2020-8-21 05:00 |

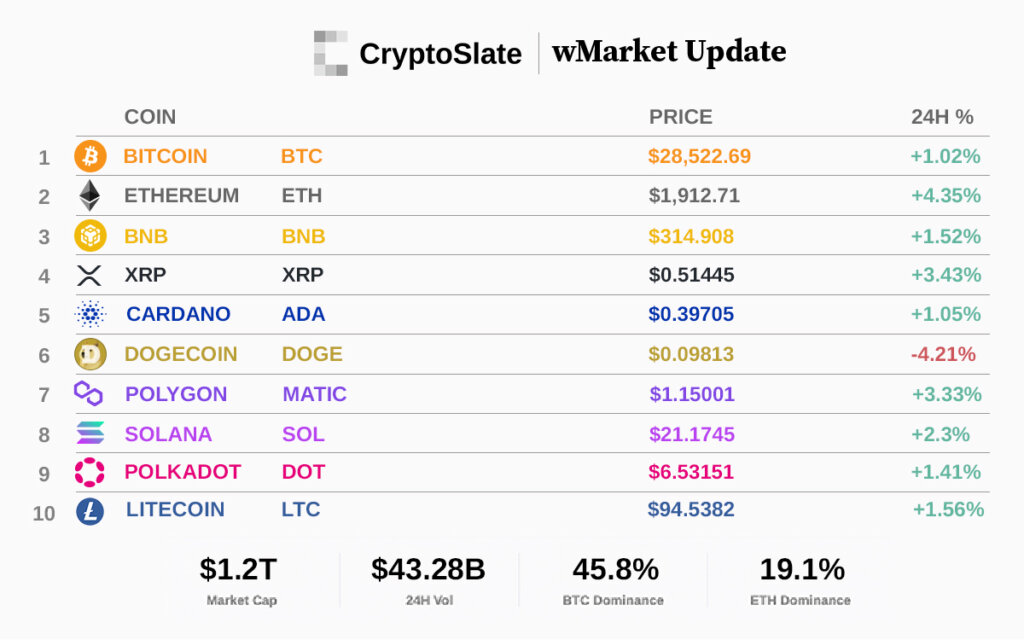

The Ethereum options market is seeing massive growth as of late, with the total open interest now rapidly approaching $500 million.

The vast majority of this open interest still resides within Deribit, with the popular trading platform currently dominating the crypto-options market.

Options have been seeing increasing popularity throughout 2020, with investors widely pivoting away from margin trading and towards alternative investment tools.

As for what the options market is saying about Ethereum’s near-term outlook, data shows that the majority of traders are expecting the cryptocurrency to end the year below its current price of roughly $420.

Considering the macro strength expressed by ETH, Bitcoin, and many other digital assets throughout 2020 so far, this statistic is rather surprising.

Ethereum Options Open Interest Rockets – Deribit Market Dominance Remains HighEthereum’s volatile price action seen in recent weeks appears to have led directly to a surge in the value of ETH options open interest.

According to data from the analytics platform Skew, the total open interest for Ethereum options currently sits at just under $500 million.

Deribit currently accounts for 91% of this total outstanding OI, with the number of open ETH contracts on the platform now exceeding one million.

“Total ETH options open interest on Deribit now exceeds 1 million contracts with a notional value of ~USD 424 million. This represents a 91% market share on Deribit,” the platform said in a recent note.

As seen below, the vast majority of this growth in OI has come about since late-July, at which time total open interest for Ethereum options was sitting below $200 million.

Options Market Thinks There’s a Sub-6% Chance of ETH Breaking $1,000 by 2021As the open interest and investor involvement within the options market grows, so too will its influence over Ethereum’s price dynamics.

Currently, the majority of the contracts on Deribit expire on either August 28th, September 25th, or December 25th – making these important dates to watch.

As seen on the below chart from Skew, for the December 25th contract expiry, traders are currently placing a sub-6% chance on Ethereum’s price being over $1,000.

Interestingly, the market is also only placing a 41% chance on its price being at or above $420 by the end of the year – a sign that the majority of traders are expecting it to decline from its current price levels as the year drags on.

Featured image from Unsplash. origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|