2021-8-13 07:03 |

The Ethereum (ETH/USD) continued its upward trend as investors reacted to the relatively weak US inflation data. The coin’s price rose to $3,278, which was the highest level since May 19th. As a result, the market value of all Ether tokens jumped more than $378 billion.

Ethereum rally acceleratesEther is the second-biggest cryptocurrency in the world after Bitcoin. The token helps to power Ethereum’s ecosystem, which allows developers to build quality decentralized applications. Today, most of the well-known cryptocurrency projects like Aave, Maker, and Uniswap have been built using Ethereum’s technology.

The Ethereum price rally accelerated in the overnight session after it emerged that US consumer prices were easing. According to the Labor Department, the headline CPI remained unchanged at 5.4% on a year-on-year basis. But it also declined slightly on a month-on-month basis.

The CPI includes everything, including food, energy, clothing, and furniture. In the same period, the core CPI, which excludes food and energy declined from 4.5% in June to 4.3% in July.

Inflation plays an important role in cryptocurrency prices. For one, it is part of the Federal Reserve’s dual mandate role. This simply means that the Fed looks at both inflation and unemployment rate when making its decision.

As such, with inflation rising, and with the unemployment rate higher than where it was before the pandemic, there is a possibility that the bank will maintain its easy-money policies.

The Ethereum price has also rallied because of the overall performance of the Decentralised Finance (DeFi) industry. This week, the total value locked in the industry has jumped to more than $80 billion.

This is notable since the industry’s value declined below $45 billion during the crypto sell-off. It is also an important thing considering that most DeFi projects are built using Ethereum’s technology.

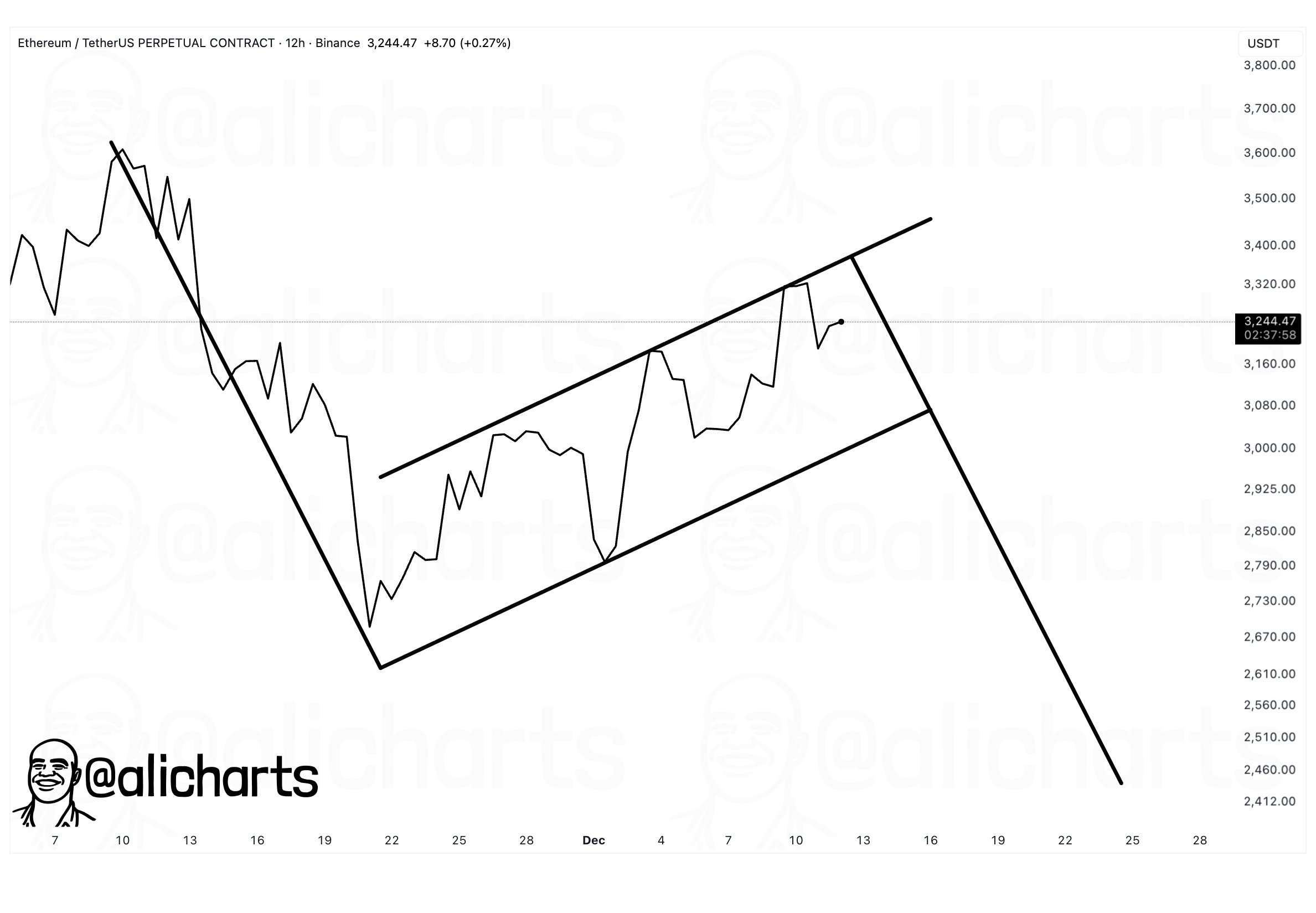

Ethereum price predictionThe three-hour chart shows that the ETH price has been in a strong bullish trend in the past few weeks. It has been moving literally on a straight line and is about 87% above its lowest level in July. As a result, the bullish trend has been supported by the 25-day and 50-day moving average.

Most importantly, the coin’s volume has been rising, which is usually a positive thing. It is also being supported by the rising trendline shown in black. Therefore, the pair will likely keep rising as bulls target the key resistance at $3,000.

The post Ethereum price forecast after the remarkable 87% comeback appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|