2026-1-15 21:00 |

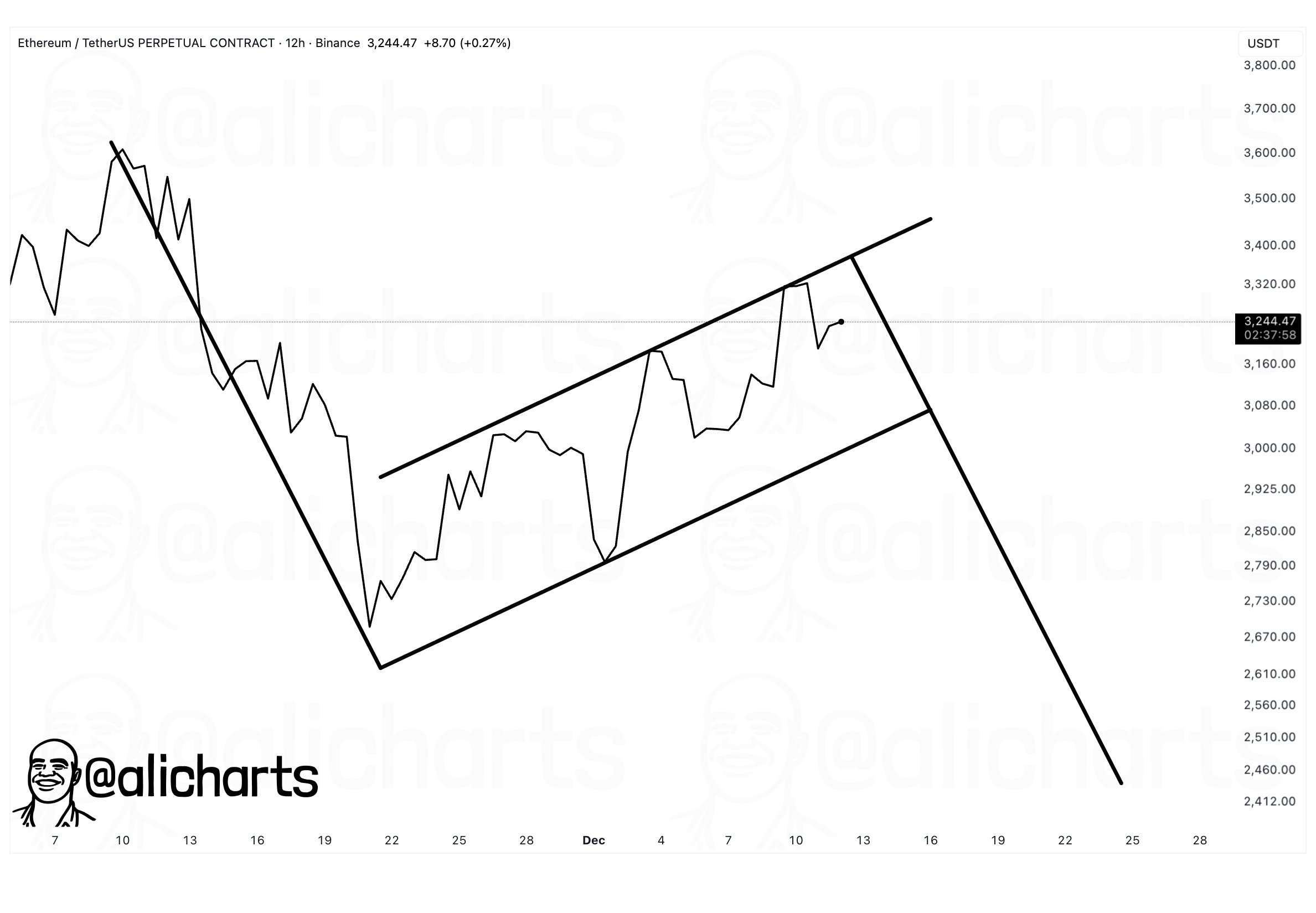

After breaking above the $3,300 level, the Ethereum price is now testing a technical zone that could determine whether the market is gearing up for a run toward $4,000 or setting up for another pullback.

