2020-11-28 16:03 |

The last week or so brought a major price increase for the cryptocurrency market, even allowing Bitcoin to hit $19.1k for a brief moment. However, Thursday, November 26th, started a strong correction that caused many coins to lose as much as 10% of their value, which also had significant consequences on the stablecoin markets.

Exchanges using Compound oracles saw DAI price growAs the crypto market started seeing price drops on Thursday morning UTC, traders, as always, rushed to exit. Most of them just wanted to exchange their coins for stablecoins, and wait for the price crash to end, so that they can buy Bitcoin again.

However, this new crash had an unexpected effect on stablecoin Dai (DAI), which briefly saw its price surge from $1 to $1.3.

Not only that, but this happened only on two exchanges — Uniswap and Coinbase. The stablecoin managed to remain stable on many other major platforms, such as Bitfinex or Kraken.

Many started wondering why did DAI behave like this on Coinbase and Uniswap, but not on other platforms, which led to the realization that both of these exchanges are used by Compound’s Open Price Feed oracle.

Coinbase acts as the oracle’s baseline, while Uniswap behaves as an anchor and sanity check. However, at the time when everyone started rushing out from the market, Uniswap failed in its function, and it started posting a higher price than normal.

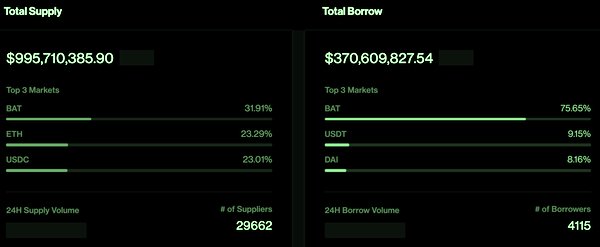

A liquidator earns $4 million from the DAI price surgeOne thing to note is that Compound’s liquidation this morning hit $89 million, with $52 million coming from DAI. One particular liquidation stood apart, as it contained 46 million DAI repaid.

Sam Priestley, a known DeFi researcher, noted that the liquidation was done on a COMP farmer who used DAI and USDC collateral for powering recursive borrowing in these same currencies. As a result, the account ended up below the liquidation threshold due to the DAI price increase.

Someone got liquidated for $49m on compound today. Liquidator got $3.7m just for calling a method.https://t.co/A8gw7uhQau

— Sam Priestley (@arbingsam) November 26, 2020As a result, the liquidator seized $50 million in cDAI, while returning only $46 million. Basically, the liquidator earned $4 million. The liquidator issued four other transactions, which removed an extra $6 million in debt.

The post Increased Dai price allowed Compound (COMP) liquidator to earn $4 million appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|