2020-6-30 23:00 |

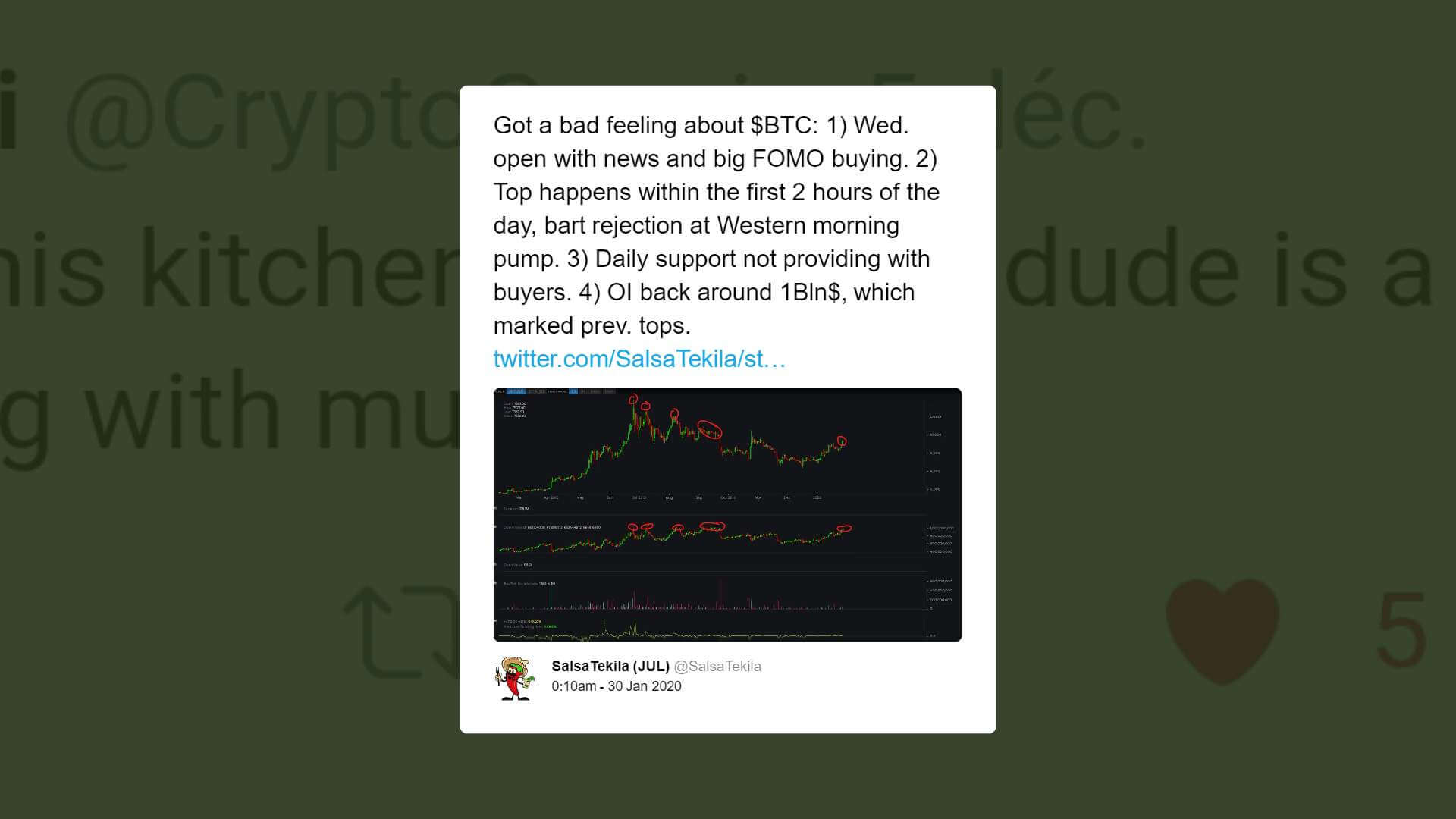

Ethereum’s price has been sliding lower over the past several days Despite Bitcoin being able to maintain above the lower boundary of its long-held trading range, ETH is now trading firmly below the range it formed over the past several weeks This points to some underlying weakness amongst its buyers which comes as it nears its crucial $220 support level It also just confirmed a “death cross” formation that hasn’t been seen since March. This could cause it to post a massive decline in the coming days One analyst is even noting that its next downtrend could lead it to as low as $120 Ethereum has been flashing signs of major technical weakness in recent days. This comes as the cryptocurrency grows incredibly strong from a fundamental perspective. There are a few factors that are driving this weakness, including a heavy trendline that has proven to be insurmountable, mounting selling pressure, and it just confirmed a dreaded “death cross” formation. These factors are likely to lead it lower in the near-term, but how ETH trends next may depend largely on how strong the support at $220 is. An ardent defense of this support will be imperative if buyers want to see any further upside. Ethereum’s Technical Strength Degrades as It Struggles to Break Key Trendline At the time of writing, Ethereum is trading down nearly 2% at its current price of $221. This marks a notable decline from recent highs within the $230 region that were set last week when it bounced from a fleeting visit to its current price region. $220 has been established as ETH’s “last-ditch” support over the past several weeks, making a bounce here crucial. One analyst explained that a failure to do so would likely spark a rapid 10% decline to $195. “ETH HTF Update: I would be heavily executing buy orders around $195 if we see this level get tested again over the next month, I think the next 12/24 months will be heavily bullish and I am expecting ETH to outperform the rest of the market,” he said, remaining bullish on ETH’s mid-term outlook. In spite of this sentiment, another analyst recently put forth a chart showing a downside target in the $120 region. He notes that the multiple rejections at $250 are cause for concern. Image Courtesy of AMD Trades. Chart via TradingView. ETH Forms Dreaded “Death Cross” The same technical weakness that caused the aforementioned analyst to set a target in the low-$100 region also caused Ethereum to form a “death cross.” It had not formed this pattern since March – before it plunged below $100 – and this could be a grave sign. “Confirmed, death cross here as well – didn’t happen since March,” one trader stated, pointing to the below chart. Image Courtesy of Teddy. Chart via TradingView. Featured image from Shutterstock. Charts from TradingView. origin »

Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) íà Currencies.ru

|

|