Meanwhile, key metrics signal renewed hope for 2026, adding credence to the prospects of a move to $4,000.

Ethereum Tests Key $3,450 Resistance as $4,000 Comes into FocusThe Ethereum price has already cleared an important hurdle after breaking above $3,300, but now faces a decisive test, needing to reclaim the $3,450 level. According to analyst Ted Pillows, once this happens, the path to $4,000 could easily follow.

“ETH has broken above the $3,300 level. Ethereum needs to reclaim the $3,450 level, and a rapid rally towards the $4,000 level could occur,” wrote Pillows.

However, the rally is not guaranteed, as a rejection from the $3,450 resistance zone could invalidate the prospective rally.

Ethereum (ETH) Price Performance. Source: TradingViewWhat makes this setup different from past attempts is what’s happening beneath the surface. While price action remains relatively contained, Ethereum’s on-chain activity is accelerating at a pace rarely seen before.

Data shared by BMNR Bulls shows Ethereum recorded 393,600 new wallets in a single day, marking a new all-time high.

Over the past week, new wallet creation averaged around 327,000 per day, pushing the number of non-empty ETH wallets to a record level. According to BMNR Bulls, this growth is not driven by speculative price chasing.

“This isn’t price-driven speculation,” the post said. “It’s driven by lower fees post-Fusaka, record stablecoin settlement activity, and real users onboarding into apps, payments, and DeFi.”

Ethereum Network Growth and Total Amount of Holders. Source: CryptoQuant Ethereum Network Activity Hits New Highs Despite Rangebound PriceThat adoption surge is clearly evident in transaction data. Network researcher Joseph Young noted that weekly transacting users on Ethereum have reached a new record, with 889,300 users actively using the network each week.

Ethereum Transacting Users. Source: ArtemisHe attributed the growth to Ethereum’s dominance across stablecoins, DeFi, and trading platforms such as Uniswap.

“…post-Fusaka ethereum is scaling VERY effectively,” he added.

Analyst Leon Waidmann echoed the trend, noting that transaction volumes across the Ethereum ecosystem continue to rise.

Number of transactions processed across the ETH ecosystem keeps trending higher! 📈

Overall activity remains on a steady growth trajectory, with new all-time highs being set consistently over the past couple of months.

January is starting a bit slower so far, but the bigger… pic.twitter.com/BkT2QroVNE

Elsewhere, technical analysts, including Kyle Doops, highlight the growing divergence between price and fundamentals.

“Price has been calm. The network hasn’t,” he said, noting record wallet creation, rising transaction counts, and ETH staking at all-time highs. According to Doops, that disconnect is “worth watching as January unfolds.”

Large players are also making moves. On-chain data tracked by Onchain Lens shows the whale wallet “pension-usdt.eth” recently closed a leveraged ETH long position. With this, they secured a $4.72 million profit on the trade.

Overall, the wallet has generated approximately $27 million in ETH profits, reflecting the scale of capital actively positioning around Ethereum’s recent rally.

The whale "pension-usdt.eth" has completely closed its $ETH (3x) long position, making a profit of $4.72M.

Overall, he has made ~$27M.https://t.co/4bHeKskbfz https://t.co/d6Nb8L8JQU pic.twitter.com/LVw8SzrlZO

Meanwhile, institutions are growing increasingly optimistic. Standard Chartered, as cited by Walter Bloomberg, stated that Ethereum’s outlook has improved and that the asset is likely to outperform Bitcoin.

The bank highlighted Ethereum’s leadership in stablecoins, real-world assets, and DeFi, alongside rising network throughput and potential US regulatory clarity. According to Standard Chartered, Ethereum is forecasted to reach $7,500 this year and $30,000 by 2029.

With adoption, activity, and institutional interest all accelerating, Ethereum’s test of the $3,450 level may prove decisive for short-term price action, as well as whether $4,000 becomes a near-term reality.

The post $4,000 Is Suddenly in Play for Ethereum Price as Key Network Metrics Accelerate appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|