2019-2-20 18:59 |

Ethereum Could Pullback After Monumental Two Weeks

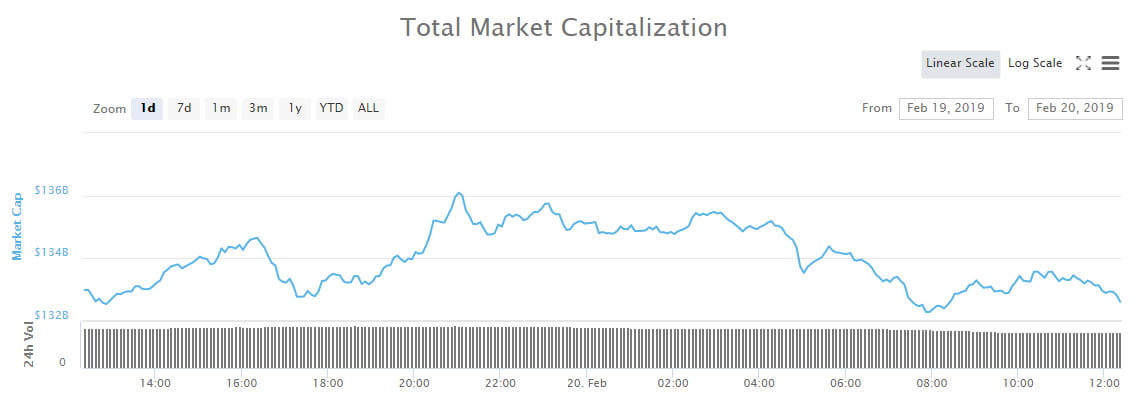

It goes without saying that Ethereum (ETH) has had an amazing week. As of the time of writing, the asset is sitting at a hefty $143 a pop, posting a 40% gain since February 6th. Mati Greenspan of eToro even recently argued that the asset led the Bitcoin rally seen on Sunday and Monday, which pushed BTC past $3,800/$3,900, and a mass of other cryptocurrencies above notable levels of support.

But is this move real? In the eyes of CryptoMedication, also known as Proof of Research on Twitter, yes — without a doubt.

The leading industry researcher, who recently issued harrowing analysis of QuadrigaCX’s cold wallets (or lack thereof), recently opted to do some technical analysis, rather than deep-dives into blockchains.

He/she claimed that Ethereum’s move above $120 in early-February allowed it to surpass a long-term downtrend resistance line (from a logarithmic standpoint) that spanned back to May 5th, 2018. Medication added that the volume candle that accompanied this recent move, purportedly the largest in over one year, signifies this breakout is “real,” rather than “false.”

1/ $ETH #Ethereum's growth has been absolutely crazy over the past two weeks. So I felt compelled to look at it and see what the heck is going on and why its going crazy the way that it is. pic.twitter.com/eWb07BIati

— CryptoMedication (@ProofofResearch) February 20, 2019

While this should have some investors enthused, the analyst made it clear that in the short run, there are some levels that ETH will likely have troubled surpassing. The most notable of these being $155, where Ether plateaued at during its recovery from December’s lows on the back of Constantinople and a short squeeze. By the same token, Medication noted that Ethereum is likely to find some semblance of support at $120, where the asset found some stability on its daily chart.

Medication then touched on a handful of technical levels that traders should be watching. It was explained that the fact the 12-day exponential moving average (EMA) is higher than the 26 EMA is bullish. Ethereum also purportedly tested the 50 EMA, while easily surmounting the 100 EMA without as much as a hitch, further confirming that this recent move could have further legs. The QuadrigaCX whistleblower also noted that Ethereum also broke above its Ichimoku cloud in the $120-$130 range — another bullish sign.

Yet, it isn’t that cut and dried. The analyst noted that the daily Relative Strength Index (RSI) is starting to look “grossly overbought,” buy pressure is waning to “weak,” and a negative divergence in the RSI could signal that consolidation is inbound. The so-called ZN Double Guppy Channels, a lesser-known indicator that Medication utilizes, also shows Ether falling lower in the short-term soon.

Regardless, the fact of the matter remains that ETH has been outperforming many of its counterparts in recent weeks. But what are analysts saying about catalysts for the asset’s sudden rally?

What Were The Catalysts For The ETH Run?In a recent appearance on BlockTV, an Israel-based cryptocurrency multimedia outlet, Greenspan claimed that it has much to do with the Constantinople hard fork (redux pt. two) that is slated to activate in the coming week. Greenspan, one of the most prominent voices in this space, noted that the Ethereum network outputs 20,000-30,000 ETH per day. Thus, the fact that the so-called “ice age” has curbed issuance rates to 13,000 ETH as of Sunday, while demand has all but stayed the same likely pushed the asset higher.

In my personal opinion, the recent rally could have a lot to do with the growth of the MakerDAO ecosystem, which facilitates the MKR and DAI tokens. In recent months, the project, centered around decentralizing finance, has seen monumental levels of growth. In fact, data from LongHash indicates that the number of active addresses users that utilize the DAI stablecoin is swelling by 20% month-over-month. Other reports indicate that there is now approximately 2% (and rapidly growing) of all Ether in circulation locked up in MakerDAO’s contracts, accentuating how important the project really is to the ecosystem.

So in other words, there is a rapidly swelling need for so-called “defi” (one use case is borrowing DAI, converting it to Ether, and longing the asset), thus creating demand for Ethereum.

The post Ethereum (ETH) Breakout Past $140 Was “Real,” But Pullback Is Possible appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|