2019-2-17 19:44 |

Grayscale Investments, a digital currency group that specializes in cryptocurrency investing, has just released its 2018 Q4 investment report. In it, the firm informs that it managed to attract a total of $30.1 Million in capital for the fourth quarter of 2018. The average weekly investment was around $2.3 Million. Of this weekly amount, $2 Million went to its Bitcoin trust and $0.3 Million went towards other investment products centered on digital assets such as Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Stellar (XLM), XRP and ZCash (ZEC).

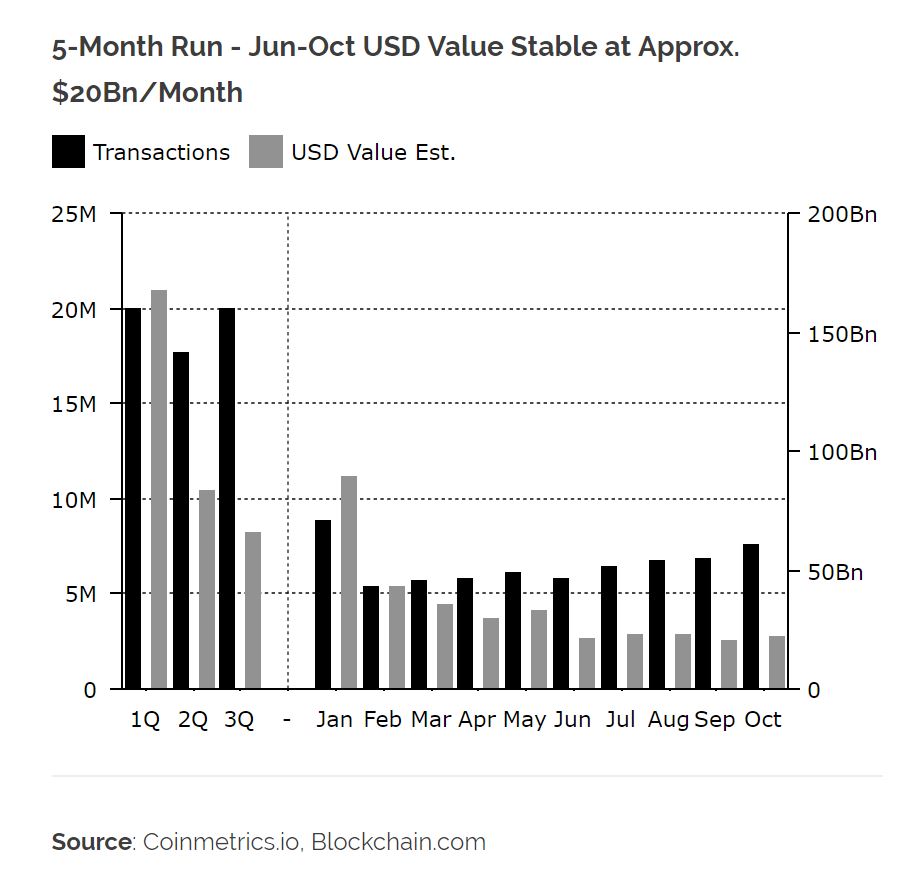

A better representation of the Q4 distribution of the various digital asset products can be found below and courtesy of the team at Grayscale.

Bitcoin Was the Preferred Digital AssetFrom the chart, it is clear that many investors prefer investing in Bitcoin (BTC) products. This has been summarized in the report as follows:

Grayscale Bitcoin Trust (f/k/a Bitcoin Investment Trust) stood out this quarter, attracting the most capital within the Grayscale family of products despite further price declines in the digital asset market. In the fourth quarter, 88% of inflows were into Grayscale Bitcoin Trust, while 12% were into products tied to other digital assets.

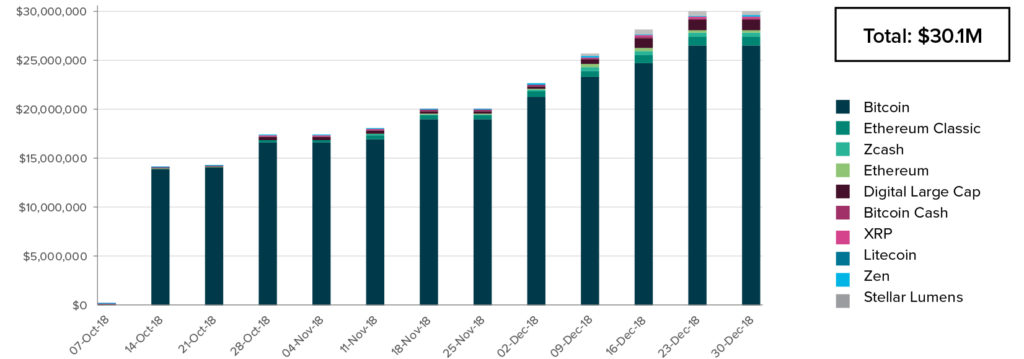

66% of Capital Inflow Was From Institutional InvestorsThe team at Grayscale have also pointed out that 66% of the $30.1 Million in capital that came their way, was from Institutional investors. The report further notes that retirement accounts have show an interest in their investment products that are tied to digital assets.

Looking at the profiles of our investors, we saw that retirement accounts comprised a higher percentage of total demand for Grayscale products in the fourth quarter (40%), while institutional investors continued to be the dominant source of inflows for 2018 (66%). These datapoints reinforce two important trends that we’re observing.

First, the average investor at this stage of the bear market is patient with a multi-year investment horizon (i.e., investing for retirement). Second, institutional investors are building core strategic positions in digital assets over time and have largely viewed the 2018 drawdown as an attractive entry point. While the dollar amounts invested declined in Q4, institutional investors share of the ‘new investment pie’ was roughly consistent throughout the year.

The following chart from the report gives a better visual cue of investor profiles at Grayscale for Q4.

What are your thoughts on the findings on the Grayscale’s 2018 Q4 report that Institutional investors are keen on digital assets and primarily Bitcoin? Please let us know in the comment section below.

[Feature image courtesy of Unsplash.com]

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.

The post Grayscale’s 2018 Q4 Crypto Report Indicates Institutional Investors Brought in 66% of New Capital appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|