2022-5-24 00:34 |

In the decade-plus since bitcoin was launched, crypto assets have become synonymous with wild price swings. Regulators are presently trying to come up with the best way to monitor and classify them, with so many fine points to put into consideration.

A top watchdog official has indicated that crypto is now one of the top agendas for regulators. As such, there is a high likelihood that securities commissions around the world will form an official joint regulatory group in an effort to oversee crypto at a global level.

First Global Cryptocurrency Policy BodyThe crypto space could come under potential global regulation by the same time next year. This is according to Ashley Alder, the International Organization of Securities Commissions’ chairman. The IOSCO is an association of the world’s securities and futures regulators.

Speaking during the Official Monetary and Financial Institutions Forum on Thursday, Alder noted that the cryptocurrency explosion is one of the three main agendas alongside COVID and climate change that the authorities are now laser-focused on.

The IOSCO chair mentioned the multiple risks and the “wall of worry about this [crypto] in the conversations at an institutional level,” citing cybersecurity, operational sustainability, and a lack of transparency as the main issues around crypto that could prompt the creation of a joint regulatory body.

Alder’s statements come as the market sees one of the worst events in crypto history, thanks in large part to the dizzying collapse of the Terra ecosystem. Terra’s decentralized algorithmic stablecoin recently fell to the sub-dollar doldrums, bringing its sister token LUNA down with it. The Terra crisis has reverberated through the market, with bitcoin sinking to 2020 prices.

In Alder’s opinion, a global body to coordinate crypto rules is evidently needed. He compared it to the task forces already set up for climate change mitigation such as the one under the G20 group of top economies. At the moment, there isn’t such a thing for cryptocurrencies. However, Alder, who also doubles as the CEO of Hong Kong’s Securities and Futures Commission, thinks this is bound to change over the next year.

Crypto Regulations Enter Critical Juncture As Authorities Show InterestAuthorities in many major countries have failed to introduce clear guidelines on crypto and stablecoins. This is despite multiple calls from crypto pundits who stress that clear and comprehensive regulations will foster innovation and are key to the market’s sustainable development.

However, it seems that a big change is coming pretty soon. Some feel that the recent Terra downfall will jolt regulators into action.

While Treasury Secretary Janet Yellen doesn’t believe that stable coins’ recent de-pegging presents any real threats to financial stability, she highlighted Terra’s collapse in fresh calls for stablecoin regulation.

Moreover, the UK introduced two bills on May 10 that look to strengthen the nation’s financial services industry, including promoting the “safe adoption of cryptocurrencies”.

Meanwhile, President Biden has already signed an executive order that seeks to establish a strategy that aligns with the U.S.’s approach to crypto, and there are also various bills in Congress that aim to clear up the uncertainties currently weighing down the cryptosphere.

origin »Bitcoin price in Telegram @btc_price_every_hour

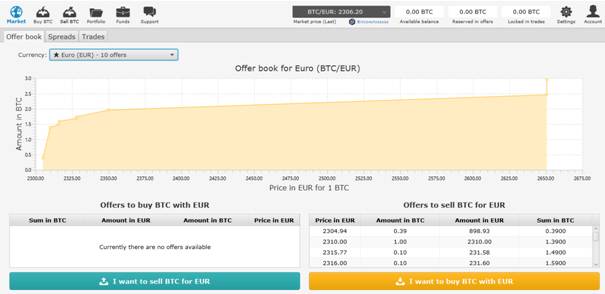

BestChain (BEST) на Currencies.ru

|

|