2021-2-2 14:13 |

After shutting down in December amid a historic Ethereum bull run, Grayscale has decided to reopen its Ethereum Trust (ETHE) for accredited investors.

This will allow users to buy and sell shares of Grayscale’s publicly traded Ethereum Trust. This avenue provides exposure to the largest decentralized smart contract platform without worrying about storage, security, or regulatory concerns.

For many users and especially for organizations, this is a preferred way to invest in cryptocurrencies. They essentially benefit the same way from price movements without adopting the inherent risks that come with owning and storing cryptocurrency on their own.

Grayscale May Have Plans to ExpandThis resumption of trading is a good sign for regulated investors looking to gain additional exposure to a growing asset class — but Grayscale isn’t stopping there. The investment firm registered to open five more publicly traded trusts based on different cryptocurrencies last week.

Although this registration does not guarantee the public offering of these trusts, it shows the direction Grayscale is planning to move in the future. As the top digital asset manager in the world with billions of dollars of digital assets under management (AUM), Grayscale is putting the peddle to the metal and working towards cornering the trust market.

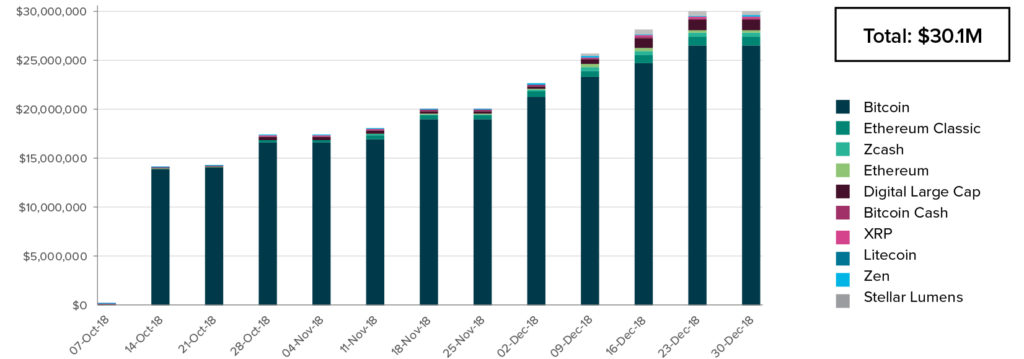

Increasing Digital Assets Point to Increase DemandGrayscale has grown rapidly this year, adding billions of dollars to its AUM and making these tokens available to investors. Since the firm purchases and manages all of the cryptocurrency on its platform on behalf of its investors, the firm’s continued growth shows the growing interest in the cryptocurrency asset class by regulated entities.

Grayscale AUM – Grayscale InvestmentsFor many, Grayscale is the only legal way to gain exposure to this highly unregulated market.

For now, it is impossible to say how long Grayscale will keep its Ethereum Trust open for investment, as it has decided to shut it down before. But with billions of dollars in Ethereum alone, Grayscale is poised to continue to dominate the space and grow along with the increased interest in cryptocurrencies.

Grayscale’s largest trust is its Bitcoin Trust. As more investors begin to see the top cryptocurrencies like Bitcoin and Ethereum as legitimate stores and transfers of value, more should continue to flock to its regulated cryptocurrency offerings.

The post Grayscale Ethereum Trust Reopened to Investors and Traders appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

TrustPlus (TRUST) на Currencies.ru

|

|