2020-2-1 19:43 |

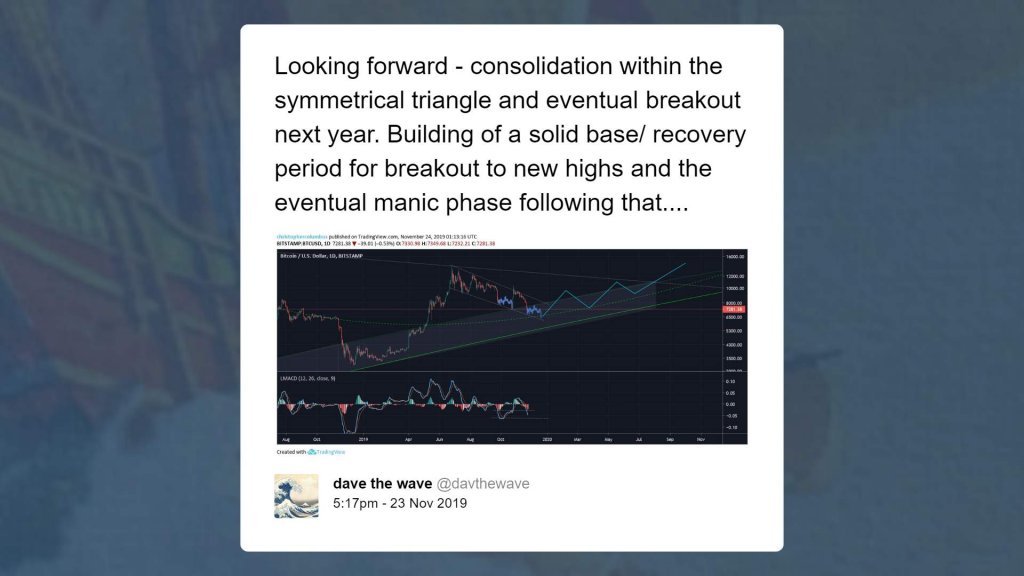

Believe it or not, Bitcoin is only 53% below its all-time high near $20,000. Ethereum, on the other hand, hasn’t fared so well. The second-largest cryptocurrency, despite the recent rally in the cryptocurrency markets, is still down by over 80% from its all-time high above $1,400, which it reached during the mania of the previous bull market. In spite of this harrowing price trend, analysts are starting to become convinced that ETH is ready to surge higher. Ethereum Preparing To Burst Higher: Here’s Why Josh Olszewicz, a crypto asset analyst at markets research firm and data provider Brave New Coin, recently gave a confluence of technical analysis factors as to why the price of Ethereum could soon surge by hundreds of percent: ETH is currently in the midst of forming an Adam & Eve bottom on its weekly chart. Should the bottom play out in full, the price could reach $444 to $555, Olszewicz suggests, noting that is where there exists a confluence of the 1.618 Fibonacci Retracement and the measured move, which are both nearly “yearly pivots.” The volume profile purportedly agrees with this sentiment, with the analyst adding that a pitchfork he drew on the chart of Ethereum suggests a move to the aforementioned level by late July or late September. Ethereum is showing the potential to embark on an end-to-end Ichimoku Cloud move from $200 to $750, which is a move that Bitcoin did from 2015 to 2017. 1W $ETH still very early, but possibility of A&E-type pattern building 1.618 and measured move are also near yearly pivots, $444-$555 pic.twitter.com/OZSFBxyc87 — Josh Olszewicz (@CarpeNoctom) January 30, 2020 The Brave New Coin analyst isn’t the only market commentator to have suggested that Ethereum could soon rally towards $800. Per previous reports from this very outlet, leading cryptocurrency trader CryptoWolf shared a TradingView analysis in which he stated that the largest altcoin could soon return to levels it hasn’t seen since early-2018. He noted that he believes ETH has just exited the recent bear market, having broken above key resistance levels, a bearish price channel, and a falling wedge that has constrained price action for months on end. He added that once the cryptocurrency manages to surmount the $175 to $190 range, which are levels of historical importance, the cryptocurrency will likely be clear for a long-term surge towards $800 — over 300% above current prices. Dependent On Bitcoin Ethereum’s price action should be dependent on Bitcoin, despite the abovementioned technicals. But fortunately for ETH bulls, the technicals purportedly favor BTC bulls too. SmartContracter, the trader who called Bitcoin’s $3,200 bottom in June 2018, said that BTC is currently forming a five-wave rise from the $6,000s, thus “breaking [a] key downtrend.” He added that considering the rally from the 2018 bottom at $3,150 — which he called — was also five waves, he expects for this bull run to continue into 2020. Featured Image from Shutterstock The post appeared first on NewsBTC. origin »

Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|