2026-1-10 15:30 |

Ethereum price has slipped into a tense zone after a weak start to January. ETH is down just under 1% over the past 24 hours and is now extending its 30-day decline to around 3.6%. At the same time, price remains well above major long-term supports, leaving traders split on direction.

What makes this setup tricky is the balance of risks. Ethereum is trading inside a bearish chart pattern, but positioning data suggests the downside may not be as straightforward as it looks.

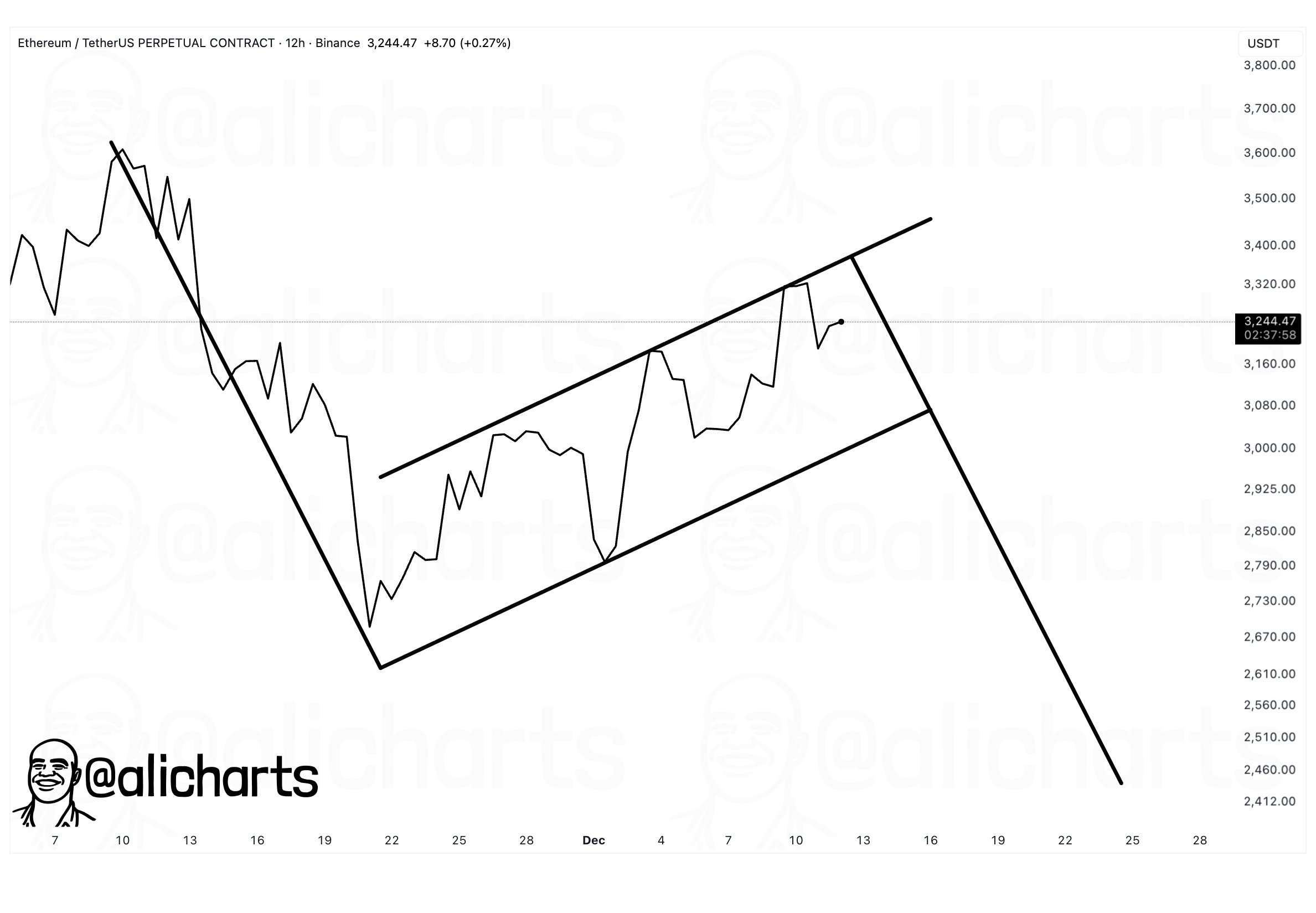

Ethereum Trades Inside a Bearish Pattern?On the daily chart, Ethereum is forming a head-and-shoulders pattern. This is a bearish structure where price forms a left shoulder, a higher peak called the head, and a lower right shoulder. A break below the neckline confirms downside.

