2021-7-27 01:08 |

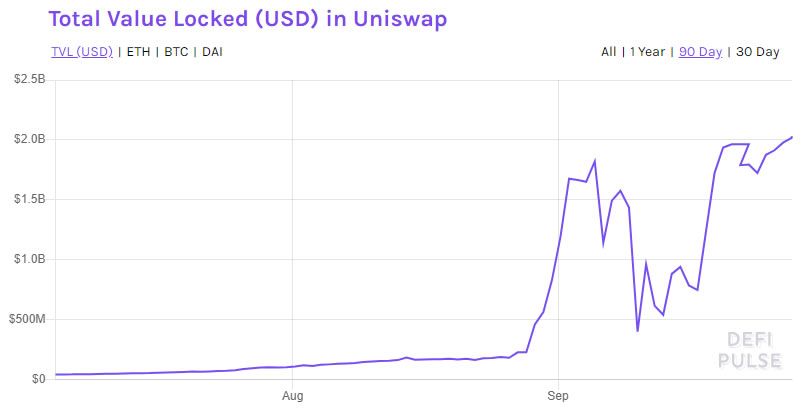

Uniswap UNI/USD is by far one of the biggest decentralized trading protocols that can facilitate automated trading of decentralized finance (DeFi) tokens.

Uniswap Responds to Changes in RegulationOn July 23, Uniswap Labs announced that they would start restricting access to a small number of tokens.

The tokens which got delisted from the platform include ones that could be at risk of being classified as securities by regulators, such as tokenized stocks, option tokens, and insurance-based tokens alongside synthetic assets from crypto derivatives platforms.

However, despite that fact, Uniswap has been improving steadily since the drop it experienced on July 20, where it fell to $14.62.

It is signaling a steady rise in value so far, and this could potentially be the advent of a market runaround.

While regulators are slowly predicting impending regulations for stock tokens, this restrictive action could potentially take away the benefits the tokens are offering now, such as existing outside of the regulatory reach of governments.

Despite this, the UNI token is growing in value.

Should you buy Uniswap (UNI)?On July 26, Uniswap (UNI) had a value of $19.75.

Uniswap (UNI) saw its all-time high on May 3, where it reached a value of $44.92. This showcases just how far the token has managed to historically climb in value.

As for the more recent changes in value, let’s analyze June. On June 3, it had a value of $29.26 which was 32% higher than its current value. On June 22, it had a value of $14.70 which was 25% lower than its current value.

According to data from IntoTheBlock, the UNI token has seen over $1.22 billion in transactions greater than $100.000 in the past 7 days.

It has also experienced $63.45 million in total exchange inflows in the last 7 days.

UNI also saw $74.61 million in total exchange outflows in the last 7 days.

This indicates that the token has recently shifted around 30% in value, and has the potential to climb further. In the last 24 hours, it has experienced a 13% increase in value, as well as a 43% increase in trading volume, which has driven its price higher. At this pace, we could see it go well past the $20 range, even to $25 by the end of August.

The post I’m buying Uniswap (UNI) on July 26 and this is why! appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Uniswap (UNI) на Currencies.ru

|

|