2019-7-20 19:52 |

BitMEX in The Firing Line

BitMEX, the leading Bitcoin derivatives platform, is purportedly under investigation. Per a Bloomberg report released a number of hours ago, the Seychelles-based exchange, which also has a luxurious office in Hong Kong, the cryptocurrency platform is being investigated by the U.S. Commodity Futures Trading Commission (CFTC).

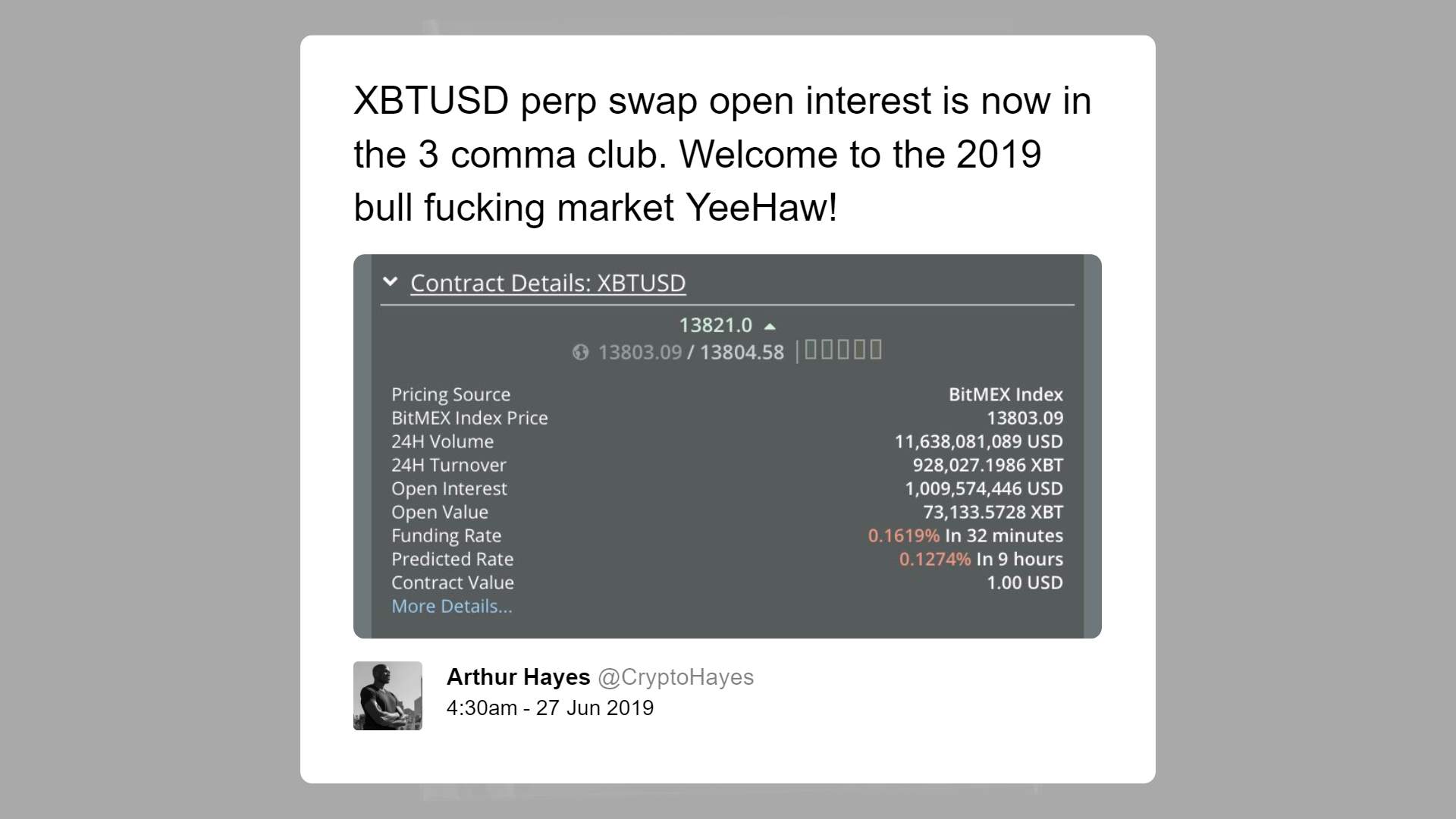

The financial regulator, which presides over most Bitcoin-related vehicles, is reported by insider sources is looking into if BitMEX has been knowingly allowing American users to trade on its platform. This is presumably in response to the exchange’s sudden spike in volume that came alongside this bull market, with it processing over $1 trillion worth of volume in the past year. Both the CFTC and BitMEX were rather quiet on this whole purported situation. A spokesperson of the Bitcoin exchange told Bloomberg:

HDR Global Trading Limited, owner of BitMEX, as a matter of company policy, does not comment on any media reports about inquiries or investigations by government agencies or regulators and we have no comment on this report.

It is important to note that this rumored CFTC investigation may be unfounded. Arthur Hayes, the chief executive of the platform, has explained that it removes anyone found in violation of BitMEX’s terms of services, which includes a clause about the trading of its crypto derivatives in certain regions (including the U.S. and Quebec). Though, users can bypass these IP checks through virtual private networks, which have become somewhat of a given/no-brainer for tech-savvy Bitcoin investors.

Nouriel Roubini VindicatedThis Bloomberg report has somewhat vindicated Nouriel “Dr. Doom” Roubini, the famous Great Recession soothsayer that has turned his sights on the cryptocurrency industry. As detailed by this outlet, the economist and Stern School at New York University professor has been bashing Hayes and his platform for a while now, calling it a platform that takes money from “retail suckers”.

In fact, Roubini even took to the stage, debating Hayes earlier this month about BitMEX’s practices and the future and validity of Bitcoin and the cryptocurrency space at large. During that spat, the economist bashed the exchange for being based in Seychelles and not complying by U.S. regulations. This seeming CFTC investigation, which comes alongside the U.K.’s Financial Conduct Authority proceedings to ban cryptocurrency derivative products entirely, is presumably been a sight for sore eyes for Roubini.

Crimes probed by @CFTC are a fraction of sleaze going on in BitMEX:

U.S. Regulator Probing Crypto Exchange BitMEX Over Client Trades. Trading platform known for 100x leverage futures contract. Probe comes as regulators ramp up scrutiny of crypto sectorhttps://t.co/X0JDU5Ge46

Even if this rumor is false, one thing is for certain: U.S. regulators and lawmakers are starting to crack down on this industry. Just look to the cases laid out by The Block’s Larry Cermak below, which involves some of the biggest cryptocurrency exchanges in the industry.

This is getting quite serious. Let's summarize:

– Both BitMEX and Bitfinex are now investigated for servicing U.S. customers

– Bittrex and Poloniex started to geo-block tokens from the U.S.

– Binance pulled crypto-to-crypto trading out of the U.S. completely

These seem to be preemptive responses to an impending crackdown, which have been hinted at by President Donald Trump and Treasury Secretary Steven Mnuchin.

Photo by Ben Rosett on UnsplashThe post Bitcoin Exchange BitMEX Under CFTC Investigation: Bloomberg Insiders appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Safe Exchange Coin (SAFEX) на Currencies.ru

|

|