2024-12-13 22:37 |

Ethereum (ETH) may be poised to break the $5,000 mark for the first time, according to blockchain analytics platform CryptoQuant.

In its recent weekly report shared with CryptoSlate, the platform’s latest report highlights critical supply-demand trends and network conditions that could drive this upward momentum.

Growing demand through spot ETFsSpot Ethereum ETFs have seen a remarkable surge in holdings, reflecting growing investor interest. Since their launch in July 2024, the total ETH held by these ETFs in the United States has grown from 3.095 million to a record 3.41 million.

Ethereum ETFs (Source: CryptoQuant)This increase follows a recovery from September 2024’s low of 2.716 million ETH, signaling renewed confidence in Ethereum as a viable investment.

The sustained accumulation of ETH by ETFs can significantly influence price as strong buying pressure from these vehicles may create upward momentum that could drive the asset closer to its all-time highs and beyond.

ETH supply trendsEthereum’s total supply has reached 120 million ETH, its highest level since April 2023. At the same time, the burn rate—where ETH is permanently removed from circulation through transaction fees—has risen steadily since September. For context, the amount of assets burnt through transaction fees has grown to over 2,700 ETH from a daily average of 80 ETH in August.

ETH Supply and Burns (Source: CryptoQuant)This dynamic creates deflationary pressure, as the burn rate can surpass new ETH issuance during periods of heightened network activity. Inadvertently, the increased usage of Ethereum’s decentralized applications contributes to higher transaction fees, further boosting the burn rate.

The analysts believe this deflationary pressure can create a supply squeeze that could contribute to favorable conditions for price increases.

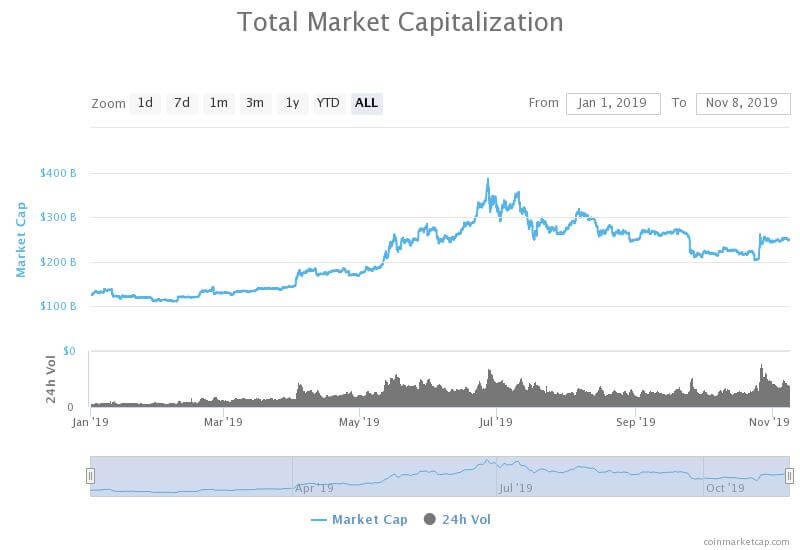

Valuation metrics indicate a $5,000 targetUsing Ethereum’s realized price, which reflects the average price paid by ETH holders, CryptoQuant estimates the current upper price limit at $5,200.

Ethereum Realized Price (Source: CryptoQuant)This valuation mirrors the peak of Ethereum’s 2021 bull run. So, if the current demand and supply trends persist, ETH is positioned to reclaim and exceed its previous all-time high.

The post Ethereum supply squeeze and ETF demand set stage for $5,000 breakout appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|