2020-8-6 19:40 |

Grayscale Investments has publicly filed a registration statement on Form 10 with the US Securities and Exchange Commission (SEC) on behalf of its Ethereum product, Grayscale Ethereum trust (ETHE).

If approved, it will offer the product a higher SEC status, the same as Grayscale Bitcoin Trust, to become the second digital currency investment vehicle to attain the status of a reporting company by the SEC.

The prominent change will be reducing the unlocking period of ETHE shares from 12 months to 6 months, the same as GBTC. If effective,

“accredited investors who purchased shares in Grayscale Ethereum Trust’s private placement would have an earlier liquidity opportunity, as the statutory holding period would be reduced from twelve months to six months.”

This is a “milestone” for Grayscale Ethereum Trust as even though Bitcoin is the most popular of its products, “Ethereum has gained significant traction and interest over the years.”

Grayscale notes that there is a “strong demand” for access to Ethereum which has grown to become the “largest” Ethereum investment vehicle.

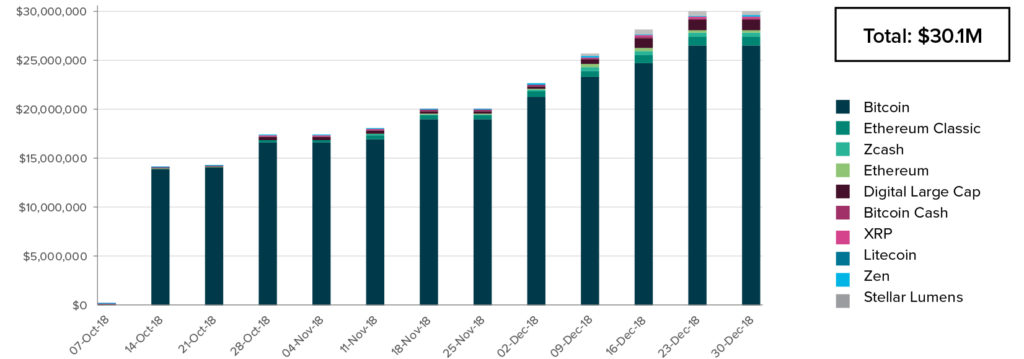

In Q2 2020, Grayscale’s Ethereum Trust hit a weekly investment of $10.4 million in ETHE, amounting to the record quarterly inflows at $135.2 million. Overall, demand for ETHE accounts for nearly 15% of total inflows into Grayscale products this past quarter.

In other news, Grayscale is interested in getting its products on the Robinhood app. A zero commission trading place, Robinhood is popular among millennials that got even more so in 2020 thanks to the lockdown and government's monetary stimulus to combat the coronavirus pandemic.

Hi Friends — show your love and help get the @Grayscale family of products on @RobinhoodApp! https://t.co/dZAVBajEvf

— Grayscale (@Grayscale) August 5, 2020

However, not everyone thinks it is a good decision, given that Robinhood already allows trading for Bitcoin and Ethereum along with five others including Bitcoin Cash, Bitcoin SV, Ethereum Classic, Litecoin, and Dogecoin.

Also, while ETH is trading on Robinhood at the same price as any spot exchange, ETHE shares are trading at $100.50 at a premium of over 200%. The premium has come down drastically from about 950% in early June 2020, as per Ycharts.

Also, no matter which option users go with, they are not getting the crypto to themselves as while Grayscale has Coinbase Custody to safe keep the digital assets for their users, Robinhood doesn’t support coin withdrawals or transfers of existing cryptos.

origin »Bitcoin price in Telegram @btc_price_every_hour

TrustPlus (TRUST) на Currencies.ru

|

|