2018-10-16 06:51 |

Ripple recently surged past its short-term descending trend line to signal a reversal from the downtrend and a continuation of the longer-term rise. Recall that Ripple previously busted through a large descending trend line to signal that a rally was underway.

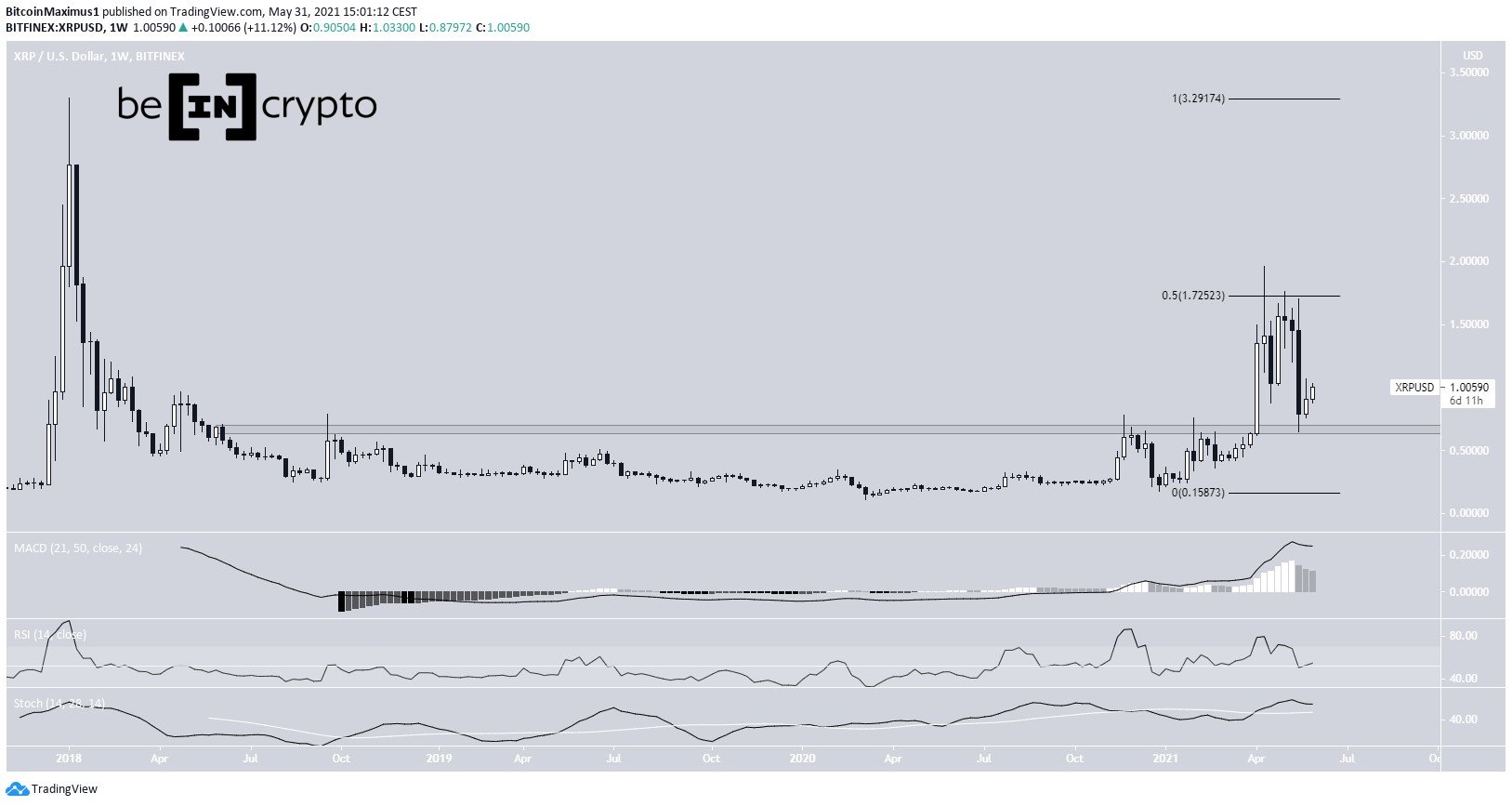

Price hit resistance around the 0.5300 level and is in the middle of a correction right now. Applying the Fibonacci retracement tool on the breakout move shows that price is already bouncing off the 61.8% Fib and might be already prime for a bounce back to the swing high and beyond from here.

However, the 100 SMA is still below the longer-term 200 SMA to signal that the path of least resistance is to the downside. In other words, there still might be a chance for the selloff to continue. Then again, the gap between the moving averages is narrowing to signal slowing selling pressure. Also, the 200 SMA dynamic inflection point lines up with the current Fib level and is adding to its strength as support.

Stochastic is also pulling up to show that buyers have regained the upper hand and might be ready to push Ripple back up. RSI, however, still has plenty of room to head south so there may be some selling pressure left for a larger correction to the new rising trend line forming closer to the 100 SMA dynamic support.

Cryptocurrencies like bitcoin and Ripple appear to be regaining traction these days on the Tether scare, as the massive drop in the stablecoin’s price prompted liquidation. The launch of Fidelity’s institutional platform for bitcoin and ethereum has also been a plus for Ripple and its peers.

As for Ripple itself, there have been reports that its team is in talks with the White House on a number of issues and possible solutions. Also, U.K. e-money company Moneynetint is partnering with Ripple to use the firms blockchain-based instant payments rails.

The post Ripple (XRP) Price Analysis: Bulls Push for Reversal, Quick Pullback Happening appeared first on Ethereum World News.

origin »Ripple (XRP) на Currencies.ru

|

|