2018-12-11 06:13 |

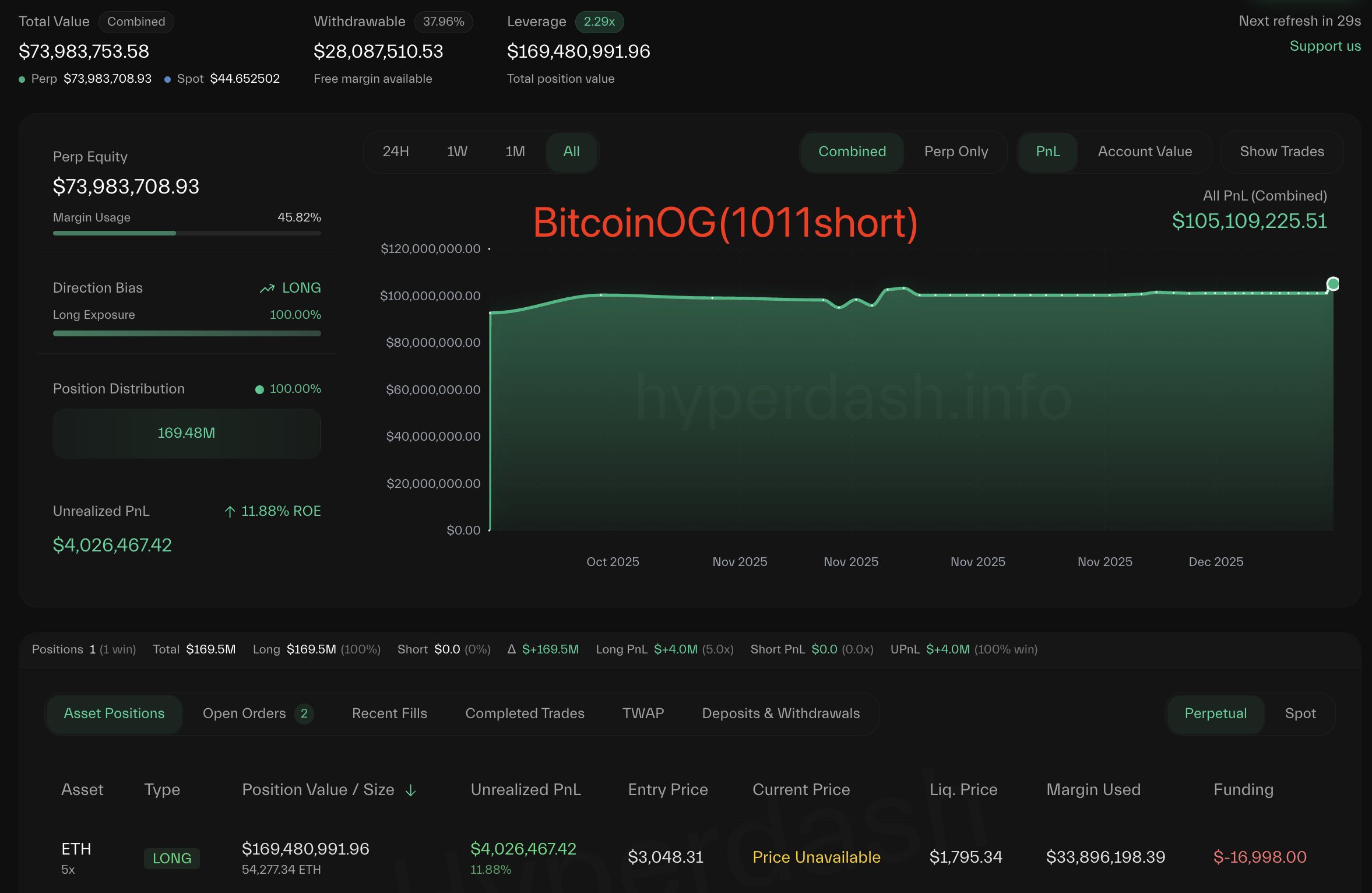

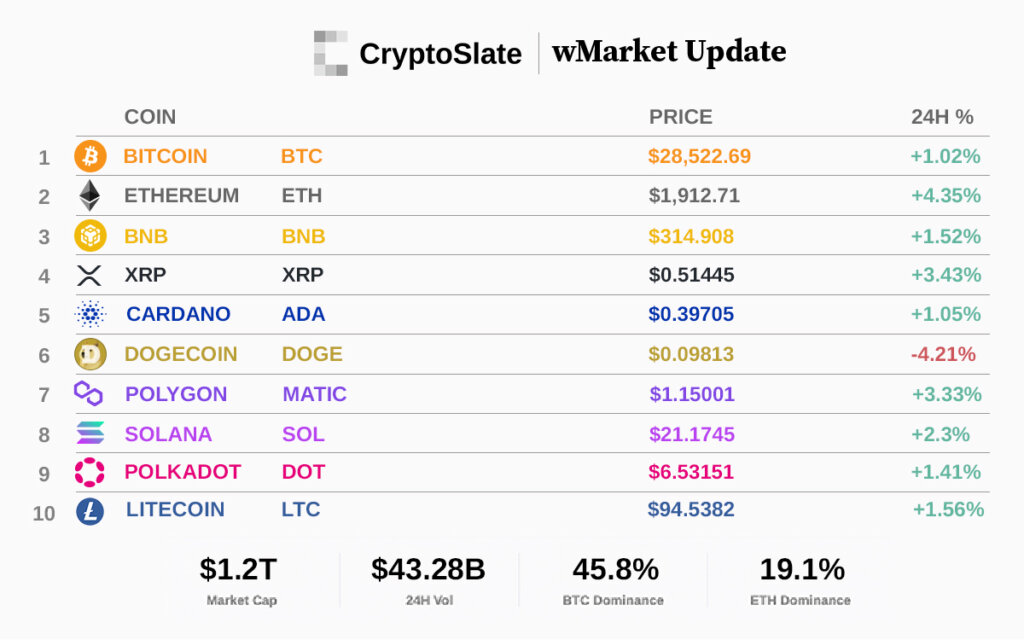

During November, the market lost an important part of its value after falling during the current year around 80%. Some virtual currencies such as Ethereum (ETH) have been severely damaged by this bear market. Ethereum is currently being traded around $91 and it has a market capitalization of $9.49 billion.

Some other virtual currencies have lost more than 95% of their price since their all-time highs between December 2017 and January 2018. However, not all the virtual currencies are affected in the same way. Those projects that are used as a network such as Ethereum have not been designed for external payments.

Ethereum’s network activity remained relatively constant compared to its price. That means that although prices have fallen around 50% in the last months, the activity in the network remains to be high. Indeed, the network is registering between 500,000 and 600,000 per day, according to Etherscan.

For example, XRP has also experienced a price reduction during the last months. But the Chief Cryptographer at Ripple, David Schwartz, said that higher the price of XRP, the larger the payments that Ripple can target.

At the same time, there are several advantages of Ether being traded under $100. The network was completely congested and it was very expensive for developers to build functions on the platform. Earlier this year, a transaction could be processed for $9 while now it is possible to do so for less than a dollar.

However, there are some experts that have different opinions on the matter. For example, Mati Greenspan, a senior analyst at eToro, mentioned that a stable price of Ether would clearly be more beneficial for the whole network and space. Developers would be able to plan their projects and work knowing how much Ether they are going to spend and when.

For Ethereum to raise as much as it was in January, some months have to pass and new developments should prove to be reliable in the real world.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|