For Ethereum, a daily close below the neckline would require roughly a 9% downside move. On the flip side, a move of about 12% higher would invalidate the pattern entirely.

Bearish ETH: TradingViewWant more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Momentum is not yet helping bulls. The Relative Strength Index, or RSI, measures price momentum. When RSI makes a higher high while price makes a lower high, the hidden bearish divergence signals weakening trend strength. That is exactly what has happened between early December and early January.

RSI Divergence Led To The Dip: TradingViewSince then, the price has pulled back, and no bullish divergence has formed. This keeps the breakdown risk active rather than resolved.

So structurally, Ethereum remains vulnerable. But structure alone does not explain everything. The next question is where the selling pressure is coming from.

Short-Term Selling Grows as Holder Behavior Weakens SupportOn-chain data helps identify who is selling and who is not.

First, HODL Waves. This metric breaks Ethereum supply into groups based on how long coins have been held. Short holding periods usually represent speculative money, while longer periods reflect conviction.

Between January 6 and January 9, the 1-week to 1-month cohort saw a sharp drop in supply share, falling from 7.44% to 3.92%. That is a 47% reduction, which helps explain much of the recent ETH price weakness.

Short-Term ETH Holders Dumping: GlassnodeAt the same time, the 1-day to 1-week cohort increased its share from 1.34% to 2.21%, a 65% jump. This matters because this group often sells quickly if the price even moves a bit.

Another Short-Term Risk Builds: GlassnodeLonger-term support is also weakening. The Hodler Net Position Change metric tracks whether long-term holders are adding or reducing exposure. While this metric remains positive, buying pressure has clearly slowed. Net inflows fell from roughly 179,000 ETH on January 4 to about 135,500 ETH by January 9, a 24% decline in accumulation strength.

ETH Buyers Slowing Down: GlassnodeIn simple terms, long-term holders are still buying, but they are buying less aggressively. That reduces downside protection.

With spot support fading, attention turns to derivatives, where positioning can often decide short-term direction.

Derivatives Skew Builds Rebound Risk as Ethereum Price Levels TightenDerivatives data show a strong imbalance.

On major perpetual markets, cumulative short liquidation exposure stands near $3.38 billion, while long exposure is closer to $1.57 billion. That means short positioning outweighs longs by roughly 115%. In percentage terms, the market is heavily tilted toward expecting lower prices.

ETH Liquidation Map: CoinglassThis matters because crowded shorts can fuel upside moves if the price starts rising. Forced short covering creates automatic buying pressure via the “short squeeze” phenomenon.

That risk clusters around key levels. Ethereum is currently trading near $3,080. The first support level to watch is $3,050, one of the most critical levels in the near term, supported by multiple touchpoints.

It is then followed by $2,890. If that breaks a daily close below $2,809, the projected 9% decline would confirm the bearish pattern and complete the neckline break.

On the upside, $3,300 is the first level that weakens the bearish structure. A daily close above that zone would begin invalidating the right shoulder. A further move toward $3,440 would fully cancel the pattern and likely liquidate all the 7-day short positions, aligning with the 12% rebound scenario.

Ethereum Price Analysis: TradingViewRight now, Ethereum sits between fading spot support and an increasingly crowded short trade.

Ethereum price is not breaking down yet, but it is not safe either. Selling pressure has arrived, long-term buying has slowed by nearly a quarter, and short-term holders remain active. At the same time, derivatives positioning leaves the door open for a sharp counter-move.

The next decisive move will come from the price itself. Whether Ethereum slips 9% or rallies 12% will depend on which side loses conviction first.

The post Ethereum Price Flirts With 9% Risk and 12% Hope, What Tips the Balance? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|