2019-4-27 11:30 |

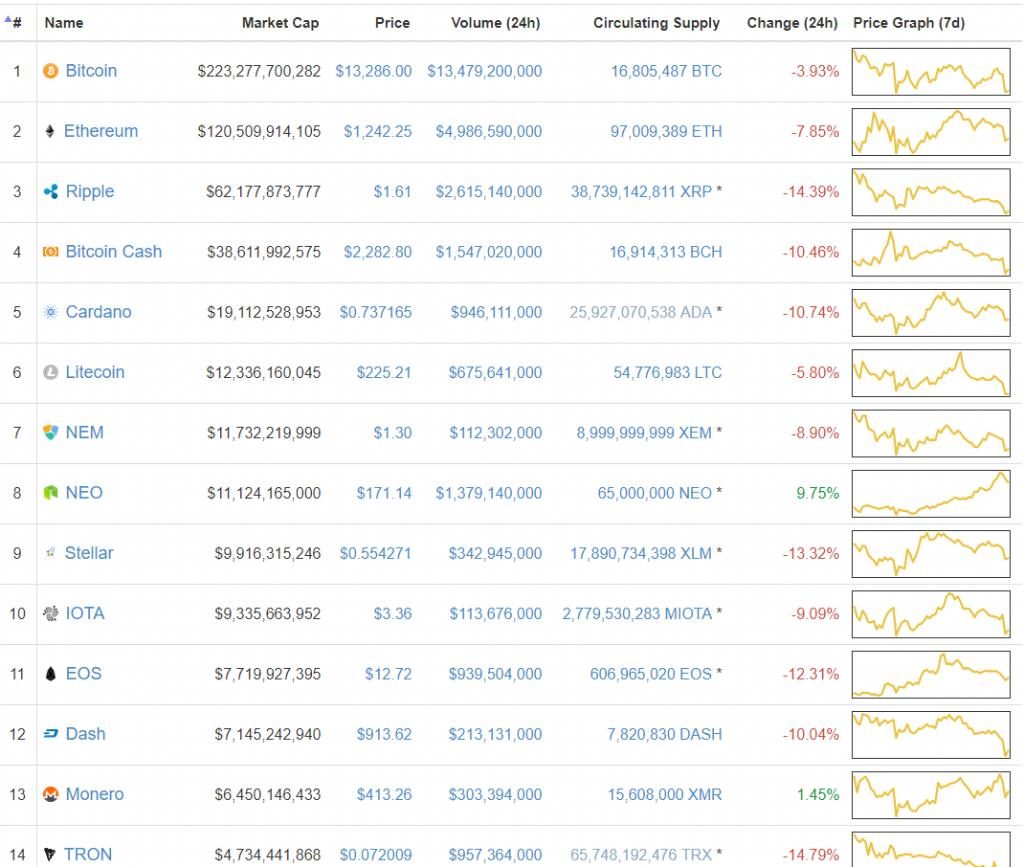

The collective market had seen a bearish flash-fire clawing down the collective market to under $170 billion for the first time since March. Since then, correction forces raged, leading to a resurgence over the mark, spearheaded by Ethereum [ETH] and Tron [TRX], the two biggest gainers in the top-12, marginally albeit.

Ethereum inclination was not as magnified as Tron’s, but the top altcoin’s climb back up with Bitcoin [BTC] in red signals a market revival. At press time, Ether gained 0.31 percent against the dollar in 24-hours. The coin was trading just under $160 with a market cap of $16.59 billion.

Tron, on the outside fray of the top-10, outperformed all the coins ahead of it, posting a relatively significant 2.86 percent gain against the dollar. The Justin Sun-led cryptocurrency was trading at $0.0236, with a market cap of $1.57 billion, behind Cardano [ADA] by a little over $200 million.

Ethereum 1-day:

Source: Trading View

The top-altcoin had witnessed sluggish movement over the past two weeks, with the market’s sideways movement leading to the price of the coin surging first from $142.84 to $182.16, which was followed by a drop initially to $169.43, and then to the recent low of $155.

Ethereum found immediate support at $154.33, which is likely to break if bears continue their charge. The coin’s immediate resistance stood at $181.5.

The Bollinger Bands indicated a drop in volatility of the coin, while the Moving Average showed a bearish market.

The Chaikin Money Flow tool pointed to marginal positive money flow, with the CMF hovering just above 0. However, if bearish waves continue, it could slip below.

The Awesome Oscillator showed short-term momentum to be over its long-term equivalent, but with concluding bars red, a bearish swing was imminent.

Tron 1-day:

Source: Trading View

Despite being the highest gainer in the top-12, the coin had seen only six green candlesticks since the first week of March. Owing to this, the coin saw a massive downtrend from $0.0308 to $0.0244, post its uptrend, ranging from $0.0237 to $0.0307.

Tron found immediate support at $0.022, which has sustained since February. The coin’s immediate resistance level stood at $0.0308, which the coin last touched in early April.

The MACD added to the bearish claim as the Signal Line shot above the MACD Line.

The Relative Strength Index showed a massive drop in investor interest as the coin’s RSI dropped from 75.02 at the start of the month, to 41.16 at press time.

Conclusion:

Ethereum and Tron are two of the best performing coins in the market currently. Ethereum was trading in the green, but indicators did not look positive. Volatility was low, but money flow was pegged to turn negative, while the AO indicated an upcoming bearish swing. Tron, post the USDT drama, was posting the highest gains, although in a bearish market, as attested by the indicators. Furthermore, investor confidence was on the low, dropping continuously in April.

The post Ethereum [ETH] and Tron [TRX] Price Analysis: Tether-induced bearish swing fails to oust coins from green appeared first on AMBCrypto.

origin »Ethereum (ETH) на Currencies.ru

|

|