2022-4-20 11:30 |

The Ethereum Foundation, the non-profit organization behind the largest smart contract network, has released a detailed 2021 financial report. While it’s barely bedtime reading, the report outlines the amount of money the non-profit spent on research and development as it prepared for the “Merge” as well as its current treasury holdings after selling ETH at the very top.

Ethereum Foundation Owns Almost 0.3% Of The Entire ETH SupplyThe Ethereum Foundation’s 28-page report on Monday aims to boost transparency and share its vision with ethereum investors. The report indicates that the organization’s total holdings amounted to $1.6 billion as of March 31, 2022. The largest portion of the treasury was in crypto, while only $300 million was in non-crypto currency investments.

The Foundation has an eye-popping $1.3 billion held in ETH, which accounts for nearly 0.3% of the total ethereum supply. The report explained that they abide by a conservative management policy that guarantees the organization has adequate resources to fund its goals even during a prolonged period of market correction.

Another big revelation from the report is that the EF spent roughly $48 million last year on a multitude of projects including second-layer research and development, Zero-Knowledge (ZK) R&D, community development, and ethereum mainnet development. Notably, an ethereum core developer recently revealed that the much-awaited Merge was pushed to Q3 2022 despite the successful implementation of the Shadow hard fork.

Almost $20 million was spent on grants via the Foundation’s Ecosystem Support Program, third-party funding, and sponsorships, the report said.

The EF Clarifies Why It Sold ETH At The TopThe Ethereum Foundation team further explained why it sold ether to increase its non-crypto holdings. The EF noted that the reason for selling during parabolic rallies in the ETH market was to offer a great security margin for its core budget.

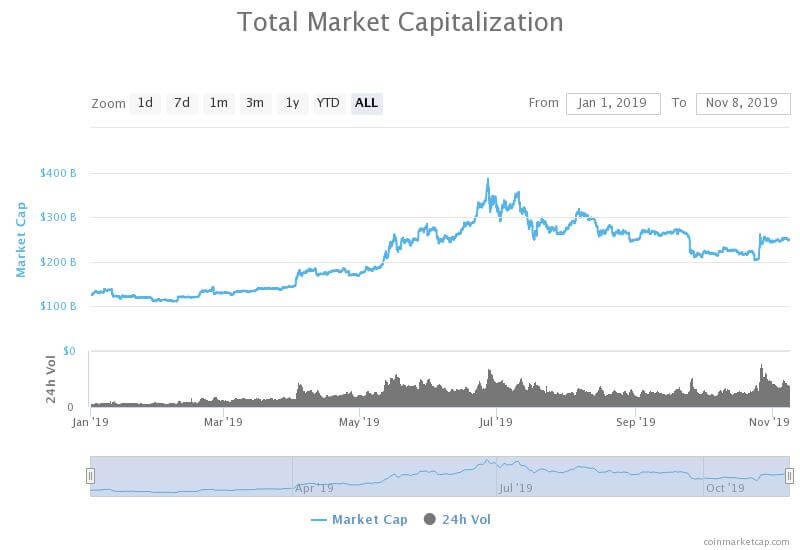

The Foundation has drawn criticism in the past for tactically selling ETH at market peaks; for instance, during the 2017 bull run, the May 2021 record rally, and again at the height of the November upsurge. The exceptional timing has raised speculation about possible insider trading at the EF.

That being said, the non-profit still holds a gargantuan amount of ether as it believes in the long-term potential of the world’s second-largest cryptocurrency based on market cap.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|