction Fees Remain A Major Hurdle For EthereumWhile ETH has been reaping the benefits of the DeFi hype, the network’s transaction fees have been skyrocketing. Data from CoinMetrics reveals median transaction fees stood at 0.5658 as of July 21 – the highest level seen in two years.

These high fees are holding ethereum back from seeing its full potential. Some market experts have even suggested that ethereum can be dethroned by another more scalable smart contracts platform with lower transaction fees.

I've changed my mind after using a dozen of Defi platforms. So long as ETH 2.0 is not fully rolled out, there's an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX. https://t.co/vXAAFET3YK

— Qiao Wang (@QWQiao) June 28, 2020The good news is, the long-awaited solution for ethereum’s scalability problem, ETH 2.0 upgrade, is on track to launch this year per the co-founder of ethereum Vitalik Buterin. This upgrade promises more scalability, security, and a proof-of-stake network which will ultimately reduce the high transaction fees that are forcing some investors to stay on the sidelines.

Meanwhile, ETH is changing hands at $304.75 at the time of publication with 7.53% gains on a 24-hour adjusted timeframe.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|