2020-6-24 23:00 |

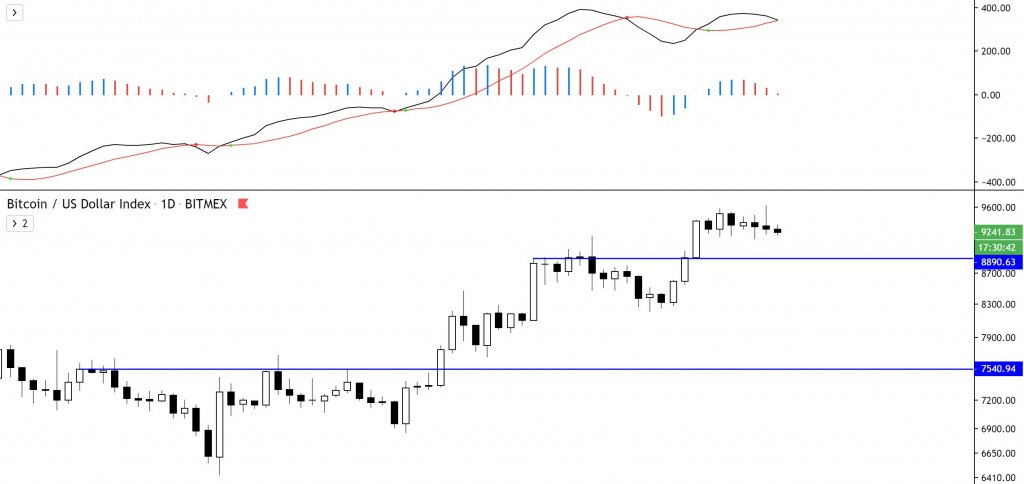

Ethereum’s price has seen a notable rebound from its recent lows, but it still remains caught within its wide multi-week trading range Its present lack of strong momentum has been surprising to many investors, as it has been garnering massive utility in recent times This has led one prominent data analyst to explain that it’s becoming “do or die” time for ETH He notes that a failure for it to post a swift rally in the near-term could throw a wrench in its chances of seeing any type of intense upwards momentum in the years ahead Ethereum’s price action in recent times has been closely associated with that of Bitcoin. This has caused to fall into a massive trading range between $230 and $250. Earlier this week the cryptocurrency did face some intense momentum that caused its price to decline down below the lower boundary of this trading range. From here, however, buyers stepped up and catalyzed some intense buying pressure. ETH has been under the spotlight as of late, primarily due to the explosive popularity of DeFi. Despite seeing a massive growth in utility and usership, its price has not yet reflected this. That’s why one prominent data analyst is noting that it is now or never for Ethereum to see an intense rally. Ethereum’s Fundamentals Grow Strong, But Price Remains Stagnant At the time of writing, Ethereum is trading up under 2% at its current price of $242. This marks a notable surge from recent lows of roughly $230 that were set yesterday. It also marks a climb from lows within the $220 range that were set last week. This upswing came about in tandem with that seen by Bitcoin and has not been enough to propel the cryptocurrency past its key near-term resistance that sits around $250 to $255. There are many strong fundamental factors currently working in Ethereum’s favor, despite these not being reflected in its price. Avi Felman, the head of trading at BlockTower Capital, explained in a recent tweet thread that there are only a few risks to this fundamental strength. “Some wrenches: 1. Wrapped BTC could become widely used, proving that no one cares about ETH if btc is available 2. A very volatile BTC could hurt the ETH/BTC pair 3. While there is locked ETH, most new locked assets are actually stablecoins,” he noted. Why It is Vital for ETH to Rally in the Next Six Months Ceteris Paribus, a respected pseudonymous data analyst, recently noted that it is vital for Ethereum to rally in the coming six months. He points to a few key factors to warrant this: “If ETH doesn’t go on a significant & idiosyncratic run over the next 6 months then I don’t see how it ever will. – DeFi boon -> profits to ETH – ETHE arb play, consistent spot demand – ETH 2.0 phase 0 – Fees skyrocketing. Everything is lining up. If it doesn’t happen now, when?” Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

Rally (RALLY) íà Currencies.ru

|

|