2020-12-1 18:07 |

The yellow metal continues to get hammered.

Today, gold fell further to $1,764, down 15% from its all-time high of $2,075 in early August, recording losses for four months in a row now.

November is on track to be bullion’s worst month since Nov. 2016, as it fell more than 5%.

Since July, sliding below the $1,800 level for the first time, the key technical support level only accelerated the sell-off. With gold below the 200-day moving average, it could trigger even more technical selling.

These losses are in line with continued outflows of gold exchange-traded funds (ETF), the first monthly one this year.

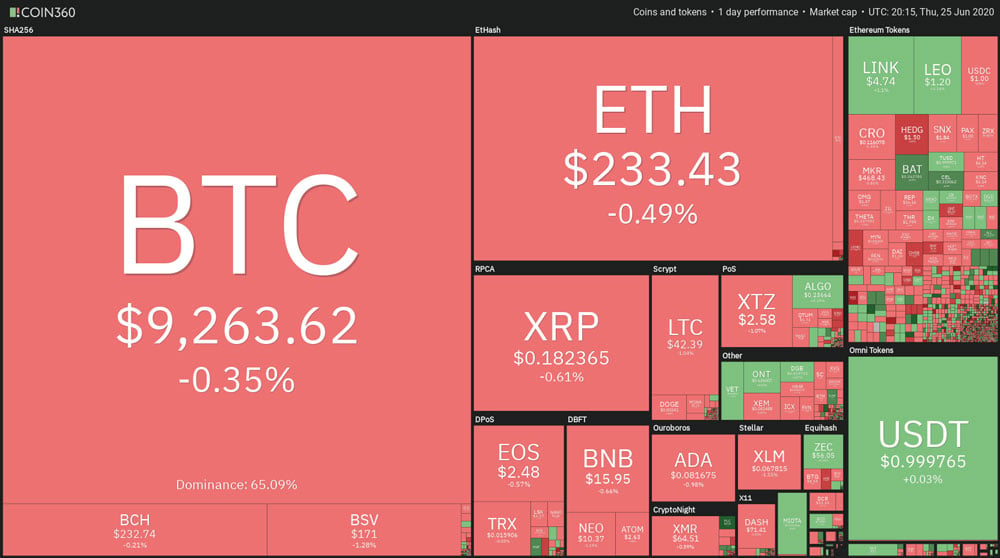

While gold has been going down for the last four months, Bitcoin has been enjoying an uptrend, going from $12,000 to $19,500 during the same period.

“It actually looks like Gold is being dumped for Bitcoin,” commented one trader on this completely opposite direction both the assets are moving in.

Up 158% YTD compared to gold’s 17%, Bitcoin is poised to break its all-time high of $20,000.

#bitcoin and gold decoupled this month. #bitcoin is up 35% in November and 72% in Q4 pic.twitter.com/kySfq36mJv

— skew (@skewdotcom) November 30, 2020

Stocks on Incline, Dollar on DeclineInvestors have pivoted into risk assets this month, as seen with global stocks heading for a record month.

“Robust price rallies in industrial commodities like copper point to an ongoing rotation from a risk-averse to risk-on asset market regime,” wrote Citigroup analysts adding the metal faces a “more uncertain path in 2021.”

The latest boost for risk appetite has been the result of America’s top two health officials saying over the weekend that a vaccine will be deployed across the US before 2020 is over.

Unlike gold, this month has been solid not only for equity markets but also fixed income on the back of liquidity provided by central banks — ECB is set to provide more stimulus next month.

While the traditional safe-haven asset extended losses amidst the growing optimism for an end to the coronavirus pandemic, copper powered to a seven-year high. Chinese brokerage Jinrui Futures wrote,

“The market sentiment is really bullish right now amid a combination of vaccines, economic recovery, and a smooth U.S. presidential transition.”

However, ultra-dovish monetary policy and the risk of steeper inflation continue to favor the safe-haven asset.

Interesting gold is showing weakness despite a weaker US dollar. Federal Reserve Chair Jerome Powell will be testifying to Congress on Tuesday could affect it further. Robert Rennie, head of financial market strategy at Westpac, said,

“The idea that a potential Treasury Secretary (Janet) Yellen and Fed chair Powell could work more closely to shape and coordinate super easy monetary policy and massive fiscal stimulus that could drive a rapid post pandemic recovery saw the dollar under pressure.”

Bitcoin (BTC) Live Price 1 BTC/USD =19,301.8876 change ~ 5.68Coin Market Cap

358.22 Billion24 Hour Volume

46.48 Billion24 Hour Change

5.68 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Gold is Being Dumped by Investors for Bitcoin; BTC Black Friday Sale Draws in New Buyers first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Golos Gold (GBG) íà Currencies.ru

|

|