2020-6-26 23:26 |

After falling under $9,000 briefly, bitcoin is now trying to stay above $9k. BTC’s losses turned the market red, but as the day progressed, cryptos have been fluctuating between gains and losses.

Bitcoin has spent most of its time in the $7,500 and $10,400 price range in the past year, shared trader Satoshi Flipper, who feels, it’s time for BTC to move on. According to him, we can dip into the $8,000s and even $7,000s on our way to test $14,000.

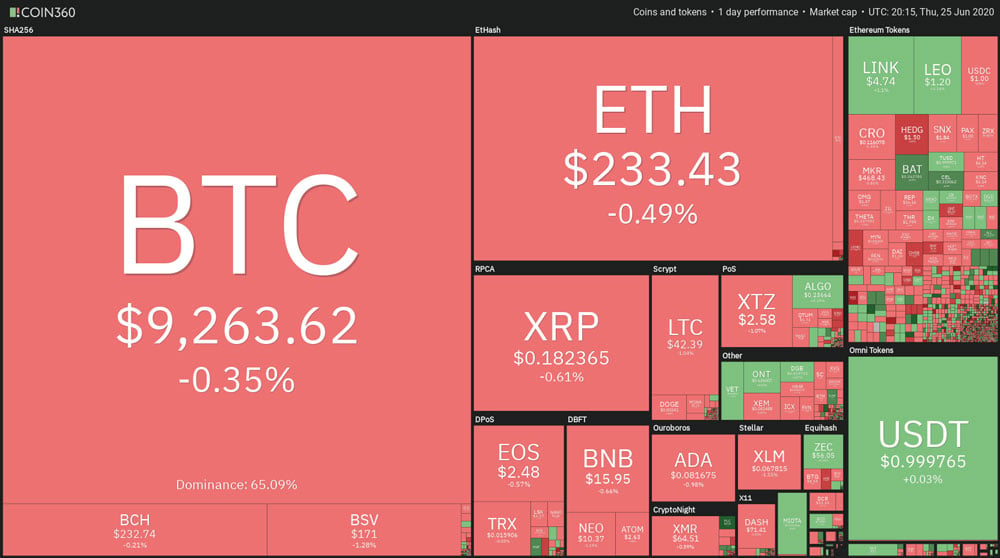

Source: Coin360According to trader Crypto Yoda, “Bitcoin remains in consolidation in uncertain territory.” Although another correction below $8,000 would be healthy for the bullish market structure, it isn't necessary, he said.

“Any break above $10,500 would be enough to kick off a larger bull run.”

Adding substance to the current bears is the expiration of $1 billion in bitcoin options contracts.

“Are you ready?” for the Q2 expiry, said derivatives exchange Deribit while sharing its options stats, out of the $1.96 billion total crypto market open interest, a whopping $1.4 billion belongs to Deribit’s options market.

Amidst this potential bearishness, the daily active addresses of bitcoin are surging. These addresses have been on a surge throughout 2020 and are reaching 1 million milestone.

“Bitcoin's network is now seeing 20.5% MORE unique transacting addresses versus 6 months ago, comparing weekly averages. Prices typically follow this DAA metric, given a long-term time scale,” noted Santiment.

The last time we had over 900,000 active addresses for #Bitcoin was few weeks before 2017 huge bull run. pic.twitter.com/7nKz8lrTyn

— Crypto Rand (@crypto_rand) June 24, 2020

Moreover, hash ribbons are also very close to giving a buy signal. The signal requires price momentum to improve as such could take a couple of weeks.

“May be the last HR accumulation zone for a long time,” said Charles Edwards of Capriole.

Lets be honest, at current time, if stocks fall, BTC will follow.

Good thing is that SPX may have found support.

Sideways before ATH by Nov. ? pic.twitter.com/KVuT5e2KPA

— Wolf (@IamCryptoWolf) June 25, 2020

Stock Market HighlightStocks aren’t doing any better, they fell sharply yesterday, on its worst day in two weeks. The losses came over the fears of an increasing number of newly confirmed coronavirus cases, which are dampening the expectation of an economic recovery.

California saw a dramatic spike of a record over 7,000 cases in one day, Florida its highest 5,508, and 5,489 in Texas. In total, the U.S. recorded 34,700 newly confirmed COVID-19 cases in a day, the highest since late April.

“The latest coronavirus news is not positive for the stock market which was betting the worst of the pandemic recession was behind us,” said Chris Rupkey, a chief financial economist at MUFG.

“All the hopes of investors looking for a better economy to improve the bottom lines of companies shut down in the recession have been dashed.”

In response, airline stocks and transport went down, and oil tanked. Today, US markets slumped after weekly jobless claims totaled 1.5 million for the week ending June 20, about the same as the previous week. Since mid-March, new jobless claims have totaled at over 47 million.

“Jobless claims are not falling fast enough. Everything we have seen in the last week or two between rising case counts/hospitalizations, stalling economic progress in some important states, government job cuts, means one thing: the Phase 4 of fiscal stimulus must be bigger,” wrote Neil Dutta, head of economics at Renaissance Macro Research.

Gold also slipped by 0.16% to $1,772.20 per ounce, reversing the earlier gain.

Bitcoin (BTC) Live Price 1 BTC/USD =$9,287.6358 change ~ -0.16%Coin Market Cap

$171.03 Billion24 Hour Volume

$4.09 Billion24 Hour VWAP

$9.22 K24 Hour Change

$-15.2786 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|