2020-3-10 03:00 |

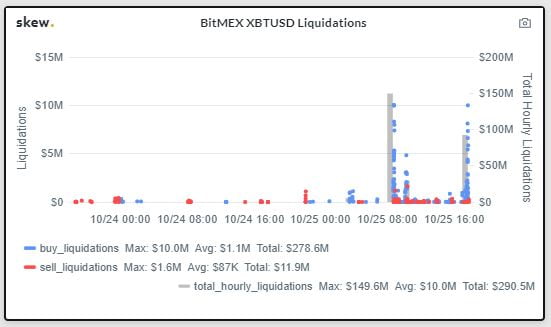

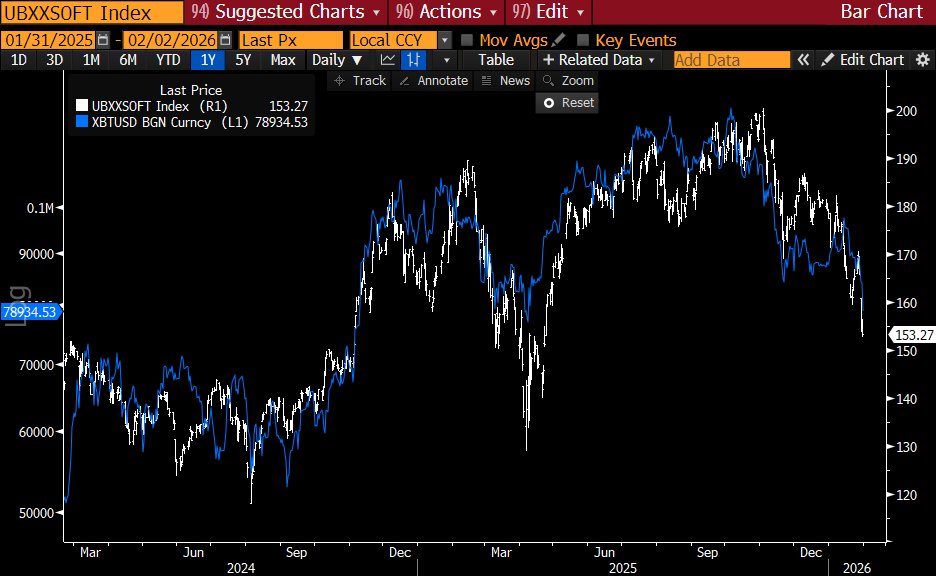

Bitcoin hasn’t done well in the past two days; since hitting $9,200 on Saturday, the cryptocurrency has plunged as low as $7,600, more than 17% lower than the weekend high, in a move that has liquidated over $200 million worth of BitMEX long positions in the process. The move undoubtedly caught traders off guard, hence the massive amount of liquidations. But, there are some weighing in on what crashed Bitcoin. Bitcoin’s Drop May Be Hedge Funds According to Raoul Pal — CEO of finance media startup Real Vision, former Europe hedge fund sales lead at Goldman Sachs, and a long-time Bitcoin adopter (since 2013) — BTC’s weakness may be related to hedge funds. He explained in a tweet published on Monday: “It feels like any hedge fund that was long bitcoin is having to liquidate. VAR takes no prisoners. (For those new to VAR it is the measure of risk in a portfolio and is connected to volatility, so as vol goes up of all assets, they have to reduce risk).” It feels like any hedge fund that was long bitcoin is having to liquidate. VAR takes no prisoners. (For those new to VAR it is the measure of risk in a portfolio and is connected to volatility, so as vol goes up of all assets, they have to reduce risk). $BTC #Bitcoin — Raoul Pal (@RaoulGMI) March 9, 2020 Indeed, BTC’s volatility, per data from Skew, has spiked over the past few days as the market has trended lower, likely shifting allocations. While Pal sees weakness due to the hedge fund narrative, he did remark that Bitcoin’s drop is a “buying opportunity,” adding that the current situation in the fiat markets is “accelerating the need for a new financial system over time. We know where this is leading to – the digital revolution.” There Are Other Crypto Catalysts Although this move may partially be hedge funds deleveraging their portfolios, there are other potential catalysts sending Bitcoin lower, as shared by prominent crypto analyst Jacob Canfield. The COVID-19 outbreak: after an extremely strong rally over the past few months, markets across the board, from American stocks (Dow Jones, S&P 500, etc.) to crypto-assets, were dealt serious blows over the past few weeks. Although some have said that the collapse in the price of Bitcoin is not correlated with the sell-off in other markets, analysts have observed an absence of volume in mainstream crypto markets since the outbreak started. This suggests there is a strong absence of liquidity, increasing the chances of a crash like the one we just saw occurring. Bitcoin miners are hoarding coins: Charlie Morris, founder of a crypto analytics platform, ByteTree, recently suggested that miners hoarding BTC has historically coincided “with negative returns and reflects a weaker market bid.” PlusToken scam moves coins again: Bitcoin blockchain researcher Ergo found that the wallets of PlusToken — the multi-billion-dollar crypto scam that last year folded and purportedly caused the mini bear market — deposited 13,000 BTC (worth over $100 million) into privacy mixers earlier this week. The scammers previously did this prior to sending the mixed funds to exchanges, which were then presumably sold for fiat or a fiat equivalent. Featured Image from Shutterstock origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|